Hex cryptocurrency has fallen victim to the famous quote, “And if you gaze long enough into an abyss, the abyss will gaze back into you.” The Hex cryptocurrency was the most talked about token between 2020 and 2022, attracting investors from around the globe. Its founder, Richard Heart, was a dynamic personality who flexed his wealth on social media at every opportunity.

Also Read: Top 2 Cryptocurrencies To Watch in September 2024

The Rise and Fall of Hex Cryptocurrency

From fancy sports cars to expensive Rolex watches and Louis Vuitton outfits, the founder lived a larger-than-life personality. However, the U.S. Securities and Exchange Commission (SEC) sued him for “misappropriating millions,” and things went downhill from there.

For the uninitiated, Hex was the only cryptocurrency that doubled in price every 48 days between August 2020 and September 2021. The surge was phenomenal, making the token bullish and the most sought-after asset in the cryptocurrency market. Investors made heaps of profits with Hex, which was touted to be the next big thing.

Also Read: VeChain: Should You Buy VET Now & Enjoy Profits in September?

The Hype and the Downfall

Last year, a documentary about its investors making millions in profits in a short period was released. It also boasted one of the biggest armies on social media, dominating the sector.

Hex Now 99.8% From Its All-Time High

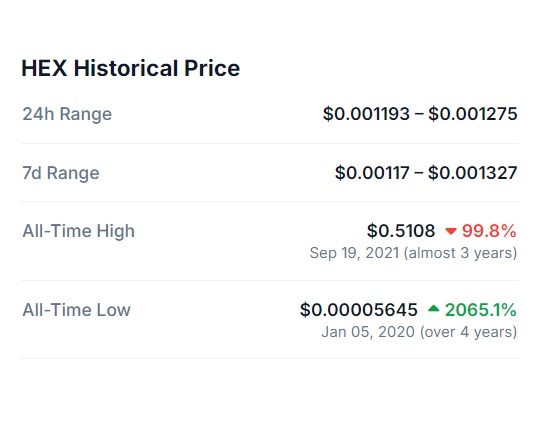

Hex reached an all-time high of $0.51 in September 2021 after doubling in price for 13 consecutive times. After the SEC lawsuit and wrongdoings, its price collapsed like a pack of cards and might never return to its previous glory.

It is now trading at $0.0012 and is down 99.8% from its all-time high. The social media presence, fanfare, hype, and buzz fizzled out, leaving investors with massive losses.

Also Read: US Dollar in Dangerous Waters: DXY Index Could Fall Below 100

Investor Sentiment & Future Outlook

Investors who took an entry position that could keep doubling in price every 48 days are seeing their portfolios being crushed. As the saying goes, And if you gaze long enough into an abyss, the abyss will gaze back into you.”

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena