Crypto miner F2Pool mined the last block on the Ethereum proof of work network a few hours back. Per on-chain data, 15537393 was the last block before the Merge, and F2Pool paid around 29,991,429 gwei in gas to mine the same.

That marked the end of the mining era on Ethereum. With the transition to the proof of stake consensus mechanism, validators are now the new block creators, and miners have been forced to exit the Ethereum ecosystem.

Over the past few months, the migration trend was in play gradually. Miners were testing alternative PoW networks where they could settle. However, on Thursday, the hashrate of prominent networks like Ethereum Classic and Ravencoin soared, hinting at the possible entrance of new miners into the networks’ ecosystems.

Chalking out the numbers of Ethereum Classic and Ravencoin

Towards the end of August, the Ethereum Classic network claimed an ATH of 38.07 TH/s on the said front. Since then, there has been no looking back. The uptrend has been consistent, and at press time, the rate stood at 160.81 TH/s.

It’s a known fact that the Ethereum Classic network has been a victim of several hacks in the past. The rising hashrate, nonetheless, will aid in curbing the same, for it makes the network more secure and less vulnerable to attacks.

Also Read: Pre-ETH Merge, Ethereum Classic hash-rate claims ATH

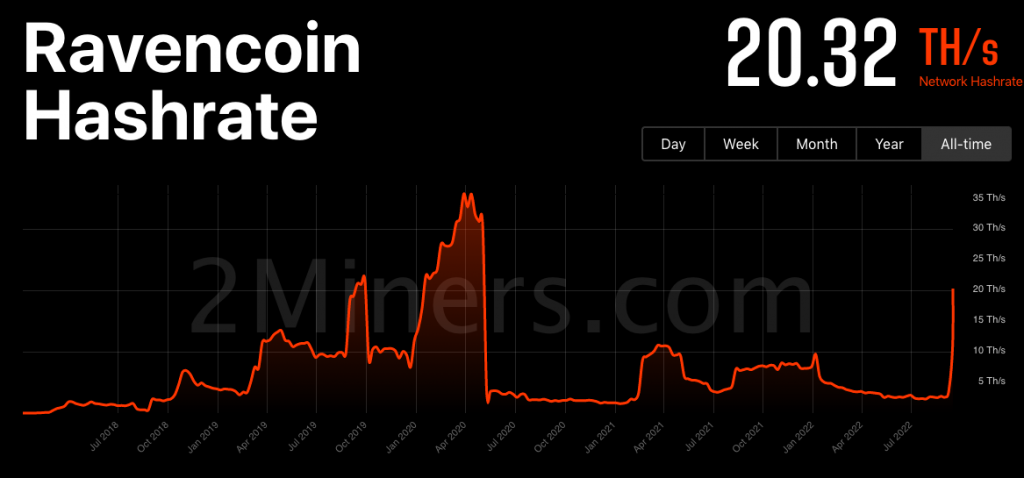

Even Ravencoin, for that matter, noted a sharp spike on the hashrate front. Per data from 2miners, the said metric’s reading revolved around 2.59 TH/s towards the end of August. However now, it stands at an elevated level of 20.32 TH/s. Even though the spike has been noteworthy, it is worth noting that Ravecoin did not create an ATH on this front today.

How the OG networks’ hashrate has been faring?

As highlighted above, miners have been flocking to alternative networks like Ravencoin and Ethereum Classic mostly because the properties and hashing algorithms of the said networks are similar to a fair extent.

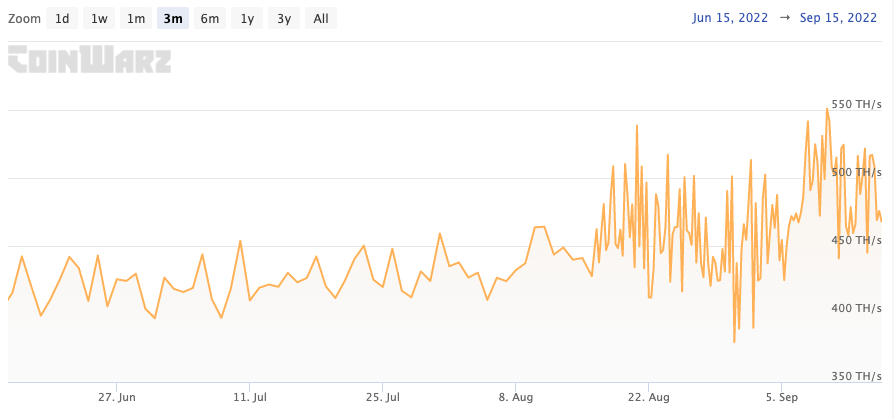

Conversely, the hashrate trend for other OG altcoin networks continues to remain monotonous. As far as Dogecoin is considered, for instance, the said metric has undoubtedly risen in the 3-month timeframe. However, of late, it has mostly remained stagnant.

Litecoin’s hashrate, on the other hand, has been on the downtrend over the past few days. From 9 September’s 527.02 TH/s, the number was down to 460.70 TH/s at press time.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC