Ethereum (ETH) continues to witness a surge in activities as the second-largest cryptocurrency was up by 4.35% to hit $3,517 during intraday trading.

At this level, ETH sits on significant support.

Market analyst Lark Davis explained:

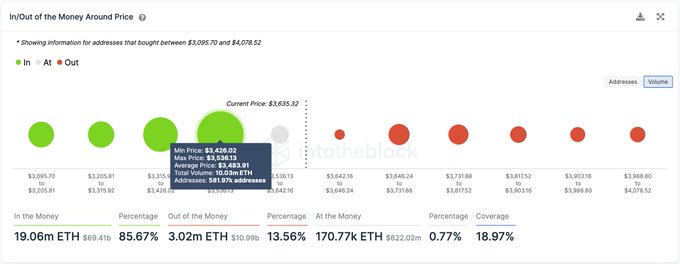

“More than 10 million Ethereum has been bought between $3,426 and $3,536. This is a very significant supply wall for support, but also it is critical to note there is very little supply bought above this level to be dumped when the price starts running.”

Ali Martinez echoed these sentiments and noted that Ethereum was edging closer to a breakout, which could see the $3,750 or $4,000 level hit. The on-chain analyst stated:

“Ethereum is a few dollars away from breaking out! The IOMAP shows Ethereum faces only one supply barrier. Roughly 500K addresses had previously purchased 8.50M ETH between $3,475 and $3,577. Slicing through this resistance wall could push ETH to $3,750 or even $4,000.”

Meanwhile, burnt Ether recently inched closer to a billion-dollar value, given that scarcity was introduced every time ETH was burnt after being used in transactions. This feature was introduced by the London Hardfork or EIP 1559 upgrade that went live on August 5.

Ethereum leaving exchanges set a new record

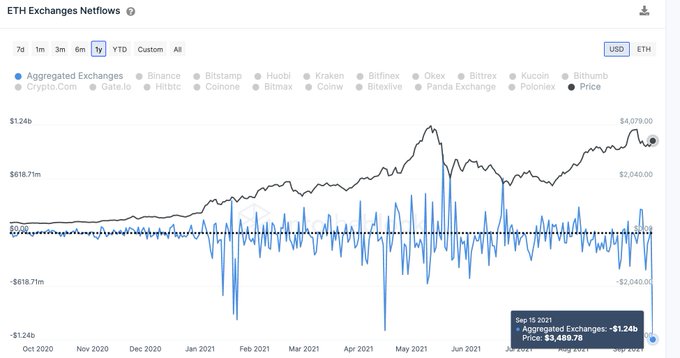

According to data analytic firm IntoTheBlock:

“The net amount of ETH leaving exchanges just hit a new record. Over $1.2B worth of ETH left centralized exchanges yesterday. Last time $1B+ left CEXs, Ethereum increased by 60% within 30 days.”

This is a bullish sign because it illustrates a holding culture. Furthermore, a drop in ETH supply on exchanges is usually correlated with a price increase.

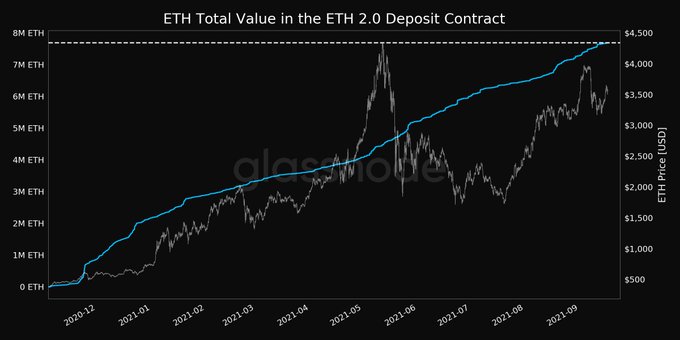

On the other hand, the total value locked (TVL) in Ethereum 2.0 deposit contract reached an all-time high of 7,683,394 ETH.

Ethereum 2.0, also known as the beacon chain, went live in December 2020 and is expected to boost scalability by offering a transition to a proof of stake (POS) consensus mechanism from the current proof of work (POW) framework.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC