Cryptocurrency exchange Gemini has filed a reply brief in response to a lawsuit initiated by the United States Securities and Exchange Commission (SEC). The lawsuit, which is being heard in the U.S. District Court for the Southern District of New York, alleges that Gemini’s service, Gemini Earn, violated securities regulations by offering “unregistered securities.”

A Robust Defense

Gemini’s legal defense, represented by firms JFB LEGAL, PLLC, and SHEARMAN & STERLING LLP, has been robust. The reply brief, dated August 18, 2023, challenges the SEC’s claims, arguing that their complaint is based on “conclusory statements” and lacks concrete evidence. Specifically, Gemini’s defense has highlighted the SEC’s failure to answer pivotal questions, such as when the alleged security was sold, who were the buyer and seller, and at what price it was offered.

Gemini Earn at the Center of Controversy

The core of the lawsuit revolves around the Gemini Earn service, which facilitates customers in lending crypto assets like Bitcoin to Genesis. The SEC asserts that this service breached securities regulations. However, Gemini has consistently contested this claim. On May 27, the exchange posited that transactions within the Gemini Earn program were essentially loans, urging the SEC to dismiss the complaint based on this perspective.

Adding to the public discourse, Jack Baugham, a founding partner of JFB Legal, made a statement highlighting the inconsistent nature of the SEC’s arguments. He described the regulator’s approach as “floundering” and emphasized the contradictory facets of their claims.

Previous Legal Challenges

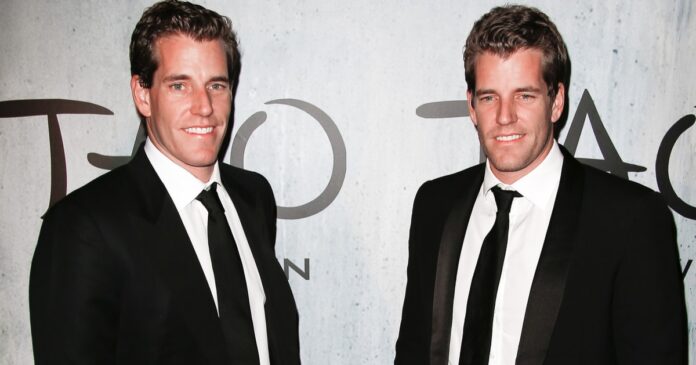

Earlier in the year, the legal waters were further muddied when US regulators initiated a lawsuit against both Gemini and Genesis Global Capital, alleging unregistered securities trading through the Gemini Earn program. This was compounded by accusations from investors against Gemini and its co-founders, alleging fraudulent activities.

In an official blog post, Gemini addressed the lawsuit, terming it “ill-conceived.” They underscored the clarity of “Section 5 of the securities act” and criticized the SEC for their ambiguous stance on the matter.

The Downfall of Gemini Earn

Genesis served as the primary lender for the Gemini Earn program, which once boasted an impressive annual return of over 8%. Digital Currency Group (DCG) borrowed a significant $1.65 billion from Genesis and subsequently channeled these funds primarily to Three Arrows Capital and the cryptocurrency exchange FTX. Unfortunately, both entities declared bankruptcy in 2022, leading to challenges for Gemini Earn users in retrieving their investments.

For transparency, the Gemini Earn website has been consistently updated with unfolding events. As of August 18th, the website reported that mediation sessions were held on August 16th and 17th, with Genesis extending the mediation to August 23rd. Gemini has voiced concerns over the prolonged negotiations with DCG, aiming to ensure fair compensation for Genesis’s creditors, including Earn users. DCG defaulted on a payment of $630 million due to the Genesis bankruptcy estate between May 9th and 11th.

Despite facing a motion by DCG and its CEO, Barry Silbert, to dismiss a lawsuit alleging them of fraud, Gemini claims to remain steadfast in its stance. They are set to respond to this motion by September 14th. On a positive note, Genesis has brokered a settlement agreement with the FTX estate, reducing FTX’s claim from $3.7 billion to $175 million against Genesis, promising better recoveries for all affected creditors.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  MANTRA

MANTRA  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC