During a Swiss event, Tether CEO Paolo Ardoino shared new details about USDT reserves. He stated the stablecoin has $100 billion in US Treasuries, 82,000 Bitcoin worth $5.5 billion, and 48 tons of gold. This was the first time Tether made its reserve details public. The announcement proved the company’s strong position in the crypto market.

Also Read: Bitcoin Reclaims $71,000: Will BTC Hit A New Peak This Week?

Understanding USDT Reserves: Financial Insights and Stability Concerns

Reserve Composition Breakdown

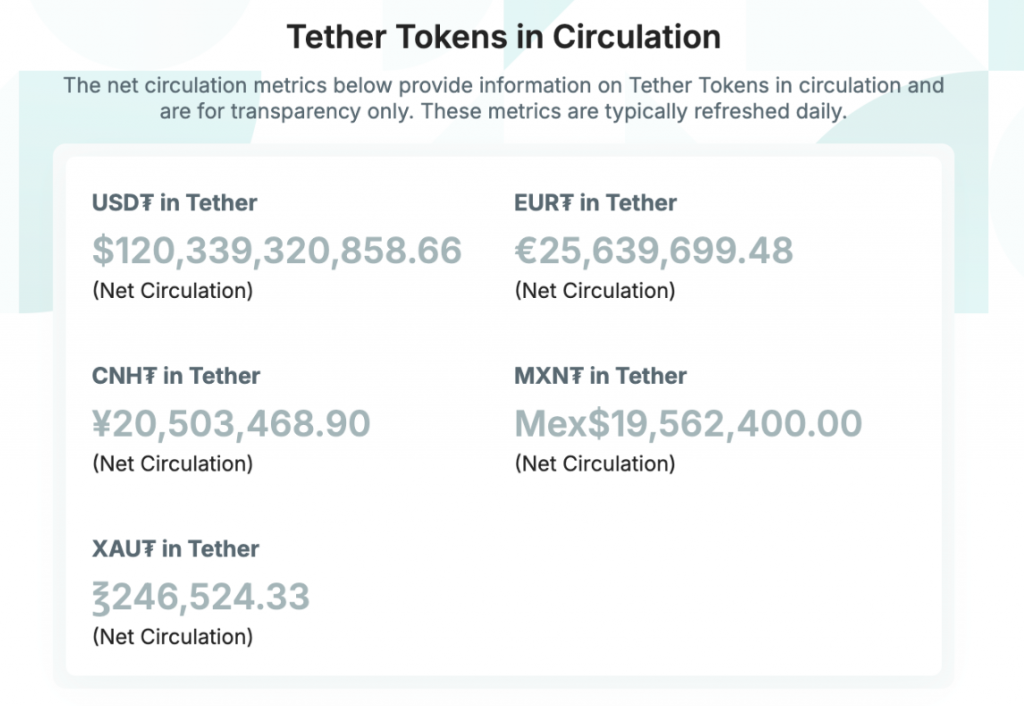

US Treasuries account for 83.5% of USDT reserves. At current prices, Bitcoin holdings account for 4.6% of reserves, and physical gold makes up the rest. This mix helps keep USDT’s $120 billion market cap stable.

The team checks these reserves daily to ensure each USDT has proper backing. Regular monitoring ensures the value stays consistent for all users.

Addressing Investigation Claims

The Tether CEO denied the Wall Street Journal’s claims about a US Department of Justice investigation. “As we told the WSJ, there is no indication that Tether is under investigation. The WSJ is regurgitating old noise. Full stop.”

He added, “We deal regularly and directly with law enforcement officials to help prevent rogue nations, terrorists, and criminals from misusing USDT. We would know if we are being investigated as the article falsely claimed.”

Also Read: Dogecoin (DOGE) To Peak And Target $0.175, Expert Shares

Transparency and Compliance Record

Since 2014, Tether has helped recover $109 million in stolen funds. They share daily updates about their reserves. Users can always trade USDT for USD at an equal value. Monthly reports confirm the reserves are accurate and adequately valued. The company follows strict rules to protect user funds and maintain trust in the platform.

Future Reserve Management

Ardoino plans to keep the current reserve structure. He expects changes in US crypto rules after the 2024 election, which might affect how stablecoins manage reserves. The company will continue to do regular audits. The Tether CEO said keeping lots of US Treasury bonds helps keep the system stable and liquid. Their approach focuses on long-term stability and security.

Market Impact

USDT gained trust after showing its reserve details. More people are trading with it now, and big companies have started using USDT to manage their funds. Having mostly traditional assets in reserves has made people less worried about risks. The transparent approach has helped USDT maintain its position as the leading stablecoin in the market.

Also Read: Buy Cardano (ADA): November 2024 Price Prediction Reveals

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Toncoin

Toncoin  Sui

Sui  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Official Trump

Official Trump  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB