Join Our Telegram channel to stay up to date on breaking news coverage

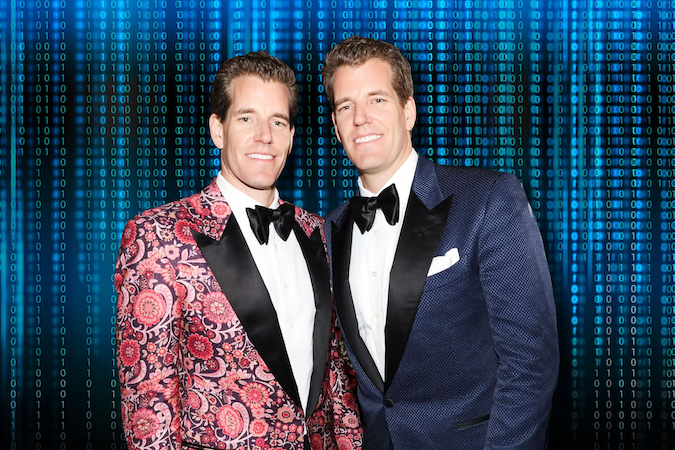

The twin billionaires behind the Gemini cryptocurrency platform, Tyler and Cameron Winklevoss, have initiated a lawsuit against another titan in the crypto industry and his firm. The Winklevoss twins claim their customers have been swindled out of significant sums, reaching hundreds of millions of dollars.

The legal action, lodged in the New York Supreme Court, targets Barry Silbert, the CEO who established Digital Currency Group, as well as the group itself. Gemini accuses the defendants of engaging in a “deception” strategy, convincing Gemini customers and various depositors to lend substantial quantities of both cryptocurrency and U.S. Dollars.

In the suit, the Winklevoss twins argue that Digital Currency Group and its founder, Silbert, are responsible for the financial chaos, asserting they made misleading statements about the risk management practices of Genesis, a subsidiary of Digital Currency Group. Despite losing more than $1 billion after the downfall of the crypto hedge fund Three Arrows Capital in the previous summer, Silbert and the firm allegedly claimed DCG had offset the losses and it was “business as usual”. But this wasn’t the case, and the aftereffect soon affected third parties such as Gemini, leading Genesis to file for Chapter 11 bankruptcy protection in January.

The lawsuit draws attention to the fact that Genesis allegedly distorted parts of its financial status, which indirectly led to Gemini users suffering losses. Gemini had previously assured customers that their lending partners, particularly Genesis, were subjected to a thorough risk management framework.

A controversy had previously surrounded Gemini Earn within the company itself, before the collapse of Genesis. When the terms and conditions of Earn were unveiled in 2021, a former staff member recalls that the internal response was one of disbelief and concern.

Gemini users were informed in the small print that their assets were unsecured if a default happened and that borrowers were not obliged to post collateral. Gemini conceded that it could not guarantee long-term returns. However, it required customers to cover potential losses unless they could establish gross negligence or intentional wrongdoing.

We perform routine analysis of our partners’ cash flow, balance sheet, and financial statements to ensure the appropriate risk ratios and healthy financial condition.

Despite these risks, the firm portrayed the venture as simple and hassle-free, with one ex-employee, Nick Fuhrmann, commenting to the press the previous year, “The company definitely sold it as like, ‘It’s hassle-free. It’s easy. Get your crypto back right away, no delays’”. Gemini also stated it would routinely perform “an analysis of our partners’ cash flow, balance sheet, and financial statements to ensure the appropriate risk ratios and healthy financial condition.”

The document for the lawsuit also indicated that numerous Gemini customers were persuaded to lend money to Genesis through a program called Gemini Earn. The program advertised that customers would enjoy up to 7.4 percent interest on their loans and could withdraw their money at any point. However, in the wake of widespread volatility in the cryptocurrency markets in November, Gemini put a halt to withdrawals, causing customer assets to be locked up. It was later reported the outstanding balance to be around $900 million.

DCG: Lawsuit is a “Publicity Stunt”

In a counter to the allegations, DCG released a statement branding Gemini’s lawsuit as baseless and defamatory. This was characterized as just another attempt by Cameron Winklevoss to deflect blame and responsibility from himself and Gemini. DCG’s response firmly denies any suggestions of misconduct by the company or its employees, labeling such insinuations as baseless, defamatory, and entirely false.

The company statement elaborated on the ongoing negotiations with the Official Unsecured Creditors Committee and the Ad Hoc Committee. DCG criticized Gemini’s leadership for their absence in these discussions while issuing press statements. The DCG press release concludes by stating that neither of the Winklevoss twins was involved in any face-to-face meetings and that they anticipate the Genesis Chapter 11 case to be resolved soon.

Reacting to DCG’s statement, Tyler Winklevoss, Gemini’s co-founder, took to Twitter, questioning DCG and Barry Silbert’s failure to address or refute the allegations detailed in the 33-page complaint. Tyler Winklevoss demanded clarity on which parts were “baseless, defamatory, and completely false”.

Related News

Wall Street Memes – Next Big Crypto

- Early Access Presale Live Now

- Established Community of Stocks & Crypto Traders

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection – Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)