- A crypto investor shares how AI agents drive innovation and new opportunities in the blockchain space.

- Diversification and research are vital lessons learned from a $2.5M crypto trading journey.

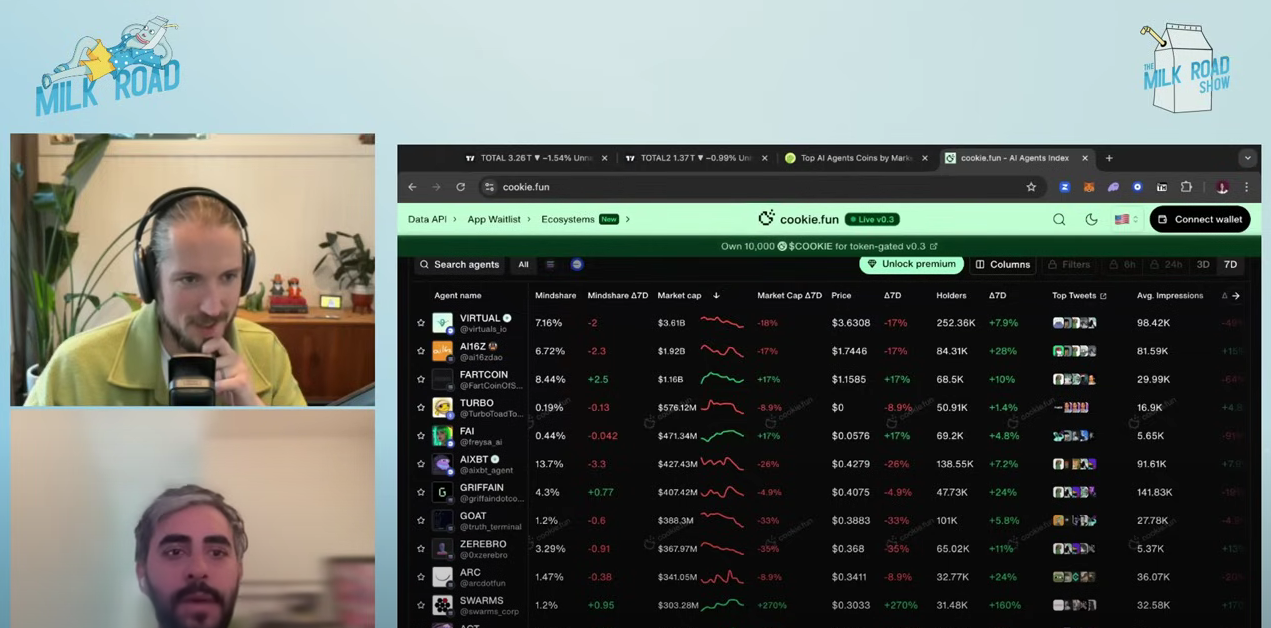

Zeneca, a well-known crypto investor, transformed a $20K to $50K initial investment into $2.5 million in just two months. Zeneca discussed his journey and the techniques, prospects, and difficulties of trading AI agent-related tokens on the Milk Road YouTube channel.

His narrative gives investors insightful analysis and emphasizes the increasing importance of artificial intelligence agents in the crypto market.

Early Successes in AI Agent and Meme Coin Trading

Zeneca entered the niche market of AI agents and meme coins, beginning with a small portfolio of Ethereum (ETH) and Solana (SOL). His first significant victory came with GOAT, a token connected to an independent “sentient” AI Agent.

Zeneca contributed $10,000 early, while Goat’s market cap was around $10 million to $15 million. He realized earnings of $500,000 to $600,000 as the token shot to a value of more than $1 billion.

After GOAT proved successful, Zeneca used a technique he calls “spray and pray.” He concentrated on intriguing initiatives within the AI agent ecosystem, distributing his investments across multiple tokens.

Investing in the Virtuals ecosystem on Base, a platform allowing the launch and running of AI agents, resulted in still another notable success. Zeneca reduced risks by focusing on initiatives gaining momentum and carefully distributing revenues.

The Role of AI Agents in Shaping Crypto’s Future

Rising as a combination of meme coins and utility tokens, AI Agents combine speculative appeal with practical possibilities. Often with autonomous decision-making powers, these agents have drawn a lot of interest for their creative uses.

Zeneca underlined the value of AI Agents, who range from handling crypto wallets to completing difficult chores, including recruiting additional AI agents. Virtuals and A16Z are among the main platforms helping developers to construct and implement AI agents.

The success of Zeneca emphasizes the need for early identification of market narratives. Combining hype with real-world use cases, he thinks AI Agents define a dominant trend in the present crypto cycle.

The ecosystem is set for major expansion with well-known sponsorships and forecasts of a multi-trillion-dollar artificial intelligence sector. Zeneca advised readers to be alert, though, since such markets naturally create speculative bubbles.

Key Lessons from Zeneca: Diversification and Informed Investing

Zeneca offered insightful analysis throughout the conversation to help negotiate the erratic realm of cryptocurrency trading. Drawing on past cycles, he underlined the need of routinely earning profits.

Unlike 2021, when he kept most of his money in NFTs, this time he diversified both inside and outside the crypto market, withdrawing gains into fiat currencies and stable assets.

Zeneca also underlined the need of gathering knowledge and developing conviction prior to making an investment. He recommended monitoring emerging platforms while focusing on established ecosystems such as Virtuals and A16Z.

He advised individuals new to AI agents to start small, track market movements, and progressively expose themselves depending on personal risk tolerance.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Bitget Token

Bitget Token  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Uniswap

Uniswap  MANTRA

MANTRA  Wrapped eETH

Wrapped eETH  Ondo

Ondo  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Aave

Aave  Dai

Dai  Mantle

Mantle  Internet Computer

Internet Computer  Aptos

Aptos  Bittensor

Bittensor  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic  Official Trump

Official Trump  OKB

OKB  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)