Quick Take

- As economic instability increases worldwide, concerns about the reserve currency will always be questioned.

- Reserve currencies tend to last around 100 years; we have heard these are the last days of the US dollar hegemony for decades.

- We don’t believe the dollar will lose its reserve currency status soon; however, news stories in recent weeks and especially since the Ukraine Invasion, freezing Russia off the swift system doesn’t bode well.

- CryptoSlate did a recent market report on de-dollarization and the possible implications for Bitcoin.

- U.S. Treasuries are the benchmark for the global economy, deemed the “risk-free” rate of the world. However, major nations are starting to offload treasuries, most notably China and Japan.

- China sold almost 18% of its holdings in the last 12 months, while Japan sold 17% of its treasuries in the same time period.

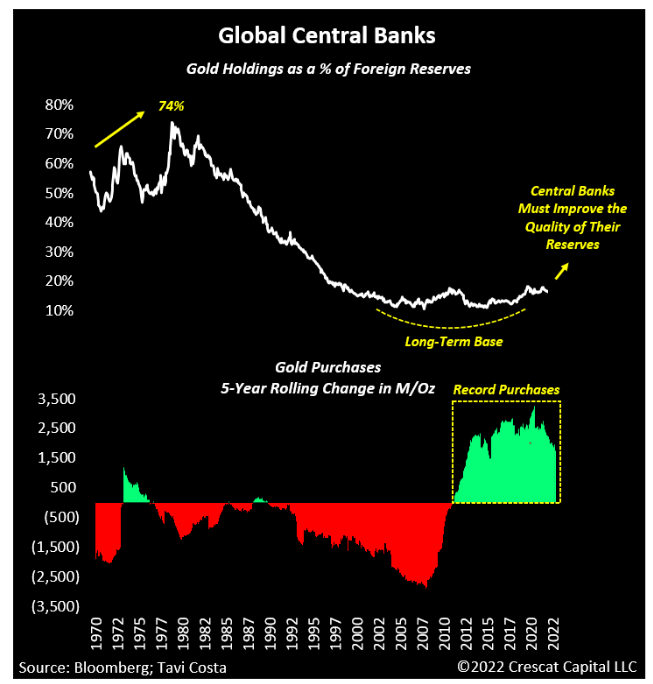

- This so happens to coincide with a time when global central banks, mainly in the East, are increasing their Gold holdings as a % of foreign reserves.

The post Global shift away from the US dollar prompts offloading of US treasuries appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC