Multiple crypto personalities have suggested Alt Season is nearing.

For example, in a recent tweet, Ash WSB described a four phase path to “FULL BLOWN ALTSEASON.”

It involved Bitcoin stabilizing around $30,000, then the money flowing into Ethereum — which has posted 9.7% gains over the last 24 hours, tapping $2,130 to mark a 48-week high.

The third phase is when (other) “large caps are going parabolic” from money flowing from Ethereum. Finally, Alt Season kicks off when large-cap gains trickle down into the rest of the market.

At this point, every coin pumps regardless of the fundamentals — creating mania and signaling the arrival of Alt Season, said Ash WSB.

It should be noted that a universally recognized definition of Alt Season does not exist. However, as alluded to above, alt season is generally identified by altcoins posting manic gains.

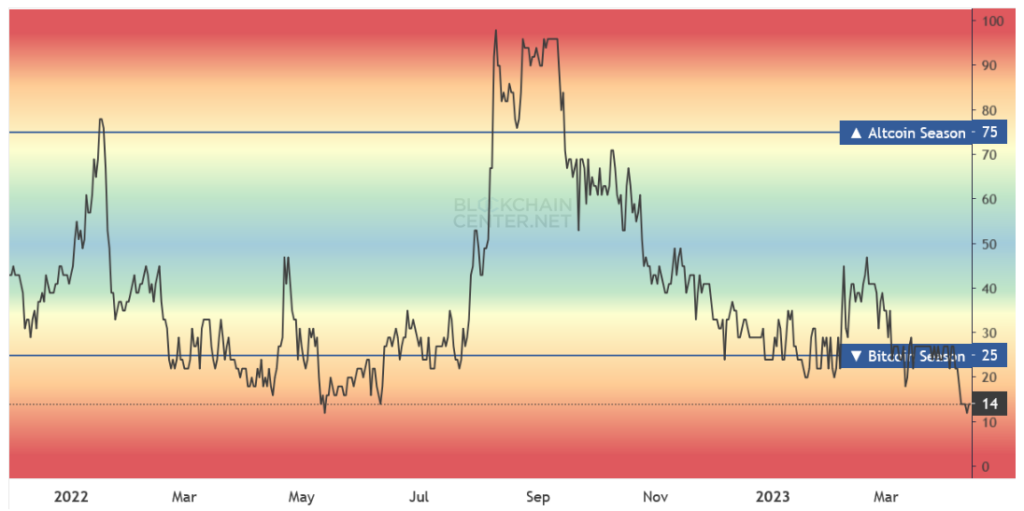

Nonetheless, Blockchain Center — with its Altcoin Season Index — has quantified an objective definition of Alt Season.

Alt season

According to Blockchain Center, Alt Season is when at least three-quarters of the top 50 coins are outperforming Bitcoin over a running three-month time frame.

“If 75% of the Top 50 coins performed better than Bitcoin over the last season (90 days) it is Altcoin Season. Excluded from the Top 50 are Stablecoins (Tether, DAI…) and asset backed tokens (WBTC, stETH, cLINK,…)”

The current 90-day performance of the top 50 shows only 9 coins/tokens outperforming the market leader — XRP, ADA, FTM, RPL, SOL, DOGE, LTC, XLM, and ETH.

By Blockchain Center’s definition, an additional 29 coins/tokens would need to outperform Bitcoin before Alt Season can be officially called.

Indexing this data, Blockchain Center has assigned a current score of 14 — deep within Bitcoin Season — spelling bad news for those who expect the imminent arrival of Alt Season.

The chart below identified the last Alt Season occurring between early-August 2022 and mid-September 2022.

How are things looking?

Bitcoin dominance reached 48.9% of the market on April 11. The rejection at this level has led to a downtrend — suggesting Phase 1 of Alt Season is underway.

However, the 47% zone represents strong support and is one to watch before declaring Phase 1 complete.

Ethereum dominance is currently soaring due to the recent Shanghai upgrade. This may have enough momentum to hinder significant outflows to the other large caps.

The chart below shows ETH.D is on the cusp of testing 20.4% resistance — a break above this level would keep Alt Season pegged at Phase 2.

Nonetheless, total market cap inflows are rising. The last seven days saw an additional $108 billion (+9%) added to the total market cap. Likewise, year-to-date total market gains were $488 billion, to $1.28 trillion (+61%) — a level not seen since May 2022 —Bitco before the Terra implosion.

This would suggest the crypto market has recovered from the contagion event.

The post Here’s why alt season may be on the horizon appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC