In their bid to better understand the crypto industry and its operations, US lawmakers invited the chief executive officers (CEO) of some leading crypto exchanges to a major hearing tagged “Digital Assets and the Future of Finance: Understanding Innovation in the United State.”

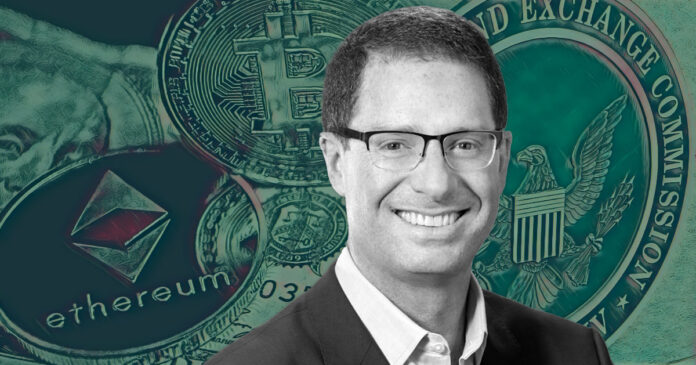

Brian Brooks criticizes SEC

One of the invited executives was the pro-crypto former head of the United States Office of the Comptroller of Currency who is now the CEO of a leading crypto exchange, BitFury, Brian Brooks, who seized the opportunity to criticize the Securities and Exchange Commission (SEC) regulatory efforts of the industry.

According to the former top government official, the SEC, through its regulatory actions, has been pushing some crypto-related firms outside the shores of the United States. Brooks cited the example of Fidelity who recently moved its Bitcoin ETF product to Canada because the Gary Gensler-led commission refused to approve its application in the United States.

You’ll recall that the US SEC has been reluctant in approving a Bitcoin Spot ETF because it believes it exposes investors to the volatile nature of the digital asset. However, players in the space have severally criticized this decision by the regulator saying its preference for a futures-backed ETF and refusal to approve a spot ETF could even be a violation of US laws.

On the growth of Stablecoins

The former Binance.US CEO also questioned why only banks would be allowed to issue stablecoins when the regulators refused to grant bank charters to major stablecoin issuers like Tether, USD Coin and others.

On the other hand, the CEO of Paxos, Charles Cascarilla, pointed out that the US has to step up its activities in the Stablecoin industry if it does not want the US Dollars to lose its status as the reserve currency of the world. According to Cascarilla, if a US CBDC project is not kickstarted or the US Dollar-backed stablecoin space is not regulated, it could have a ripple effect on the crypto industry generally.

Recently, the authorities released a Stablecoin report where they stated that only insured depository institutions should be allowed to issue stablecoin.

Within the last one year, the Stablecoin industry has seen tremendous growth as the market cap of the space has grown to over $150 billion. The top two major issuers, Tether and USDC alone account for over $120 billion of this growth.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC