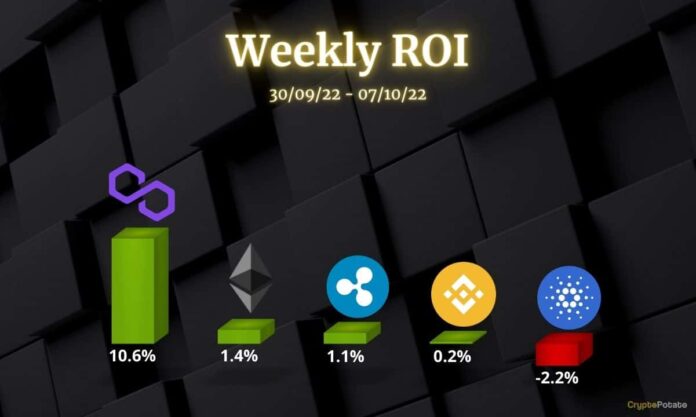

This week, we take a closer look at Ethereum, Ripple, Cardano, Binance Coin, and Polygon.

Ethereum (ETH)

With an increase of only 1.4% in the past seven days, Ethereum continues to maintain a flat price action, with market participants unable to swing the cryptocurrency beyond its current range. Since mid-September, ETH has only been moving sideways between the key support at $1,250 and the resistance at $1,400.

The last time it tested the key resistance was on September 27th, and its price is slowly approaching this level again. The indicators are turning slightly bullish, and the momentum will favor buyers if they can pick up the volume.

Looking ahead, ETH may attempt to break above $1,400 in the coming week if the market remains bullish. Turning this key level into support would allow it to move higher and target $1,700 next. This consolidation above $1,200 is bullish and may lead to another significant rally once completed.

Ripple (XRP)

Ripple had a good attempt at breaking the $0.50 level, but so far, it has failed three times in a short period. For this reason, the price only increased by 1.1% in the past seven days. If buyers cannot bring back the volume, then this price action may turn into a bearish reversal.

The support at $0.44 has held well so far after two successful tests and allowed XRP to stay on the offensive since the major rally at the end of September. But due to a decreasing volume, buyers may be in trouble soon, and bears could take over the price action.

The current bias is somewhat neutral, but this can change quickly. The daily MACD and RSI are both very close to curving down, which would shift the price into a downtrend. If this happens, then the key support at $0.44 will likely be re-tested.

Cardano (ADA)

Cardano is found at a critical junction after failing to rally higher. The price fell by 2.2% in the past seven days, and buyers are struggling to keep it above the key support at $0.43. On October 2nd, bears attempted to take ADA under this key support, but buyers managed to hold steady.

Since then, the price returned back to this key level, and any weakness from bulls will quickly be exploited by bears to their advantage. If the key support at $0.43 falls, then the next target will be found at $0.38. It is unlikely for the buyers to return to ADA until then. This leaves a wide opening for sellers to take ADA much lower.

Looking ahead, ADA displays a lot of weakness compared to XRP and ETH. Expect volatility to return next week, which makes a breakdown likely at this point. With a decreasing volume, this cryptocurrency failed to attract buyers in October, and the price action shows it.

Binance Coin (BNB)

BNB had a difficult past 24h due to a significant security breach that saw the network halted for a few hours and over $100 million compromised. The price crashed by over 5% on this news, but compared to seven days ago, it is at a similar level.

The hacker managed to generate 2 million BNB worth over $500 million but was quickly stopped from moving most of the coins outside the BNB network. This quick action also allowed the network to be restored to normal operations at the time of this post.

Should the price remain in a downtrend, then buyers may return at $260, which represents a key support level. The resistance remains at $300, and so far, BNB did not manage to break above this key level. Considering the latest news, it seems less likely for BNB to return there soon.

Polygon (MATIC)

Polygon had an excellent week, increasing by 10.6% in the past seven days. This makes MATIC the best performer on our list this week. After finding good support on the $0.70 level, MATIC seems keen to return to a $1 valuation which is also a key resistance.

The only concern with this latest performance is that the volume was flat despite a rising price. While sellers may have lost interest in MATIC, buyers are not that interested either, and the volume shows this. Nevertheless, the indicators have turned bullish on this latest move, and momentum could improve later on.

Looking ahead, MATIC is found in an uptrend that puts the price on a collision course with the resistance at $1. So far, buyers appear timid, but they could gather strength as the price raises. The bias is bullish but the road to $1 may turn out quite bumpy.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  Official Trump

Official Trump  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB