The Inverse Cramer Tracker ETF, launched on March 2 on the Chicago Board Options Exchange, has surpassed market expectations by outperforming the broader market, just two weeks after going live.

Despite not being founded on Jim Cramer’s financial advice, the fund has generated impressive returns, defying the current buying frenzy in the tech sector that the host of CNBC’s Mad Money has described as thoughtless.

The success of the Inverse Cramer Tracker ETF has caught the attention of financial experts, sparking discussions on the reasons behind its exceptional performance.

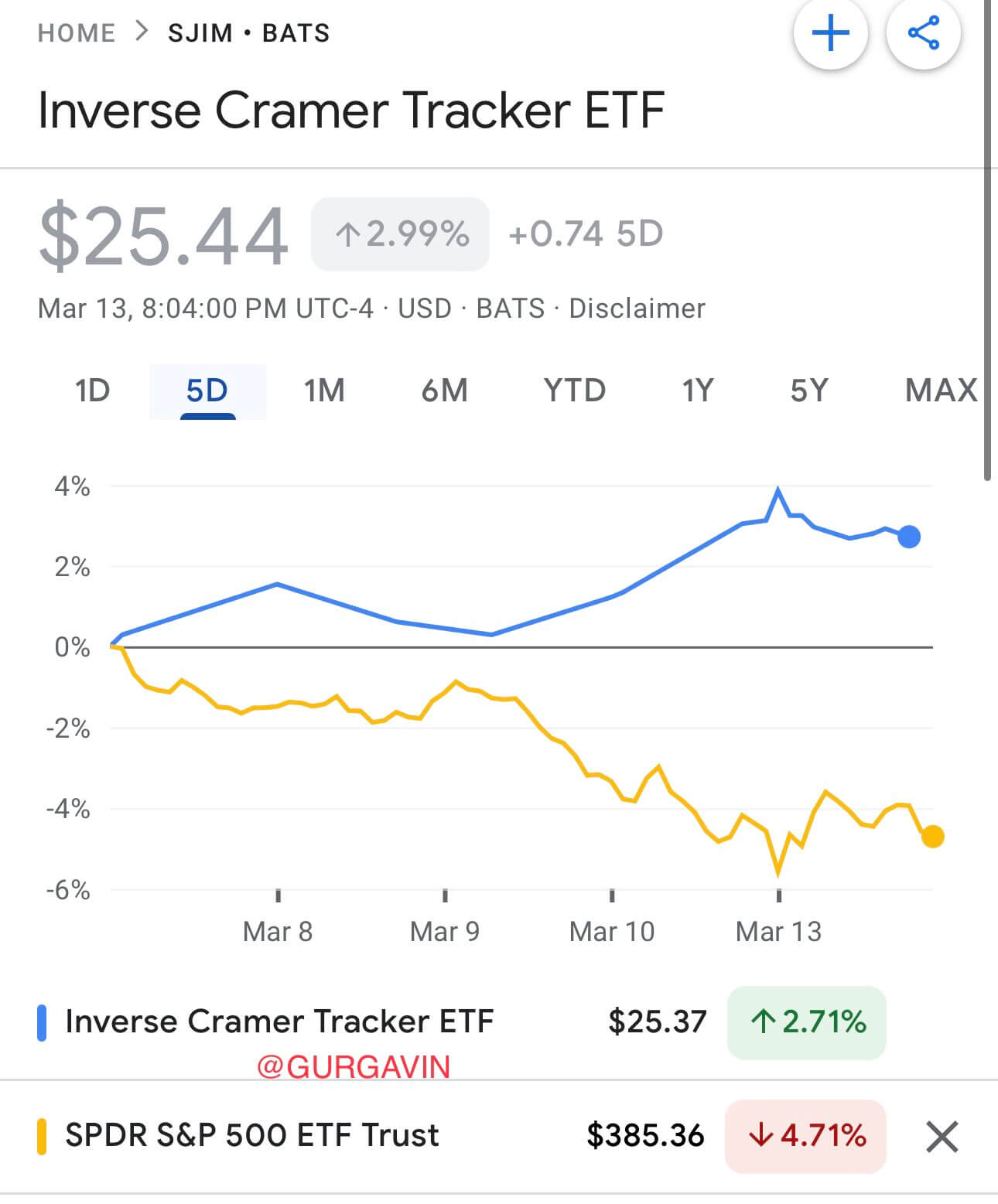

On Twitter, Gurgavin Chandhoke, an investor and founder of Uinvst, announced that the Inverse Cramer Tracker ETF, based on Jim Cramer’s advice, outperformed the market by 5%. Chandhoke compared the fund’s performance with the SPDR S&P 500 ETF Trust.

How the Inverse Cramer ETF works

The inverse ETF, as per the prospectus, tracks Cramer’s stock picks and market recommendations throughout the trading day, including those made publicly on Twitter or his CNBC TV shows. It then takes an opposite position.

In April 2022, for example, he included Signature Bank in his list of four financial companies that he believed were good buys based on earnings growth, which has since failed.

Cramer’s recent picks

In response to a question on whether stress on the banking system and the federal reserve strengthens the investment case for BTC, Cramer responded:

“No. Bitcoin went up today, and I could argue that now it can’t be held in banks. Bitcoin is a strange animal, I will say. Point blank, I think it’s being manipulated up. It was being manipulated the whole time by Sam Bankman-Fried. So please don’t assume, therefore, that it’s not still being manipulated. And I would sell my bitcoin right into this rally.

After the introduction of the inverse Cramer ETF, news from U.S. authorities guaranteeing protection of deposits in failed banks led to a surge in BTC price, reaching $26,000 as of March 14, a notable +20% increase from Friday’s lows, which has also triggered a broader crypto rally, with Ethereum also trending upward by over 11% in the last 7 days.

Read more: CNBC host Jim Cramer claims Bitcoin is being “manipulated up”

Following the collapse of Silicon Valley Bank, both the Dow Jones Industrial Average and the S&P 500 have suffered losses. However, on Monday, the Nasdaq Composite finished on a high note, leading Jim Cramer to speculate that the Federal Reserve may soon complete its tightening cycle.

Meanwhile, users commented on Cramer’s FRC First Republic Bank selection on March 10, whose stock price has decreased by over 75%.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)