The unsustainable financial system in Lebanon has brought some Lebanese to crypto. Locals are mining Bitcoin or storing wealth with cryptocurrency and completing some payments with Tether.

Dire Economic Situation in Lebanon

In 2019, Lebanon fell into a financial crisis after years of expensive wars and poor spending decisions. A CNBC ground report outlined the issue and appears to have spurred Michael Syalor, CEO of MicroStrategy to comment on the issue.

A World Bank report released on June 1, 2021, warned that Lebanon would suffer one of most severe economic crises since the mid-19th century unless its “bankrupt economic system benefited a few for so long” was reformed.

Consequently, in August 2021, the Lebanon Central Bank ended fuel subsidies, announcing that it would offer credit lines for fuel imports based on market prices for the Lebanese pound. After that, fuel prices soared, causing an economic crisis in the country.

Furthermore, several depositors were locked out of their bank accounts overnight in September 2022, preventing them from accessing their savings. In response, some of them stormed several branches, holding employees hostage and forcing them to withdraw their savings.

Digital assets way to go

Several Lebanese locals consider cryptocurrencies a “lifeline for survival,” according to CNBC.

Supporting the recent trend, Microstrategy’s CEO, Michael Saylor, noted that “Bitcoin is hope for Lebanon.”

#Bitcoin is hope for #Lebanon, where the currency has lost 96% of its value vs USD and the banks have failed.https://t.co/DkKrC4zgGY

— Michael Saylor⚡️ (@saylor) November 5, 2022

Let’s have a look at how people have incorporated digital assets into their life:

Opportunities in crypto mining

Mining cryptocurrency requires expensive equipment, some technical expertise, and a lot of electricity. At scale, miners are compelled to migrate to the world’s cheapest power sources since they compete in a low-margin industry. Southern Lebanon offers cheap electricity enabling miners to make more money.

Locals like Abu Daher and Salah Al Zaatare, bought mining equipment at fire sale prices from Chinese miners and built their farms. Additionally, they hosted rigs for people across Lebanon who lacked the technical expertise and access to electricity, a crucial resource in a country plagued by power outages.

However, the local authorities inspected them closely. In January last year, police raided and dismantled a crypto mining farm in Jezzine, a hydro-powered town. In the eyes of the authorities, “energy-intensive crypto mining” was depleting the country’s resources and draining electricity.

Payments with cryptocurrency

According to reports, some people are earning money using digital assets like Bitcoin and are trading the cryptocurrency tether for U.S. dollars through Telegram groups. Abu Daher, a local told CNBC,

“We started by selling and buying USDT because the amount of demand on USDT is very high.”

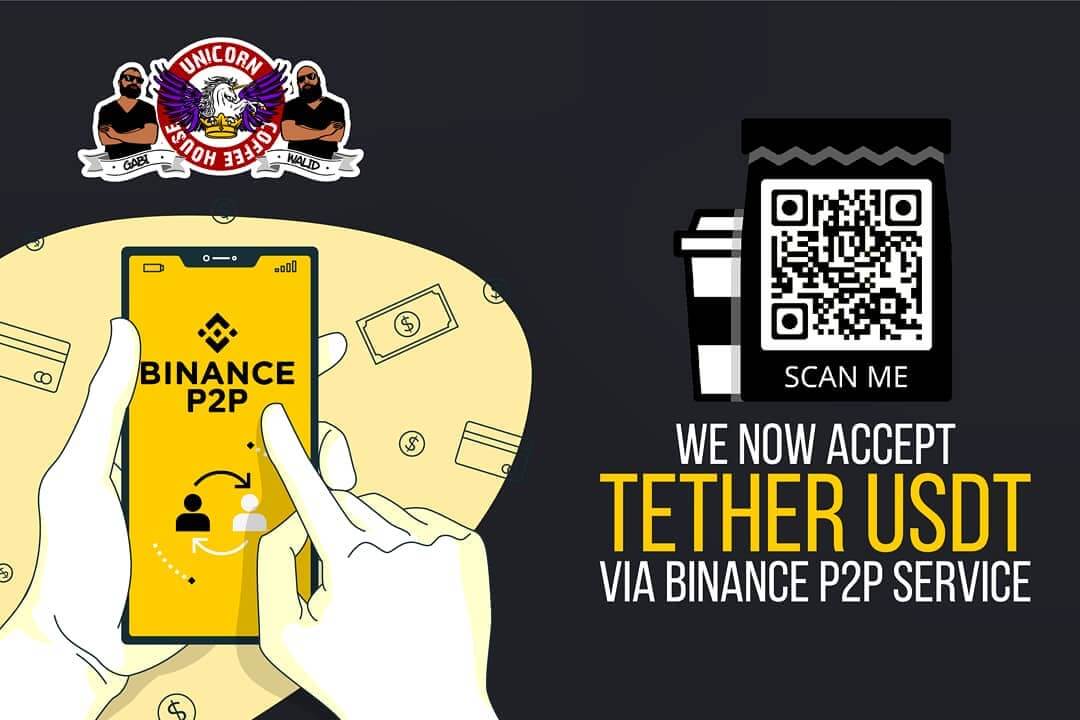

Despite Lebanese law prohibiting crypto payments, businesses are actively advertising on Instagram and other social media platforms that they accept crypto.

Reportedly, some hotels and tourism agencies also started accepting Tether.

Storing funds as Bitcoin:

People across the country are afraid of putting their money in banks or keeping it in cash at home because of the risk of theft, according to CNBC.

Among the Middle East and North African countries, Lebanon ranks second only to Turkey in terms of the volume of cryptocurrency received, according to new blockchain data from Chainalysis.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)