The amount of Ethereum’s supply concentrated in smart contracts has hit an all-time high post-merge. Smart contracts now create 0.45% of all Ethereum behind staked Ethereum at 0.57% and Exchange balances at 0.17%.

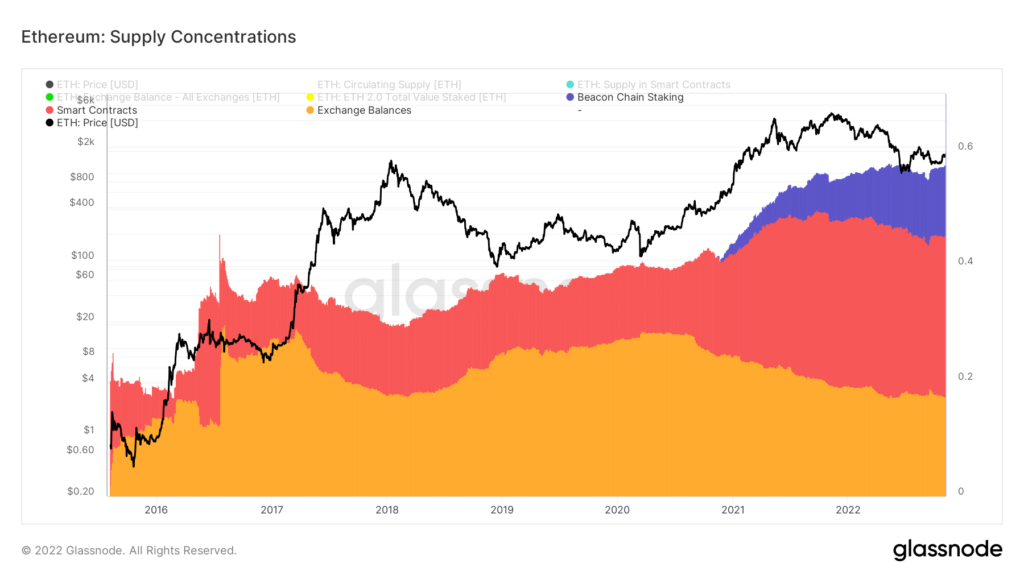

The chart below presents an area view of some of the largest concentrations of the Ethereum supply. Supply regions are shown as a ratio of circulating supply from bottom to top. The supply held on exchanges is shown in yellow, the supply held on Smart Contracts is shown in red, and the supply held on staked on the Beacon Chain is shown in purple.

The data showcases where new Ethereum is being distributed, thus giving insight into network activity for new coins. Supply concentration on exchanges has declined since mid-2020, while smart contracts and staking have increased since late 2020.

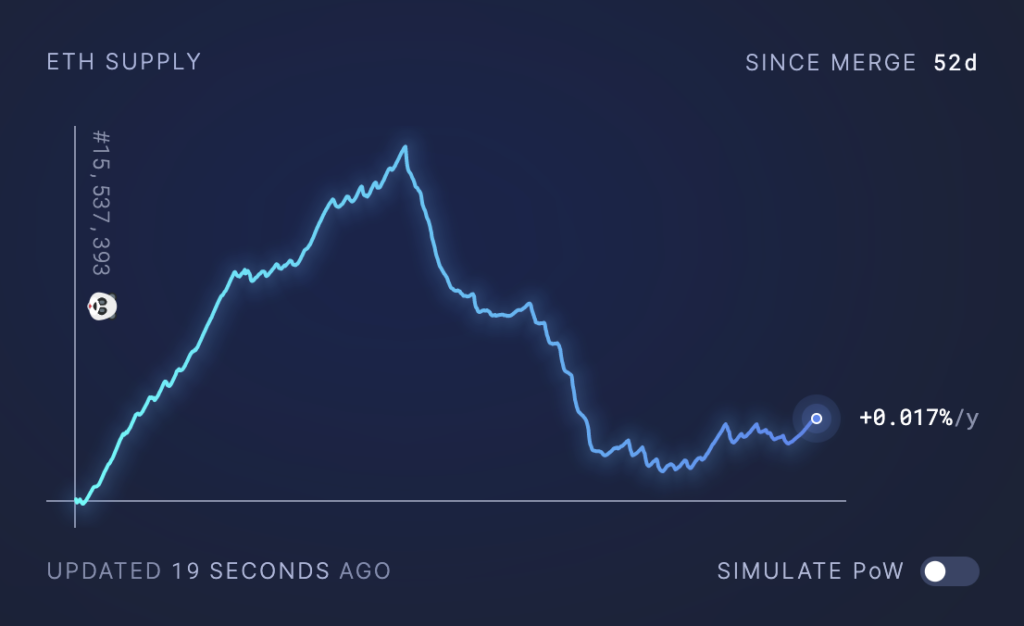

After the ICO launch of Ethereum in 2014, the total circulating supply of Ethereum was 72 million ETH. At the time of The Merge, it had reached 120,534,150 ETH and has since declined by around 10,000 ETH. The circulating supply hit a post-merge low on Oct. 27 before starting to increase into the start of November slowly.

Mining accounted for most of Ethereum’s new supply, resulting in a triple halving following The Merge. Around 13,000 ETH was created daily as a result of mining. Once mining was removed from the network, the new supply was reduced by around 99%. Just 3,000 ETH per day is created from staking, with a daily burn of approximately 1,172 ETH at press time.

The concentration of the total supply can be broken down into Ethereum accounts, smart contracts, and validators, according to data from Ultrasound Money. 72% of the total supply is held in accounts, 15% in smart contracts, and 13% in validators.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Litecoin

Litecoin  Chainlink

Chainlink  LEO Token

LEO Token  Avalanche

Avalanche  Stellar

Stellar  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  USDS

USDS  Hedera

Hedera  MANTRA

MANTRA  Polkadot

Polkadot  Hyperliquid

Hyperliquid  WETH

WETH  Ethena USDe

Ethena USDe  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Dai

Dai  Pepe

Pepe  sUSDS

sUSDS  Internet Computer

Internet Computer  Ondo

Ondo  Aave

Aave  Ethereum Classic

Ethereum Classic  OKB

OKB  Bittensor

Bittensor  Gate

Gate  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  Official Trump

Official Trump  Coinbase Wrapped BTC

Coinbase Wrapped BTC