The biggest news in the cryptosphere for Aug. 26 includes Federal Reserve Chairman Jerome Powell’s indication that recovery from the burgeoning inflation levels is still far from being done, and another stablecoin losing its peg from the U.S. Dollar as the bear market continues.

CryptoSlate Top Stories

Federal Reserve Chair urges everyone to ‘factor inflation into financial decisions’ during Jackson Hole conference

The Fed chair said in a speech at the annual economic policy conference in Jackson Hole that a single month’s improvement is not enough to return inflation to 2% and “a failure to restore price stability would mean much greater pain.”

Powell said in his speech:

“Price stability is the bedrock of the economy — without price stability, the economy does not work for anyone.”

USDN loses peg again as Neutrino upgrade to “stabilize protocol” goes live

Neutrino $USDN lost its peg for the first time since June 16 as it was updated to implement upgrades to the protocol. The confirmation of the upgrade was announced several hours after the peg fell from $0.98 to $0.96.

Update #8 was decided on through a governance vote which included four proposals and the vote passed updates to “implement new swap mechanics, so that Max Swap Amount of USDN>WAVES swaps will depend on the current BR value.”

Binance clarifies it froze Baking Bad corporate account due to law enforcement request, locked assets in agency custody

Binance responded to allegations that it had frozen and wiped the account of Tezos (XTZ) tool contributor Baking Bad “without any explanations.”

The crypto exchange giant said the freeze was due to a law enforcement request and that Baking Bad is aware of the issue behind the freeze as it was notified multiple times.

CryptoSlate Exclusive

Coinsillium CEO deems CBDCs a ‘small niche’ vs Bitcoin, other cryptocurrencies

Coinsillium CEO Eddy Travia is not concerned about the impact of CBDCs as he thinks they fail to give users an edge over existing private crypto options.

Travia said the push for CBDCs addresses the need to evolve and future-proof money while offering a strong degree of control – which is not the case with private cryptocurrencies.

“They are looking at CBDCs because, again, CBDCs are something they can control, and they feel they can impose certain rules.”

Mercury Wallet is pitching itself as Bitcoin’s answer to scalability, privacy

Software engineer and privacy advocate Nicholas Gregory discussed Bitcoin privacy and developments at privacy-focused Mercury Wallet with CryptoSlate’s Samuel Wan.

Gregory pointed out that the way it works shatters the tenet of “not your keys, not your coins,” which he finds highly entertaining.

“Mercury Wallet is an alternative scaling solution. What I like about it from an entertainment point of view is it breaks one of the foundations of Bitcoin – not your keys, not your coins. Well Mercury allows you to pass around private keys.”

Research Highlight

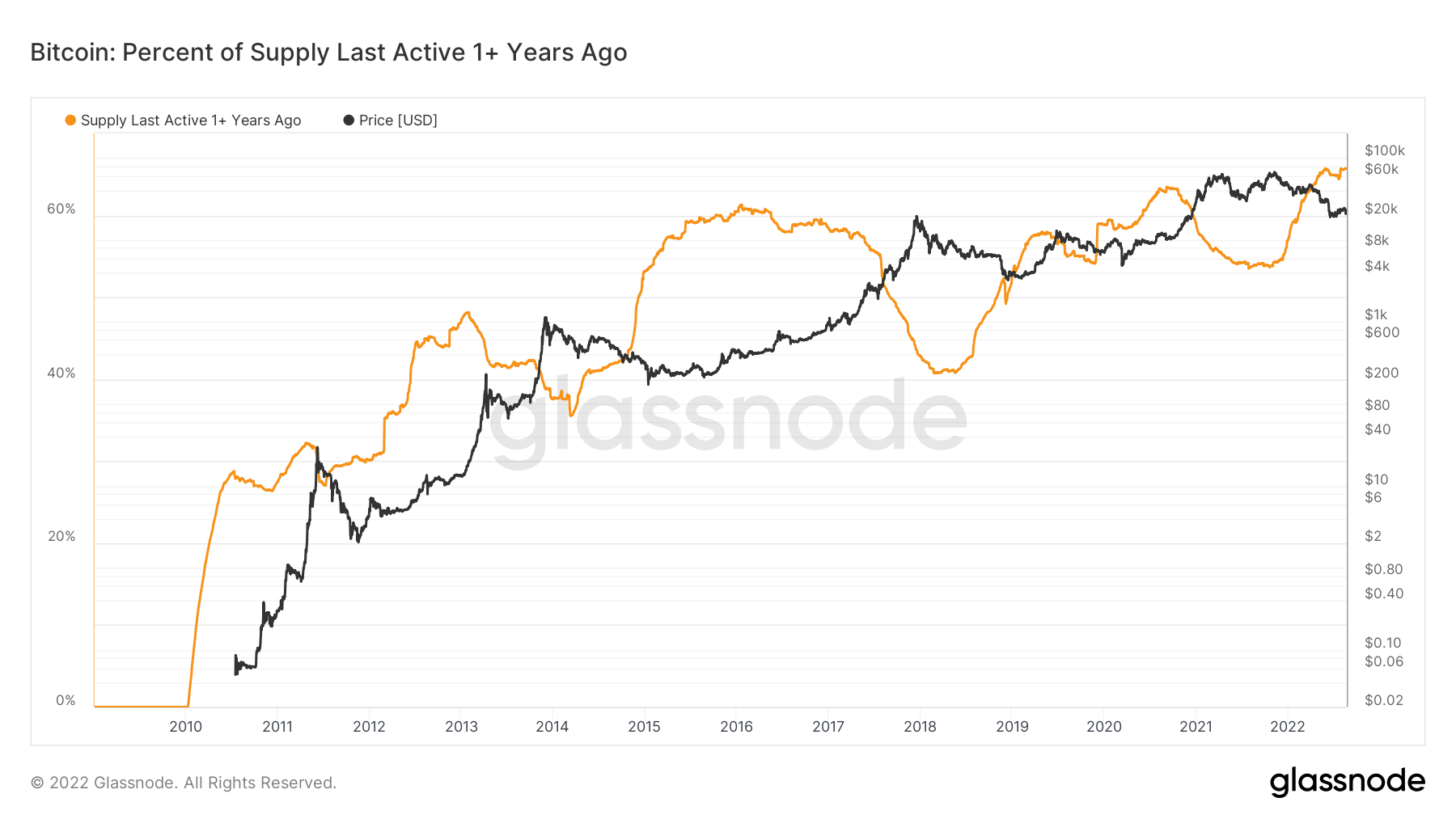

Diamond hands are at an all-time high

Bitcoin’s supply which was last active over a year ago, reached its all-time high this month and currently stands at 65.7%, according to data from Glassnode analyzed by CryptoSlate.

The current percentage is even higher than the numbers recorded in May 2022, when the crypto market entered a period of unprecedented volatility.

News from around the CryptoVerse

3AC co-founder fears jail term

Three Arrows Capital co-founder Su Zhu is worried he and other company directors could face jail terms for contempt of court due to court-appointed liquidators stating that the co-founders of the embattled firm have been uncooperative, Bloomberg News reported.

Coinbase launches voter registration portal

Coinbase launched a voter registration portal in line with its education initiative to allow the crypto community to raise their voices on critical policy discussions happening in the U.S.

Crypto Tali-banned in Afghanistan

A crypto crackdown is underway in Afghanistan after the country’s central bank banned cryptocurrencies and the Taliban regime arrested digital asset dealers, Bloomberg News reported, citing a senior police official.

Crypto Markets

Bitcoin was down 4.25% on the day, trading at $20,662, while Ethereum was trading at $1,555, reflecting a decline of over 8.47%.

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC