This is an opinion editorial by Kudzai Kutukwa, a financial inclusion advocate and Mandela Washington fellow.

“When use of strong cryptography becomes popular, it’s harder for the government to criminalize it. Therefore, using PGP is good for preserving democracy. If privacy is outlawed, only outlaws will have privacy… PGP empowers people to take their privacy into their own hands. There has been a growing social need for it. That’s why I wrote it.”

–Phil Zimmerman, “Why I Wrote PGP”

The case of Roman Sterlingov, who stands accused of running the custodial Bitcoin mixer, “Bitcoin Fog,” is indicative of the many situations in which individuals are targeted by law enforcement for safeguarding their financial privacy.

As outlined in “What Bitcoin Did,” the U.S. Department of Justice relied on Chainalysis’ Reactor software to trace the purchase of the Bitcoin Fog domain back to an address linked to Sterlingov’s Mt. Gox account, establishing him as its operator. Reactor was designed to tie cryptocurrency addresses with real-world identities. Despite the various irregularities present in this ongoing case, one could draw the conclusion that it sends a clear message of “thou shalt not have financial privacy.”

Introducing Ark

Given this growing hostility toward financial privacy for Bitcoin transactions, there is a pressing need for the development of superior tools. At the recently concluded Bitcoin 2023 conference, a potentially game-changing tool, called the Ark Protocol, was introduced.

Announced during one of the keynote sessions on the open-source stage by developer Burak, Ark is a Layer 2 scaling solution that enables cheap, anonymous and off-chain Bitcoin transactions. The protocol also has a minimal on-chain footprint, which further protects user privacy while keeping transaction costs low. In what can be described as an “accidental invention” that occurred when Burak was trying to develop a Lightning wallet, Ark is a distinct protocol that could potentially scale non-custodial bitcoin use.

Burak named the protocol “Ark” in reference to Noah’s Ark, which acts as a lifeboat that provides refuge from predatory blockchain surveillance firms and custodians.

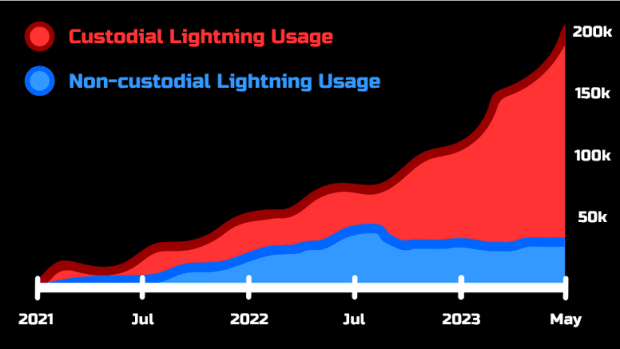

During his presentation, Burak highlighted one of the most concerning trends with the Lightning Network today, which is that there are currently more custodial users of Lightning than there are non-custodial ones. This is mainly due to the liquidity constraints on Lightning that require non-custodial users to first receive liquidity from someone else’s node before they can receive funds. Custodial wallets like Wallet Of Satoshi abstract this problem away from the user but at the expense of the user not being 100% in control of their funds, as well as their financial privacy.

An Alternative Layer 2 Protocol

I interviewed Burak to gain a deeper understanding of Ark and the inspiration behind its development. When I quizzed him on what led him to develop an alternative Layer 2 protocol, he said:

“I have always been a critic of Lightning mainly because of inbound liquidity issues, async receiving as well as its on-chain footprint. Inbound liquidity always felt like a bug to me, which made the user experience anything but pleasant. In addition to that, it would take more than a century to onboard the entire global population in a non-custodial fashion onto the Lightning Network, assuming each person has four channels that each consume a few hundred vbytes.”

As he set out to address these and other issues, his Lightning wallet idea eventually morphed into Ark.

“Ark can be best defined as trustless e-cash or a liquidity network similar to the Lightning Network but with a UTXO set that lives entirely off-chain and it’s neither a statechain nor a rollup,” Burak said. “These UTXOs are called ‘virtual UTXOs’ or ‘vTXOs,’ which have a ‘lifespan’ of four weeks. The core of Ark’s anonymous off-chain payments is driven by the vTXOs.”

Throughout the conversation, Burak continued to emphasize his obsession with a frictionless experience for the end user, his view being that sending sats should be as easy as pushing a button. This is one of the reasons why Ark users do not need to have channels or liquidity, as this is delegated to a network of untrusted intermediaries known as Ark service providers (ASPs). These are always-on servers that provide liquidity to the network, similarly to how Lightning service providers operate, but with an added benefit: ASPs are unable to link senders with receivers, which adds another layer of privacy for users.

This is made possible by the fact that every payment on Ark takes place within a CoinJoin round which obfuscates the connection between sender and receiver. The best part about this is that the CoinJoin happens entirely off-chain while settling payments every five seconds, which not only drastically reduces on-chain footprints but also fortifies the users’ privacy. The anonymity set is every party involved in a transaction and, theoretically, this creates a greater degree of privacy than what’s possible on the Lightning Network. Furthermore, Ark mimics on-chain user experiences in that users have a dedicated address for sending and receiving payments, but the difference is that it’s a reusable address that doesn’t compromise the user’s privacy, made possible in a way that’s similar to how silent payments work.

Trade-Offs

However, like any other system, Ark does have its own trade-offs. Although it may not offer instant settlements as rapidly as Lightning does, it provides immediate accessibility to funds without having to wait for confirmations in what Burak described as “immediate availability with delayed finality.”

For vendors, Lightning is still the better option when it comes to receiving payments. Additionally, liquidity providers are required, but based on the assumption that individuals will be motivated to offer liquidity to earn yield in bitcoin, Burak also thinks this challenge can be easily overcome in the long term. This novel proposition addresses certain shortcomings in Lightning, yet also comes with its own set of challenges.

The Road Ahead

In summary, the Ark protocol is a unique, second-layer scaling solution with unilateral exit capability that enables seamless transactions without imposing any liquidity constraints or interactivity, nor necessitating a direct connection between sender and receiver. Therefore, recipients can easily receive payments without the hassle of any onboarding setup, maintaining a continuous server presence or compromising their anonymity to third parties. Designed to be a scalable, non-custodial solution, Ark allows users complete control over their funds and gives everyone the option to self custody their money.

Ark is interoperable with Lightning, but also serves as a complement to it. However, due to the complicated process of self-custodial Lightning and varying levels of privacy for senders and receivers, along with the imminent danger posed by blockchain surveillance firms, scaling solutions that prioritize privacy, like Ark, have become essential. The various attempts to attack Bitcoin through malicious prosecution, like in the case of Sterlingov, and predatory legislation such as the EU’s MiCA, demonstrate the need for scalable, efficient, privacy-preserving tools in order to prevent future issues.

It’s against this background that I think Ark is an interesting concept worth keeping an eye on as development of the protocol unfolds. Of course, without code to review at the moment or a battle-tested, working prototype, it’s still a long road ahead. Despite the unforeseen challenges ahead, Burak is optimistic about Ark’s potential and is convinced that it’s a breakthrough that strikes the balance between private Bitcoin transactions and scalability, in a user-friendly manner. A sentiment that I also share, given the vital need for non-custodial, privacy-preserving tools.

This is a guest post by Kudzai Kutukwa. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC