Quick Take

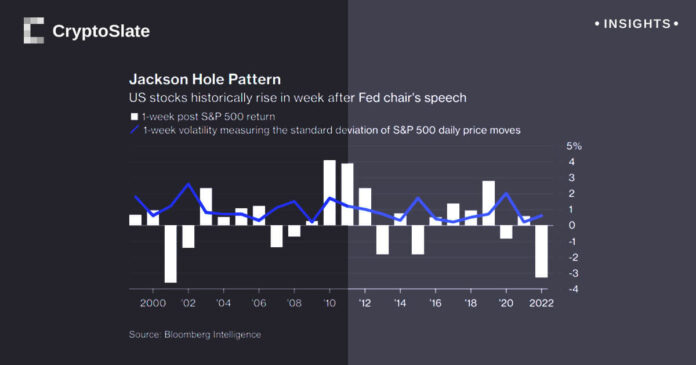

A historical analysis of the S&P index reveals significant market activity after the annual Jackson Hole meeting, which could have implications for the cryptocurrency and blockchain sectors. This comes to light via a comprehensive chart constructed by Bloomberg Intelligence and put together by Markets & Mayhem, indicating a consistent pattern of stock price increases in the week succeeding the meet. The Jackson Hole meeting, a major economic symposium attended by international central bankers and finance ministers, is scheduled for August 24 to 26 this year. The meeting is expected to center on a “structural shift in the global economy,” according to the Kansas City Fed.

These meetings have traditionally sparked a positive response from the S&P since the turn of the millennium. Despite this, it is crucial to note that 2022 marked the worst performance of the index post-meeting since 2001. This deviation from the regular pattern raises questions about the potential market response this year, especially considering the proposed focus on structural economic changes that could drive shifts in the cryptocurrency and blockchain landscape. It underscores the significance of the Jackson Hole meeting’s outcomes and their influence on the direction of the S&P and, by extension, the broader financial market.

The post Historic post-Jackson Hole S&P surges prompt heightened expectations for market responses appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)