The Shiba Inu ecosystem is abuzz with discussions surrounding the potential introduction of a Shiba Inu (SHIB) Exchange-Traded Fund (ETF), as disclosed in the tenth edition of the SHIB Magazine. This discourse gains momentum in the wake of recent approvals for spot Bitcoin (BTC) ETF products, generating interest within the cryptocurrency community regarding the role of ETFs as a conduit to traditional finance.

The ETF Landscape and the Race for Spot BTC ETFs

The pursuit of ETFs is not a novel occurrence in the cryptocurrency realm. Dating back to 2013, Cameron and Tyler Winklevoss, the Gemini exchange founders, endeavored to launch a spot BTC ETF, encountering persistent challenges. Similarly, Grayscale’s attempt to convert its Grayscale Bitcoin Trust into a spot ETF faced rejection from the U.S. SEC, despite the agency approving futures BTC ETFs.

Also Read: Shiba Inu: What Could a $1,000 SHIB Investment Yield in 2025?

The landscape underwent a significant shift in June, marked by BlackRock, the world’s largest asset manager, filing for a spot BTC ETF. This action triggered a series of filings from traditional financial institutions such as VanEck, Fidelity Investments, and WisdomTree. Following multiple revisions, the U.S. ultimately approved spot BTC ETFs, representing a noteworthy stride in integrating cryptocurrencies into mainstream traditional finance.

Shiba Inu and the Envisaged Spot SHIB ETF

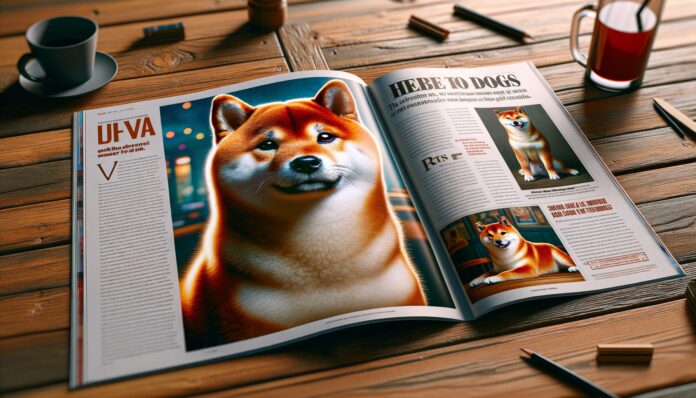

While recent focus has centered on Ethereum and XRP, the latest release of the SHIB Magazine has stirred conversations about the potential introduction of a Shiba Inu ETF. The cover page prominently displays “Wen SHIB ETF,” eliciting a response from the community characterized by curiosity and optimism.

Despite the absence of a dedicated section to this proposed investment product in the latest edition, the community poses the question, “Why not?” Shiba Inu recognized as a legitimate and decentralized digital asset, has actively undertaken initiatives to shed its meme coin image. Endeavors like Shibarium (the layer-2 network), SHIB Metaverse (the metaverse project), and SSI (the digital ID project) underscore Shiba Inu’s commitment to reshaping its overall perception.

The Prospects for a SHIB ETF in the Future

The persistent community advocacy for “Wen SHIB ETF” across various social media platforms signals a growing interest in the potential realization of such a product. While some industry commentators express skepticism about its viability in the short term, the success of ongoing initiatives could position SHIB as a contender for investment vehicles like spot-based ETFs in the future.

Also Read: Shiba Inu’s $0.001 Dream: Investment Insights for $1M, $9M Gains

Unlike certain cryptocurrencies grappling with classification challenges as securities or commodities, SHIB enjoys a favorable standing, having never been subject to allegations of being a security by the SEC. Reflecting on the dynamic nature of the crypto industry, it is noteworthy that even Bitcoin faced skepticism when discussions initially surfaced about a spot BTC ETF. Irrespective of the timing, the introduction of a spot SHIB ETF could further affirm Shiba Inu’s legitimacy within the mainstream financial landscape. As the community eagerly anticipates further developments, the Shiba Inu project remains on course to attain broader recognition and acceptance.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC