Grayscale’s Chainlink Trust (GLNK) shares are trading at a substantial premium of over 200% compared to the spot price of Chainlink’s LINK token.

Grayscale’s data shows that GLNK shares are trading at $39, while the LINK token’s market value is $12.51 as of press time. This means that the value of GLNK is three times higher than the underlying assets it holds.

Chainlink community ambassador ChainLinkGod first reported the surge in this premium on the social media platform X.

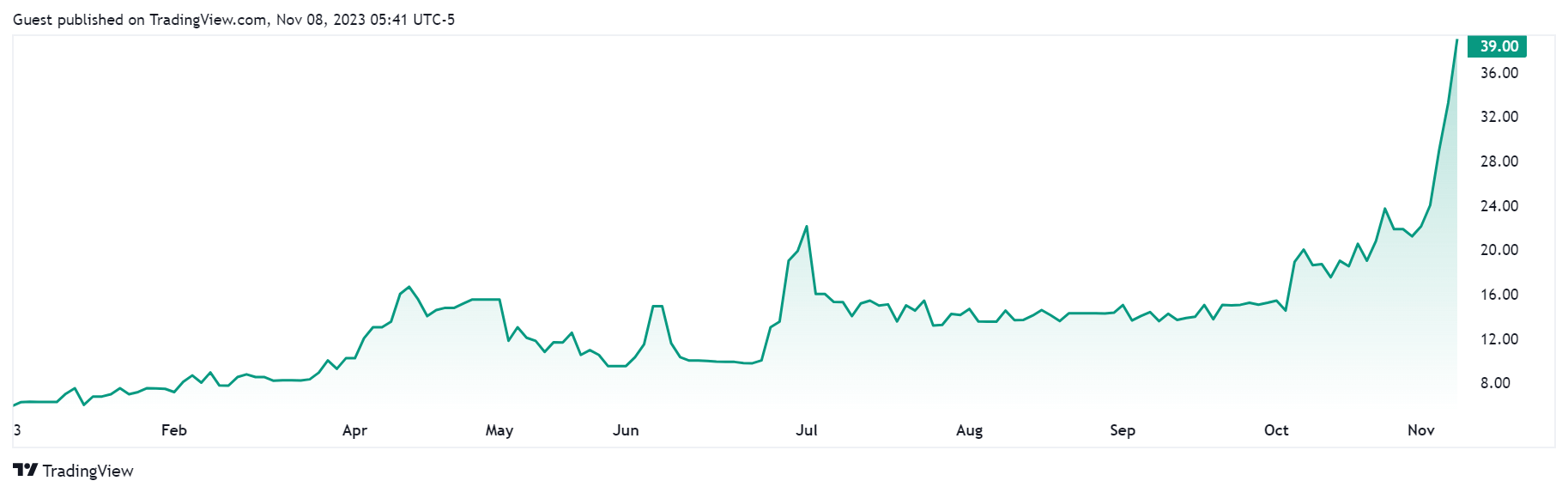

The chart below shows that the LINK and GLNK had traded almost at par earlier in the year before a premium difference emerged between the two assets in March.

Since then, the premium has continued to grow, driven by Chainlink’s increased adoption and the use of its Cross-Chain Interoperability Protocol (CCIP) by major traditional firms such as South Korean gaming giant Wemade and the global financial messaging network Swift.

Data from Tradingview also shows that GLNK has maintained strong price performance throughout the year, rising by over 250% in the last six months and nearly 540% year-to-date.

CryptoSlate, citing CoinShares’ weekly update, recently reported that Chainlink-related crypto investment products enjoyed notable inflows during the past week, with $2 million invested.

Grayscale introduced its Chainlink Trust in May 2022 as a regulated product, providing U.S. investors with exposure to LINK. Since then, the product has attracted considerable interest, with total assets under management currently valued at $3.9 million.

However, like other Grayscale Trusts, GLNK shares are not redeemable for the underlying asset they track. This means investors can only exit their positions by selling the shares to another party.

Meanwhile, LINK is also experiencing a positive rally, reaching a yearly high of $12.65 on Nov. 6 before retracing to its current levels.

The post Grayscale’s Chainlink Trust shares is trading 200% higher than LINK’s spot price appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  Official Trump

Official Trump  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB