The biggest news in the cryptoverse for Dec. 15 includes the FTX co-CEO Ryan Salame being revealed as the whistleblower, Donald Trump’s NFT collection, and research on long-term Bitcoin holders still showing bullish sentiment despite losses.

CryptoSlate Top Stories

FTX co-CEO Ryan Salame tipped off Bahamian regulators on Nov. 9 that the exchange was sending its customers’ funds to Alameda Research, according to a Dec. 14 court filing.

Salame told the Securities Commission of the Bahamas (SCB) that only three people could make such transfers. These people included FTX founder Sam Bankman-Fried, co-founder Zixiao “Gary” Wang, and director of engineering Nishad Singh.

Former US President Donald Trump brings his first NFT collection, known as Collect Trump Cards.

According to the official website, each NFT costs $99 and is designed by illustrator Clark Mitchell. Additionally, these Trump Digital Trading Cards are minted on the Polygon blockchain.

Every NFT includes an entry into “Sweepstakes” for certain prizes. Only legal residents of the 50 United States and the District of Columbia who are 18 years of age or older are eligible to enter the Official Donald Trump NFT Collection Sweepstakes.

The number of NFTs available to be minted during the Sweepstakes Entry Period is limited to 45,000, including 44,000 NFTs available for purchase during that period.

The New York Department of Financial Services (DFS) has released a guideline mandating banking institutions to seek regulatory permission at least 90 days before offering crypto-related services.

The guideline released on Dec. 15 by the DFS Superintendent Adrienne Harris stated that New York-regulated banks must seek approval from the Department before engaging in crypto-related services, even if it is via a third party.

Under the guideline, banks will need to inform the Department at least 90 days before it commences the process to offer crypto-related services.

In addition, interested banks will have to submit a document covering six broad categories of information related to their business plan, risk management, corporate governance, consumer protection, financial, legal, and regulatory analysis.

BitGo CEO Mike Belshe revealed that the firm declined Alameda Research’s request to redeem 3,000 Wrapped Bitcoin (WBTC) a few days before its bankruptcy in a Dec. 14 Twitter space.

Belshe said BitGo declined the request because the Alameda representative that reached out to his firm failed the security verification process.

He added that BitGo is familiar with the representatives of all the firms that owned WBTC, and this representative from Alameda was not someone the custodian had interacted with before.

FTX’s collapse resulted in around $9 billion in realized losses for crypto investors, according to a Chainalysis report.

Chainalysis noted that this loss paled compared to Terra’s UST depeg, which caused a loss of $20.5 billion. The implosion of crypto firms like Celsius and Three Arrows Capitals led to $33 billion in realized losses.

According to Chainalysis, weekly realized loss and gain are calculated based on the value of assets in a wallet at the time they were acquired minus the value of the portion of the assets transferred from the wallet at the time of recording the data.

While the transfer of assets from a wallet does not necessarily imply a sale, it gives an insight into how those events affected investors. The data shows that many investors had already lost significantly more value before the FTX crash.

Big Time has won the prestigious Game of the Year title at the Polkastarter Gaming GAM3 Awards 2022.

The action-adventure game from Open Loot is an open-world RPG with unique blockchain game mechanics. Take a look at the game from the episode of the SlateCast earlier this year.

After narrowing down the nominees to 32 games from a pool of over 200+ web3 games the awards are now complete. Alongside the industry jury, there were over 200,000 community votes across the 16 categories.

Research Highlight

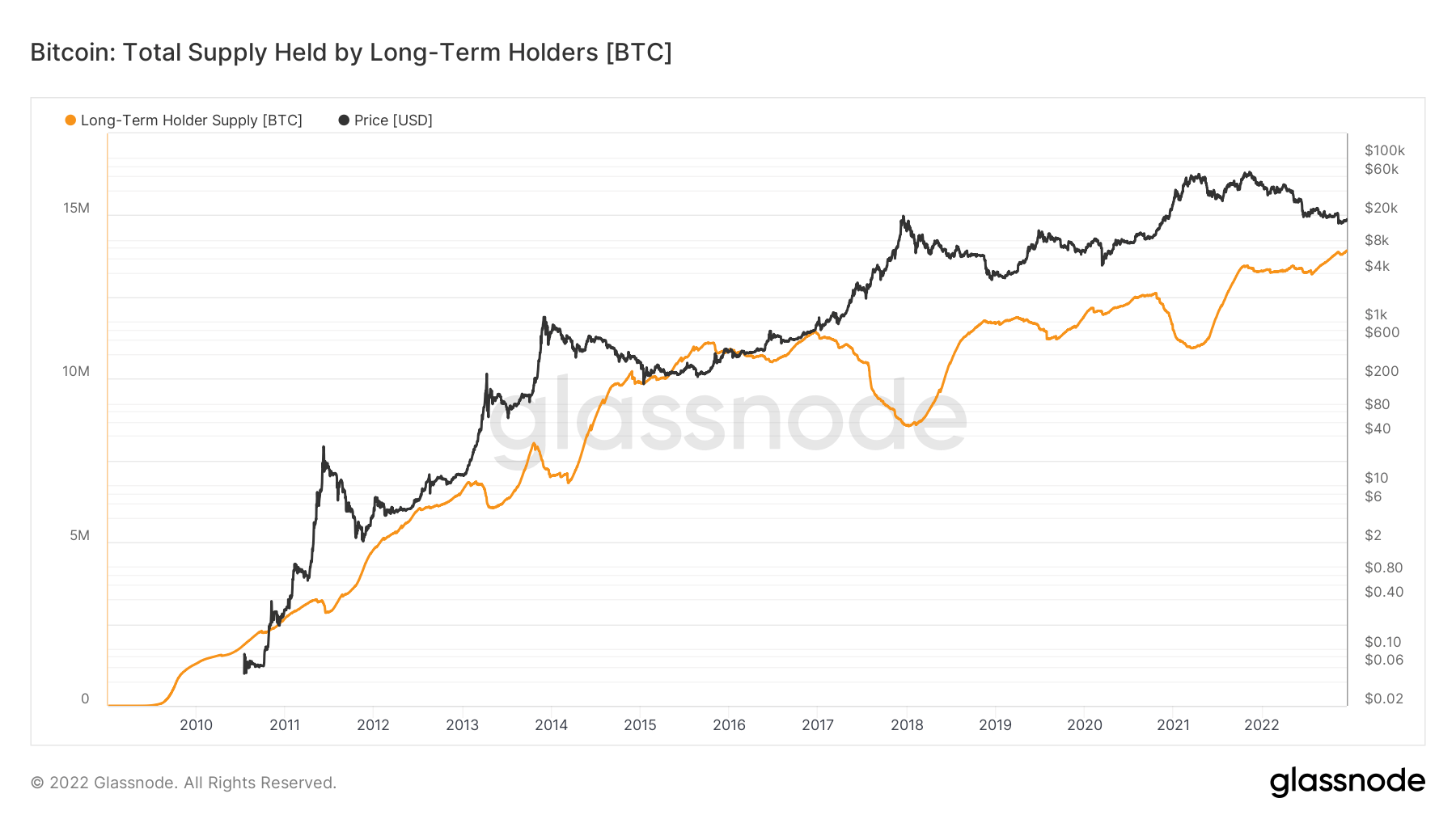

Bitcoin’s (BTC) year-long decline has left several holders with unrealized losses, including long-term holders (LTH) who have held the coin for at least six months.

However, CryptoSlate’s analysis of Glassnode data showed that this group of investors remains bullish on the flagship digital asset.

According to Glassnode data, the cohort holds a record-high amount of Bitcoin –13.8 million. The group is also considered the smart money of the Bitcoin ecosystem because they usually accumulate during bear markets and sell during bull runs.

For context, long-term holders added around 1 million BTC to their holdings in November. This was because LUNA’s crash in May triggered a significant dip in price that allowed traders to accumulate the asset. Those that bought Bitcoin at the time are now part of this cohort, as they have held for the last six months.

Crypto Market

In the last 24 hours, Bitcoin (BTC) fell by 2.97% to trade at $17,404.71, while Ethereum (ETH) fell by 3.44% to trade at $1,271.36.

Biggest Gainers (24h)

- SafePal (SFP): +9.09%

- Celo (CELO): +6.72%

- Hooked Protocol (HOOK): +6.42%

Biggest Losers (24h)

- Neutrino USD (USDN): -16.98%

- Telcoin (TEL): -13.6%

- DigiByte (DGB): -12.7%

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)