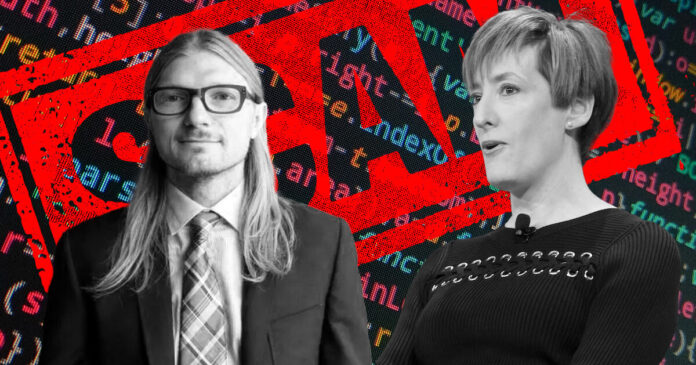

In a Twitter thread, Custodia Bank founder and CEO Caitlin Long said that she provided evidence to law enforcement about a crypto crime months before the company collapsed and left millions of customers in the lurch. She noted:

“I handed over evidence to law enforcement of probable crimes committed by a big crypto fraud, starting months before that company imploded and stuck its millions of customers with losses.”

She also added that she warned banking regulators of impending risks of bank runs at banks servicing the crypto industry before the actual bank runs took place. But Long believes that her “warnings were buried in the bowels of bureaucracy.”

Jesse Powell, co-founder and CEO of crypto exchange Kraken, which recently settled with the Securities and Exchange Commission (SEC), shared a similar experience. Powell said that he found it “infuriating” that regulators ignored the “massive red flags and obviously illegal activity” that he pointed out for years.

According to him, the regulators noted the red flags and said that “it’s complicated” because the firms are offshore, but they were “looking at everybody.”

Powell and Long expressed their discontent at their firms being used as an example of fraud when they have tried to do the right thing all along.

Long said Custodia Bank was slammed on multiple fronts when the White House attacked the Federal Reserve Board of Governors, the Kansas City Fed, and Senator Dick Durbin. Last month, the Federal Reserve Board denied Custodia Bank’s application to become a member of the Federal Reserve System.

In a senate speech, Long claims that senator Durbin “implicitly” compared her and Fidelity CEO Abigail Johnson with FTX founder Sam Bankman-Fried. Fidelity irked regulators last year when it announced that it would allow customers to invest part of their pension investments in Bitcoin.

Long added in a blog post:

“Custodia tried to become federally regulated – the very result bipartisan policymakers claim to want. Yet Custodia has been denied and now disparaged for daring to come through the front door. “

The approach to crypto regulation needs rethinking

Long said that crypto is currently comparable to the mutual funds market in the 1930s when it was rife with bad actors and fraud. But instead of thwarting the market altogether, President Franklin D. Roosevelt came up with breakthrough regulations that helped weed out the bad actors without killing the potential of mutual funds. And the U.S. needs to do the same with crypto, Long said.

The SEC stepped up its enforcement actions since the fall of FTX, and many have criticized its “regulation by enforcement” approach. According to Long:

“Washington’s misguided crackdown will only push risks into the shadows, leaving regulators to play whack-a-mole as the risks continuously pop up in unexpected places.”

Therefore, the country and regulators need to sit down with credible people in the crypto industry to develop a regulatory approach that does not thwart the innovative potential of the industry, she said.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC