Introduction

Founded in 1989, MicroStrategy is a U.S. company that provides business intelligence, mobile software, and cloud-based services. Led by Michael Saylor, one of its three co-founders, the company saw its first major success in 1992 after landing a $10 million contract with Mcdonald’s.

Throughout the 1990s, MicroStrategy saw its revenue grow by over 100% yearly as it positioned itself as a leader in data analytics software. The onset of the dot.com boom in the late 1990s supercharged the company’s growth and culminated in 1998 when it went public.

And while the company has been a staple of the global business environment for decades, it wasn’t until it acquired its first Bitcoins in August 2020 that it came under the radar of the crypto industry.

Saylor made news by making MicroStrategy one of a handful of public companies to hold BTC as part of its treasury reserve policy. At the time, MicroStrategy said that its $250 million investment in BTC would provide a reasonable hedge against inflation and enable it to earn a high return in the future.

Since August 2020, the company has periodically been purchasing large quantities of Bitcoin, affecting both the price of its stock and BTC.

At the time of MicroStrategy’s first Bitcoin purchase, BTC was trading at around $11,700, while MSTR was trading at approximately $144. At press time, Bitcoin’s price hovers around $22,300 while MSTR closed the previous trading day at $252.5.

This represents a 75.6% decrease from MSTR’s July 2021 high of $1,304. Combined with Bitcoin’s price volatility, the sharp drop in the company’s stock price in the past two years pushed many to criticize MicroStrategy’s treasury management strategy and even actively short it.

In this report, CryptoSlate dives deep into MicroStrategy and its holdings to determine whether its ambitious bet on Bitcoin makes its stock currently undervalued.

MicroStrategy’s Bitcoin holdings

As of Mar. 1, 2023, MicroStrategy held 132,500 BTC acquired at an aggregate purchase price of $3.992 billion and an average purchase price of approximately $30,137 per BTC. Bitcoin’s current market price of $22,300 puts MicroStrategy’s BTC holdings at $2.954 billion.

The company’s Bitcoins were acquired through 25 different purchases, with the largest one made on Feb. 24, 2021. At the time, the company purchased 19,452 BTC for $1.206 billion when BTC was trading at just under $45,000. The second largest purchase was made on Dec. 21, 2020, when it acquired 29,646 BTC for $650 million.

During Bitcoin’s ATH at the beginning of November 2021, the 114,042 BTC MicroStrategy held was worth well over $7.86 billion. Bitcoin’s slump to $15,500 in early November 2022 valued the company’s holdings at just over $2.05 billion. At the time, the market capitalization of all MSTR stock reached $1.90 billion.

As CryptoSlate analysis showed, it wasn’t until the end of February 2023 that MicroStrategy’s market cap got on par with the market value of its Bitcoin holdings. The discrepancy between the two is what prompted many to wonder whether MSTR could be undervalued.

However, determining over or undervaluation requires more than just looking at MicroStrategy’s market cap.

MicroStrategy’s debt

The company has issued $2.4 billion of debt to fund its Bitcoin purchases. As of Dec. 31, 2022, MicroStrategy’s debt consists of the following:

- $650 million of 0.750% convertible senior notes due 2025

- $1.05 billion of 0% convertible senior notes due 2027

- $500 million of 6.125% senior secured notes due 2028

- $205 million under a secured term loan

- $10.9 million of other long-term indebtedness

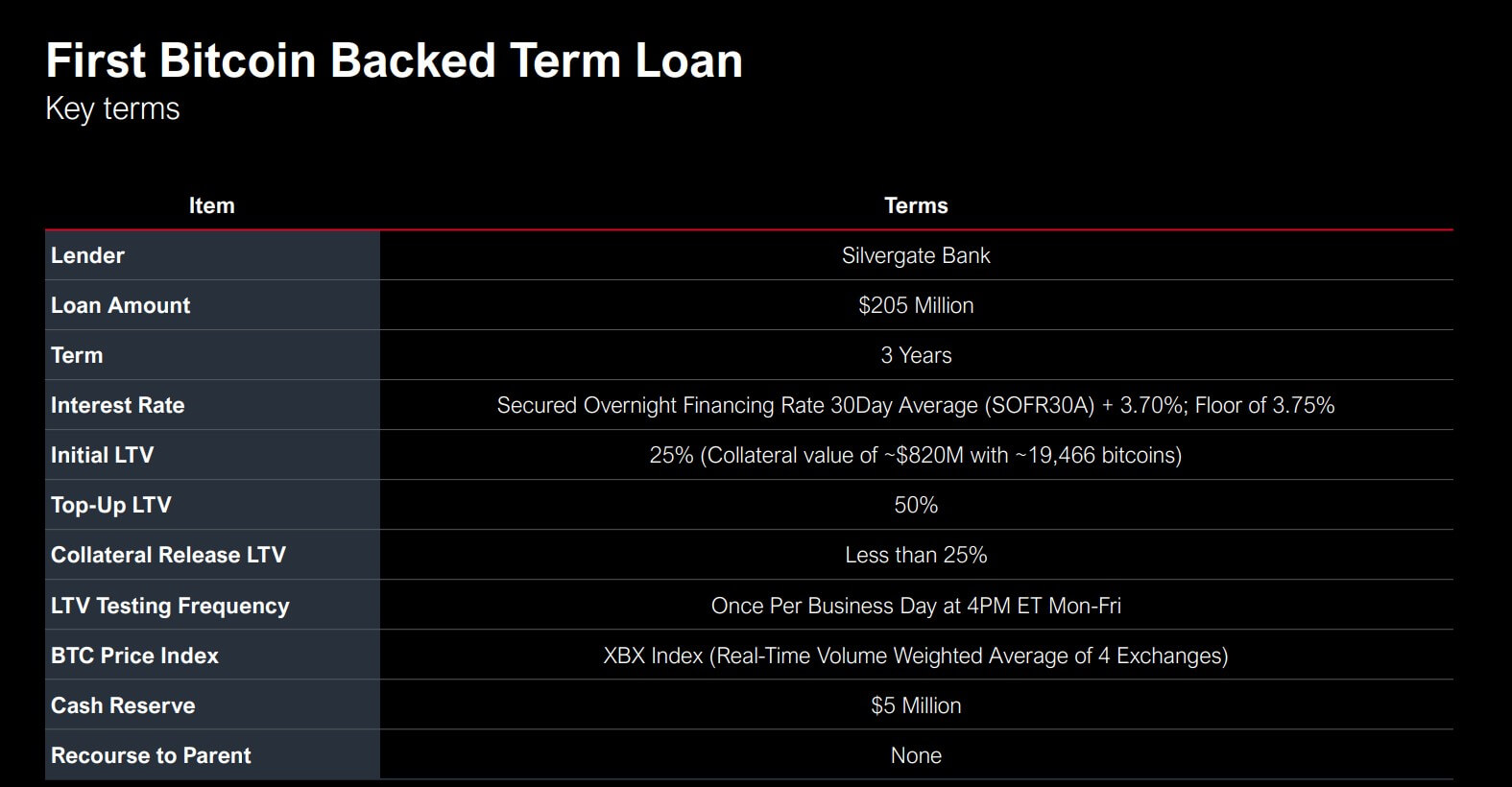

The rates the company secured on the 2025 and 2027 convertible notes proved hugely beneficial, especially in light of the recently rising interest rates. However, the benefits MicroStrategy accrued on the convertible notes are offset by the risks it took on with its $205 secured term loan from Silvergate bank in March 2022.

The loan was collateralized with 19,466 BTC, worth $820 million at the time, with an LTV ratio of 25%. Until it matures in March 2025, the loan must remain collateralized with a maximum LTV ratio of 50% — if LTV passes 50%, the company will be required to top up its collateral to bring the ratio back down to 25% or less.

Terra’s crash in June 2022 caused volatility in the market that required MicroStrategy to deposit an additional 10,585 BTC into the collateral. In addition to volatile Bitcoin prices, the floating rate Silvergate’s loan bears resulted in an annualized interest rate of 7.19%, putting significant strain on the company.

The recent controversy surrounding Silvergate, covered by CryptoSlate, prompted many to worry about the future of MicroStrategy’s loan. However, the company noted that the future of the loan isn’t dependent on Silvergate and that the company would continue paying off the loan even if the bank went under.

Of the 132,500 BTC the company holds, only 87,559 BTC are unencumbered. Aside from the 30,051 BTC used as collateral for the Silvergate secured term loan, MicroStrategy put 14,890 BTC as part of the collateral for the 2028 senior secured notes. If the collateral for the Silvergate loan would need to be topped off, the company could dip into the 87,559 unencumbered BTC.

Saylor also noted that the company could post other collateral if Bitcoin’s price fell below the $3,530 that would trigger a margin call on the loan.

MSTR vs BTC

One of the biggest stars of the dot com boom, MicroStrategy has seen its stock go through periods of intense volatility in times of expansion.

Following its 1998 IPO, MSTR saw its price increase by over 1,500%, peaking in February 2000 at over $1,300. After a spectacular price drop that marked the beginning of the dot com crash, it took the company more than ten years to regain the $120 share price it posted in 1998.

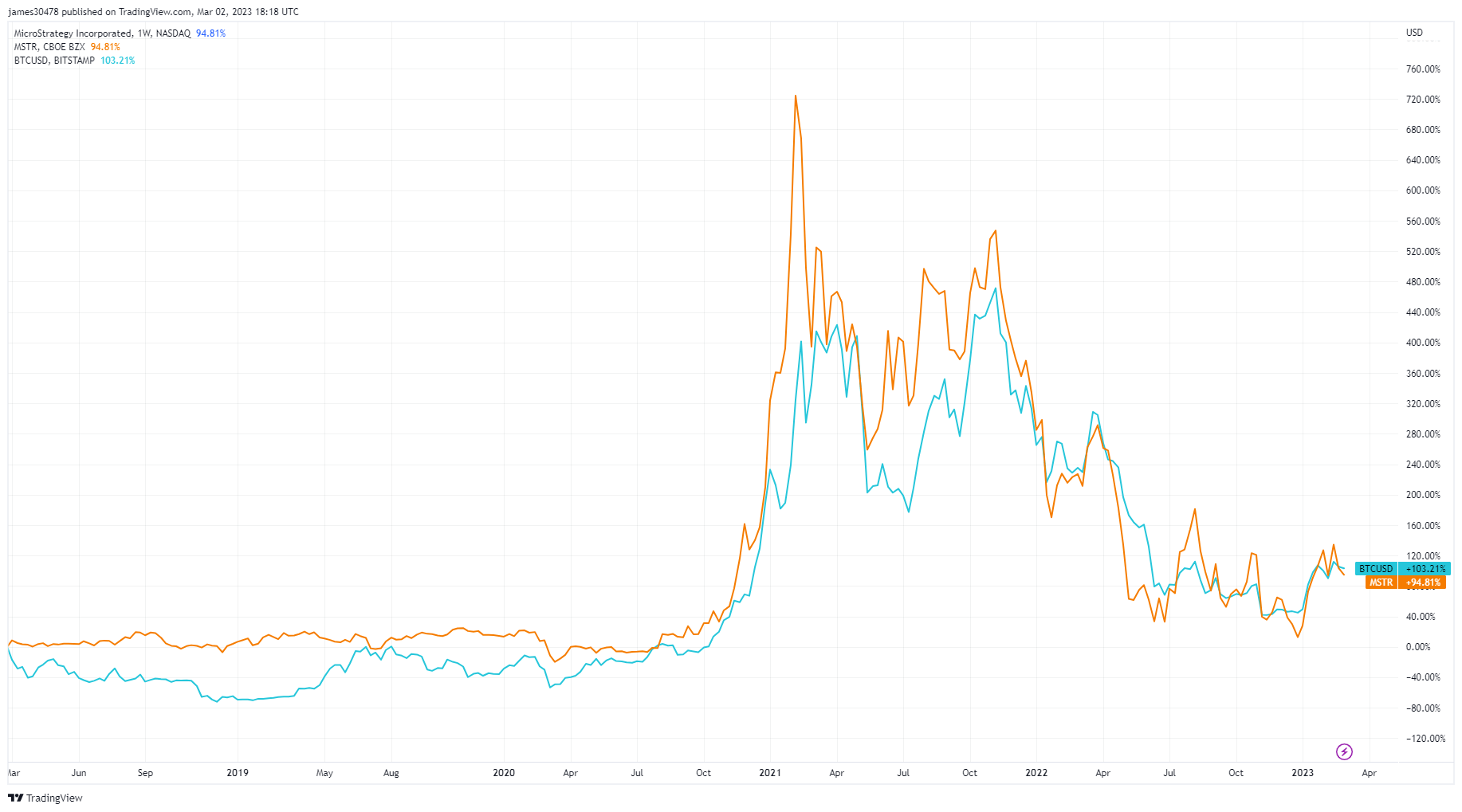

Before its first Bitcoin purchase in August 2020, MicroStrategy’s stock traded at $160. September brought on a notable rally that pushed its price to a new peak of $1,300 in February 2021.

Since then, MSTR posted a notable correlation to Bitcoin’s price movements, with the company’s performance now tied to the crypto market.

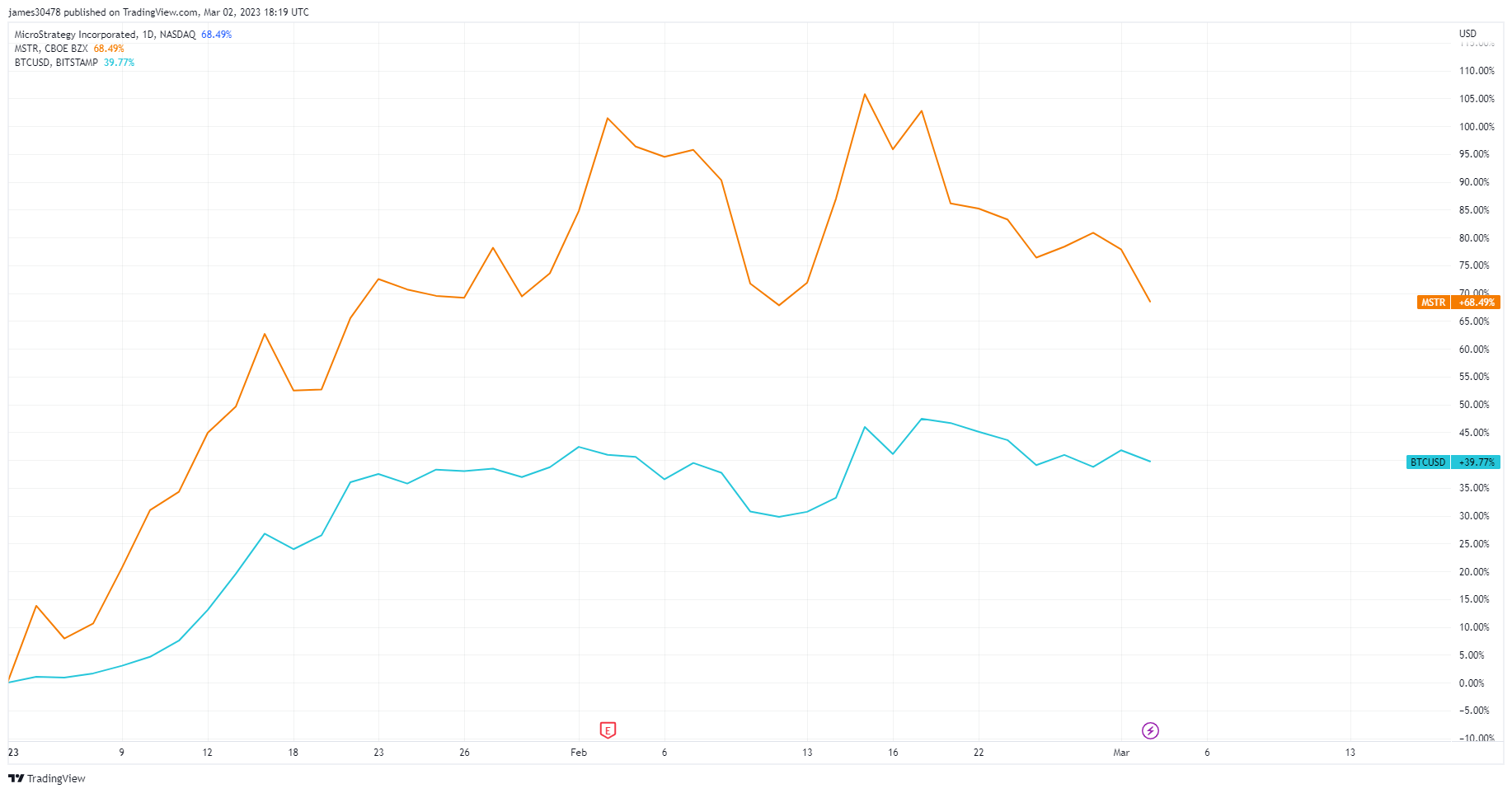

Up over 68% since the beginning of the year, MSTR has outperformed BTC, which saw its price increase by just under 40%.

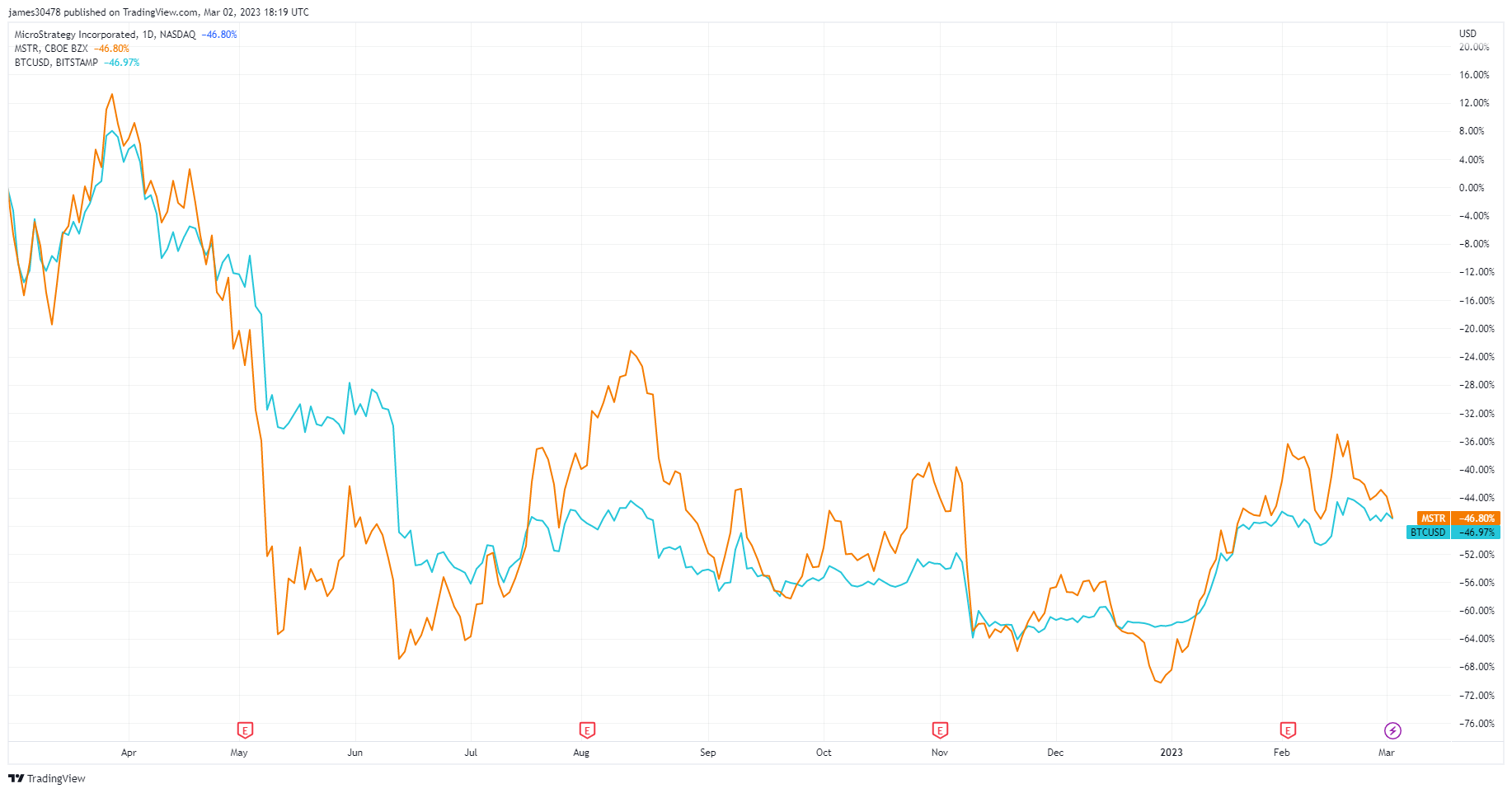

MSTR followed Bitcoin’s performance on a one-year scale as both posted a 46% loss.

Zooming out to a five-year timeframe shows a notable correlation in performance, with BTC slightly outperforming MSTR with a 103% increase.

However, MSTR’s market performance has often been overshaddowed by MicroStrategy’s worsening financial statements. At the end of the fourth quarter of 2022, the company reported an operating loss of $249.6 million, up from $89.9 million in the fourth quarter of 2021. This brought the company’s total operating loss for 2022 to $1.46 billion.

The accounting conundrum

With an operating loss of $.1.46 billion in 2022, a risky loan that may require re-collateralization, and a volatile crypto market behind it, MicroStrategy certainly doesn’t look overvalued.

However, the company’s reported operating loss might be obfuscating its profitability. Namely, the SEC requires companies to report unrealized quarterly losses on their Bitcoin holdings as impairment losses. According to MicroStrategy’s Bitcoin Accounting Treatment, the company’s impairment loss adds to its operating loss. This means that a negative change in Bitcoin’s market price shows up as a substantial loss on MicroStrategy’s quarterly statements, even though the company hasn’t sold the asset.

On Dec. 31, 2022, the company reported an impairment loss of $2.15 billion on its Bitcoin holdings for the year. It reported an operating loss of $1.32 billion before taxes.

Conclusion

Given MSTR’s correlation to Bitcoin’s performance, a bull market rally could push the stock back to its 2021 high.

The traditional financial market has historically had trouble keeping up with the rapid pace of growth seen in the crypto industry. The kind of volatility the crypto market has become accustomed to, both positive and negative, is still a rare occurrence in the stock market. In a bull rally similar to the one that took Bitcoin to its ATH, MSTR could significantly outperform other tech stocks, including the large-cap FAANG giants.

However, while MSTR’s growth could mimic the growth seen in the crypto market, it’s highly unlikely that the company will see any significant volatility in its stock price in the next couple of years. If MicroStrategy continues to service its debts, it will be extremely well-positioned to reap the benefits of a crypto-heavy market in the coming decade.

Its longstanding reputation could make it a go-to proxy for institutions to get exposure to Bitcoin, creating demand that keeps buying pressure high.

Credit: Source link

![Will Dogecoin [DOGE] Hit the $1 Mark By The End of April 2024?](https://news.coinspectra.com/wp-content/uploads/2024/04/0ee9d7d59d424a7c8bd7d70c86070beb-100x70.jpg)

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Polkadot

Polkadot  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  Official Trump

Official Trump  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Monero

Monero  Mantle

Mantle  POL (ex-MATIC)

POL (ex-MATIC)  Render

Render  Dai

Dai  Algorand

Algorand  MANTRA

MANTRA