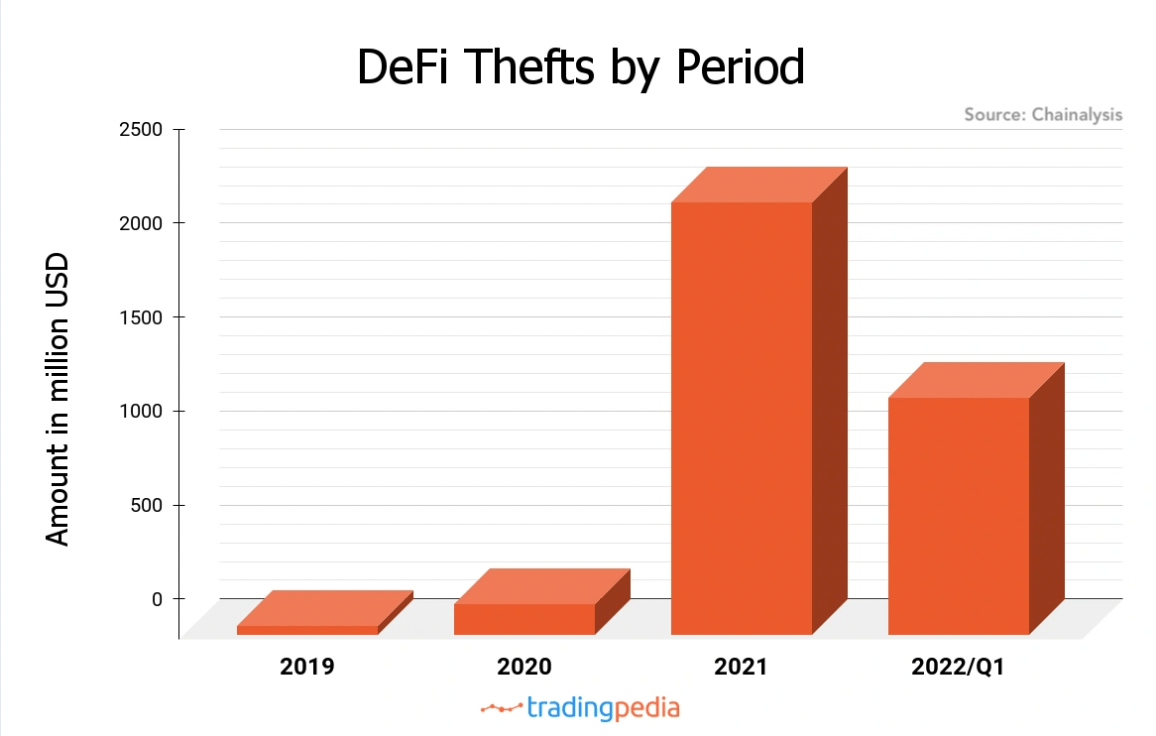

The U.S. Federal Bureau of Investigation (FBI) recently issued a warning against DeFi protocols after finding that 97% of the $1.3 billion was stolen via DeFi protocols during the first three months of the year.

The FBI said it observed cybercriminals taking advantage of the complexities of cross-chain transactions more and more each year. The warning article cited data from crypto analytics company Chainalysis and noted that the amount DeFi accounted for the total stolen funds has increased by 72% annually.

Exploited functionalities

The warning pointed to a handful of DeFi functionalities being the most prone to attacks. According to the bureau, the first and most vulnerable are smart contracts. The warning article stated that the attacks on smart contracts caused investors and developers to lose around $3 million worth of crypto during the first three months of 2022.

Signature verification mechanisms come second in line. When appropriately manipulated, they can allow for the withdrawal of all the funds within the protocol, which caused approximately $320 million to be stolen between January and March.

The FBI also warned about possible manipulations of price pairs, price oracles, bypassing slippage checks during leveraged trading, and taking advantage of price calculation malfunctions. The bureau said these attacks also cost the DeFi sphere around $35 million worth of crypto.

Recommendations

The warning was concluded with a list of recommendations for the investors and DeFi protocols separately. The bureau suggested investors learn about DeFi protocols and their functionalities, investigate the protocols before depositing funds, and look for potential risks and audit reports.

For the DeFi protocols, the FBI advised holding real-time analytics, monitoring, and periodical tests. It also added that developing and practicing a response to possible emergencies could be beneficial.

DeFi Hacks

CryptoSlate held an exclusive interview with TradingPedia technical analysis expert Brian McColl in May 2022 on the increasing attacks on DeFi protocols.

McColl said the increasing number of attacks is the growing interest in DeFi. However, it also led to FUD in the field, gradually decreasing the number of new users joining the DeFi sphere.

TrustPedia analysts said that the supporters of Central Bank Digital Currencies (CBDC) have been growing gradually due to this negative sentiment toward the DeFi projects. As opposed to the unregulated DeFi protocols, CBDCs appear safe and less prone to attacks as governmental entities host them.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC