The FTX debtors said they had paid the 14 consultancy firms and the law firms handling its bankruptcy case over $100 million as of April 30, according to a May 30 court filing.

Sullivan & Cromwell is top earner

According to the filing, FTX paid law firm Sullivan & Cromwell (S&C) $39.58 million for its services, making it the highest earner among these firms.

S&C is the company’s restructuring counsel and has played an active role in FTX’s bankruptcy case. The law firm previously described its services to the bankrupt exchange as “one of the most complicated, multi-disciplinary exercises by any law firm.”

The firm was initially met with stiff opposition from Sam Bankman-Fried, who accused the law firm of pressuring him to authorize filing for bankruptcy in the days following FTX’s implosion. S&C’s involvement in the proceedings has also been challenged by U.S. lawmakers Thom Tillis, Elizabeth Warren, John Hickenlooper, and Cynthia Lummis, who cited its previous relationship with FTX in a Jan. 9 letter to the court.

Another top-earning firm in the FTX’s bankruptcy case is Alvarez & Marsal North America, acting as a financial advisor to the bankruptcy case. The firm has earned $32.7 million.

Others like Landis Rath & Cobb, Quinn Emanuel Urquhart & Sullivan, AlixPartners, Kroll, Jefferies LLC, and others have earned between $257,149 and $5.01 million.

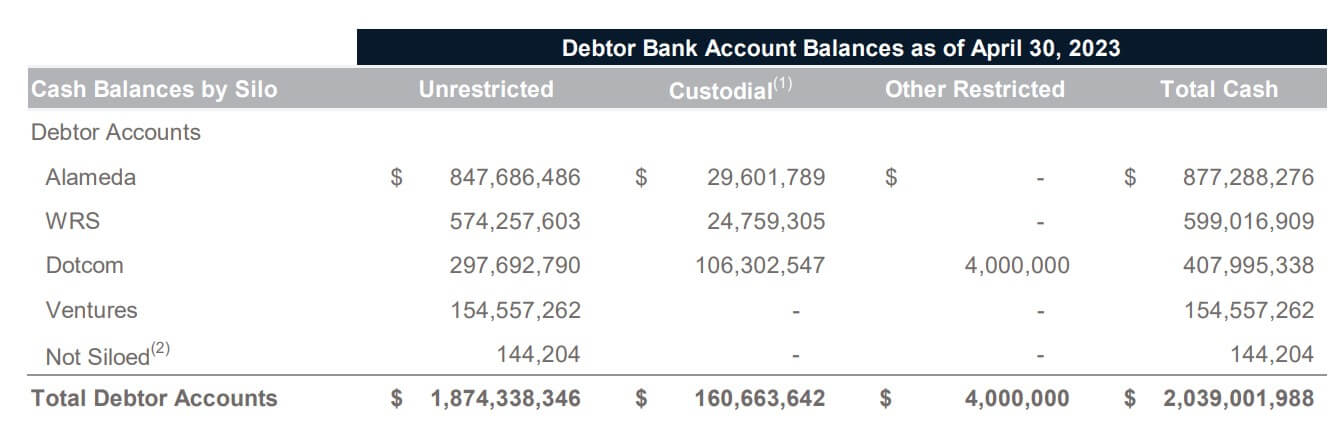

FTX has $2.03B in bank

The debtors in FTX’s bankruptcy reported that the four siloes of the bankrupt crypto empire held $2.03 billion in unnamed banks as of April 30.

A breakdown of these bank account balances showed that the Alameda silo, which comprises the principal trading firm Alameda Research and its subsidiaries, had $877.28 billion in banks. In contrast, the West Realm Shires silo — which includes FTX US and Ledger X — had 599.01 billion in the banks.

The Dotcom silo, which comprises FTX.com and other exchanges, had $407.99 billion in banks, while the FTX Ventures held $154.55 billion in these traditional financial institutions.

Additionally, Deck Technologies, Inc—a separate entity and not one of the four silos making up FTX’s main accounts — has $144,204 in banks.

The FTX debtors said they maintained accounts in foreign currencies across numerous entities. The bankrupt firm did not provide further information on the names of these banks or the amount held at each.

Reports revealed several U.S. banks’ ties to the bankrupt exchange earlier in the year. A lawsuit alleged that the defunct Signature Bank aided and abetted the FTX fraud by “permitting” the commingling of the exchange users’ funds through its Signet network.

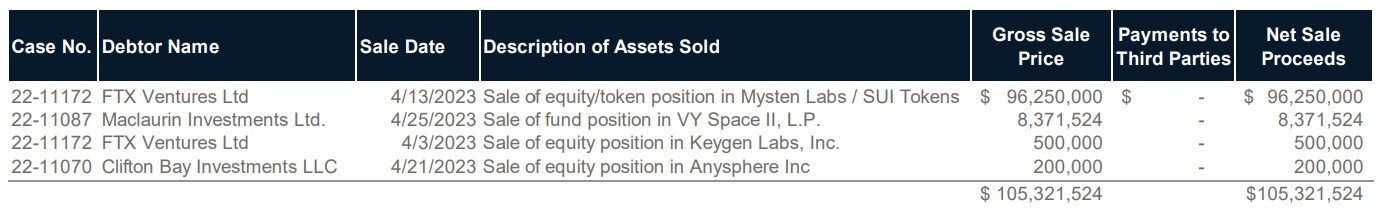

FTX earned $105M

The financial statement further showed that the bankrupt firm got $105.32 million through the sales of four different assets.

According to the filing, the exchange earned $96.25 million from the sales of its equity and token position in Mysten Labs’ SUI Tokens. CryptoSlate reported that the bankrupt exchange had undervalued its SUI holdings by approximately 1,000 times, as the tokens would have been worth over $1 billion.

Meanwhile, the firm sold its fund position in VY Space for $8.3 million on April 25 and its equity position in Keygen Labs and Anysphere for $500,000 and $200,000, respectively.

Other updates

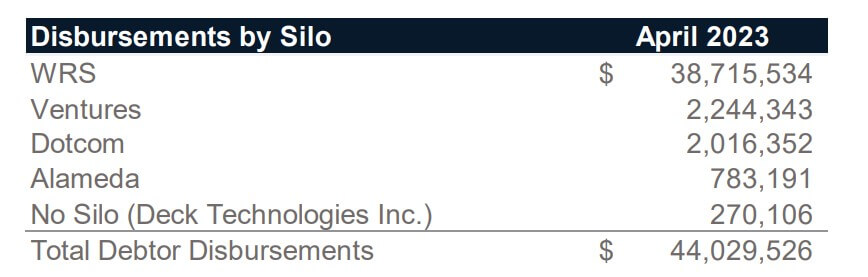

According to the court filing, FTX made $44.02 million in disbursements in April. The filing did not include details on when these payments were made and to whom they were made.

Additionally, FTX said it has 107 full-time employees, down from the 320 employees it had when it filed for bankruptcy and paid a total post-petition taxes of $386,033 in April.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Litecoin

Litecoin  Hedera

Hedera  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Bitget Token

Bitget Token  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  MANTRA

MANTRA  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ondo

Ondo  Monero

Monero  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  NEAR Protocol

NEAR Protocol  Aave

Aave  Dai

Dai  Mantle

Mantle  sUSDS

sUSDS  Aptos

Aptos  Internet Computer

Internet Computer  Bittensor

Bittensor  Official Trump

Official Trump  OKB

OKB  Ethereum Classic

Ethereum Classic  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)