Ethereum has seen its price rise by 40% in the past month while the rest of the market has been licking its wounds from the June price crash. Despite its sheer size and network effect, Ethereum’s price has historically had a tough time decoupling from Bitcoin and has always followed Bitcoin’s rallies and drops.

However, this rally has little to do with Bitcoin, which has posted only a 20% recovery from the lows it reached in mid-June.

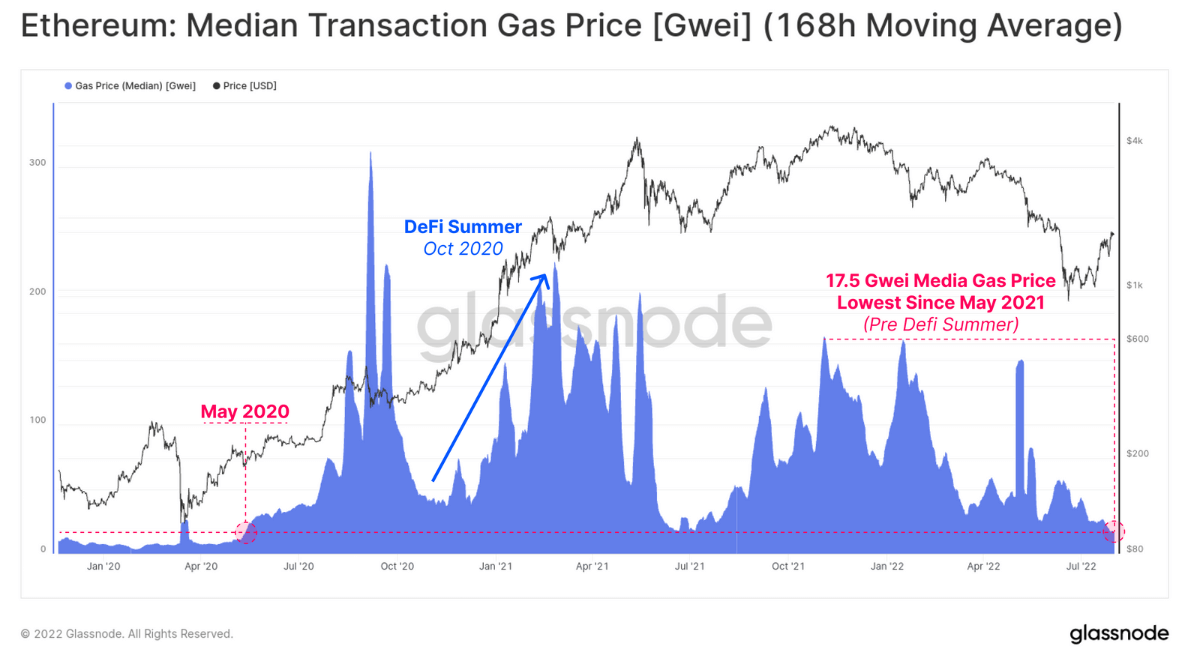

It also has little do with an increase in network usage. Ethereum gas fees have declined significantly this year and currently stand at 17.5 GWEI, the lowest they’ve been since May 2021. The low network congestion shows that user activity on Ethereum has been decreasing, with the overall number of users estimated to reach levels seen in May 2020 — before we’ve seen the network boom in the DeFi Summer of 2020.

Declining user activity stands in contrast to the rapidly rising price of ETH. This indicates that a large chunk of Ethereum’s current rally could be attributed to speculation as traders race to post profits ahead of the upcoming Merge.

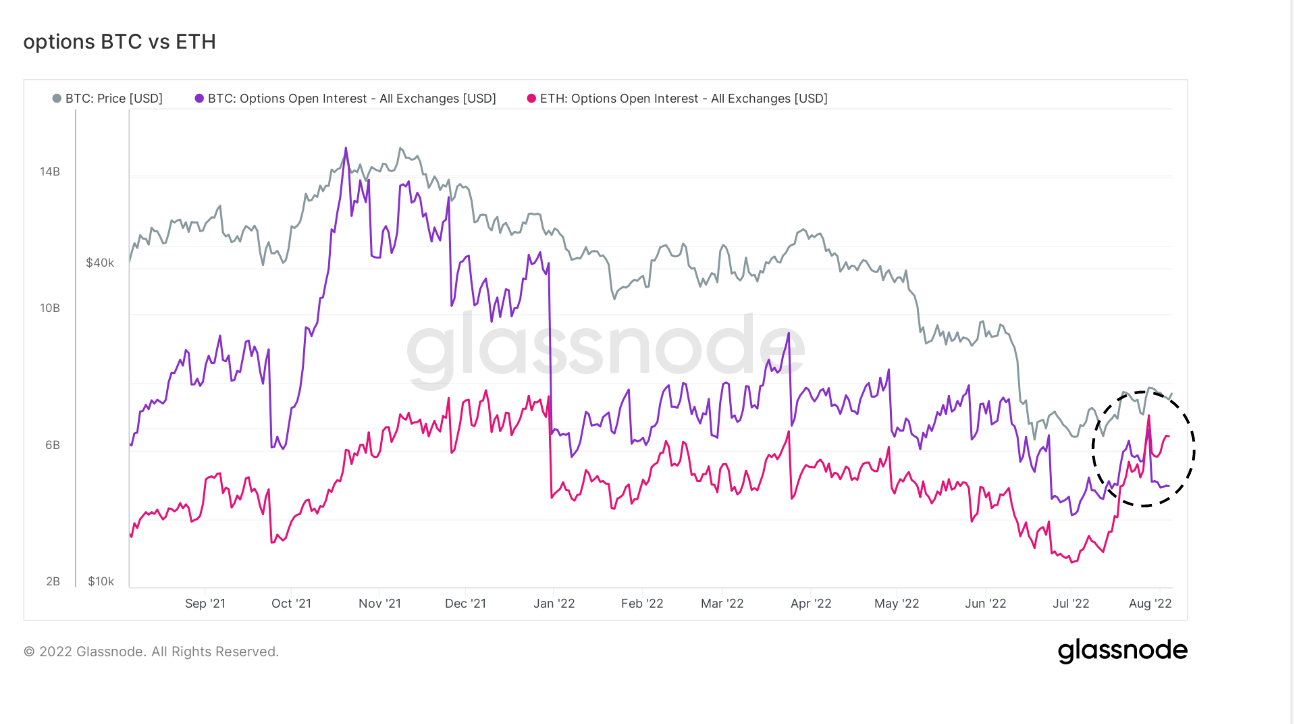

Derivatives also reveal an increasing number of traders are speculating on Ethereum’s further rise. This is the first time that open interest on Ethereum is greater than on Bitcoin — there’s currently $6.4 billion in Ethereum open interest for the Merge scheduled for September 19th, compared to $5 billion in Bitcoin open interest.

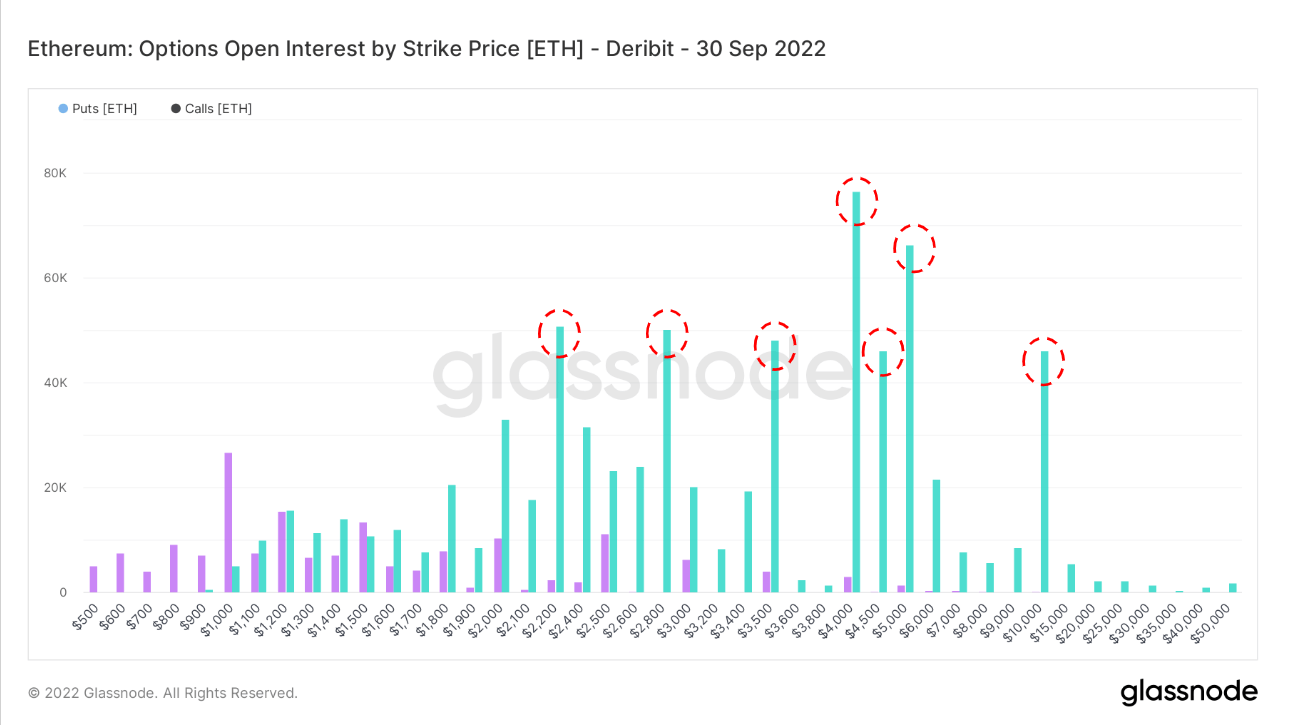

The total open interest of call and put options by strike price favor call options contracts. The majority of Ethereum’s options are call options concentrated on September 30th, with the most calling for $4,000.

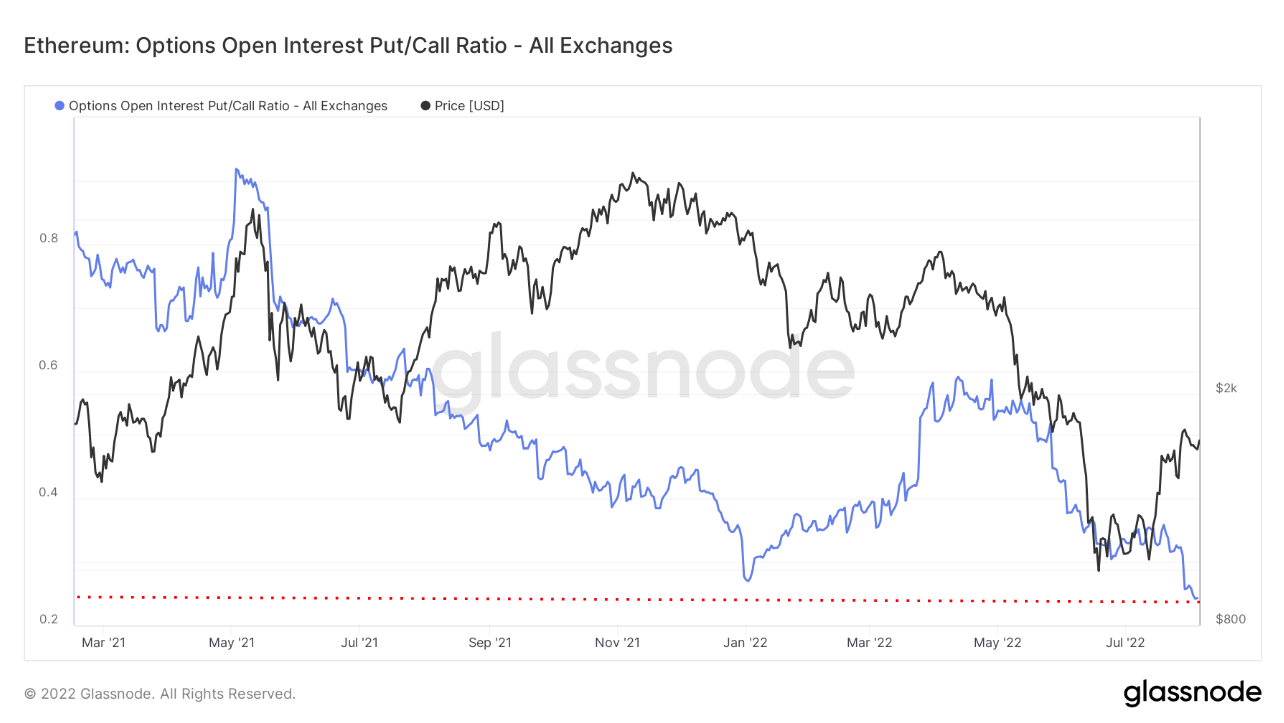

The options open interest put/call ratio also shows a speculator’s market. The indicator shows the put volume divided by the call volume of all funds currently allocated in options contracts to determine the overall mood of the market. A rising put/call ratio shows traders are speculating that the market will move lower and are buying more put options than call options. On the other hand, a falling put/call ratio shows a bullish sentiment as more traders are buying calls than puts.

Ethereum’s put/call ratio is currently the lowest it has ever been, and at 0.24 shows a huge number of traders are anticipating a bull run.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC