Ethereum price managed to hold the $2,200 support as the crypto market downturn intensified this week, on-chain signals highlight rising whale demand.

On Jan. 22, the crypto market suffered significant bearish headwinds as Bitcoin (BTC) prices wobbled below $40,000 for the first time in 50 days. At press time on Jan. 25, the global crypto market capitalization has shrunk 7%, with $108.5 billion in valuation wiped out within the weekly timeframe.

Losing 5% in Ethereum (ETH) price has maintained a relatively more resilient performance than the industry average between Jan. 22 and Jan. 24.

Ethereum whale activity remains high despite downtrend

Ethereum price has managed to keep losses below the 5% threshold this week, while Bitcoin and the global crypto market cap shrunk by up to 7%, respectively, before making a mild rebound. On-chain data trends suggest that the rising level of whale trading activity recorded on the Ethereum network this week has been pivotal to ETH’s resilient price performance.

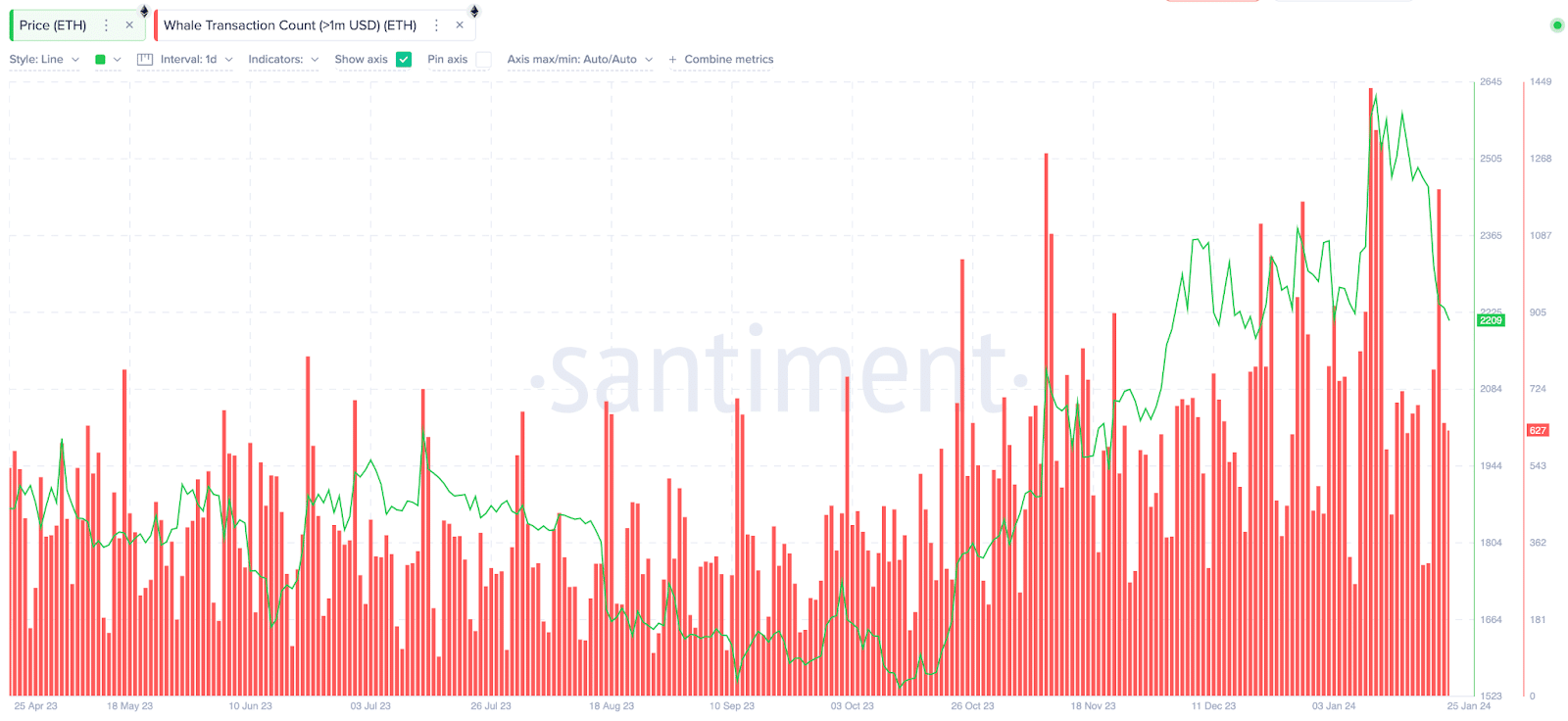

Santiment’s Whale transaction count metric tracks the daily number of transactions involving a particular cryptocurrency that exceeds $100,000.

On Jan. 23, the Ethereum Whale Transaction Count surged above 1,190. A closer look at the chart below shows this was the highest recorded since the ETH price raced to a 20-month peak of $2,690 on Jan. 11.

Corporate entities accumulate ETH at significantly high volumes despite the broader market retreat. This could be attributed to investors and fund sponsors looking to acquire Ethereum ahead of a looming ETH spot ETF verdict.

During market downtrends, an increase in whale transactions impacts the price of a crypto asset positively in two major ways. Firstly, it provides market liquidity, enabling bearish panic sellers to execute their trades at favorable prices. It also reinforces confidence among small-scale retail traders.

These factors have played a vital role as ETH battles to hold above the $2,200 support level amid market-wide sell-offs this week.

Ethereum investors opt for long-term storage

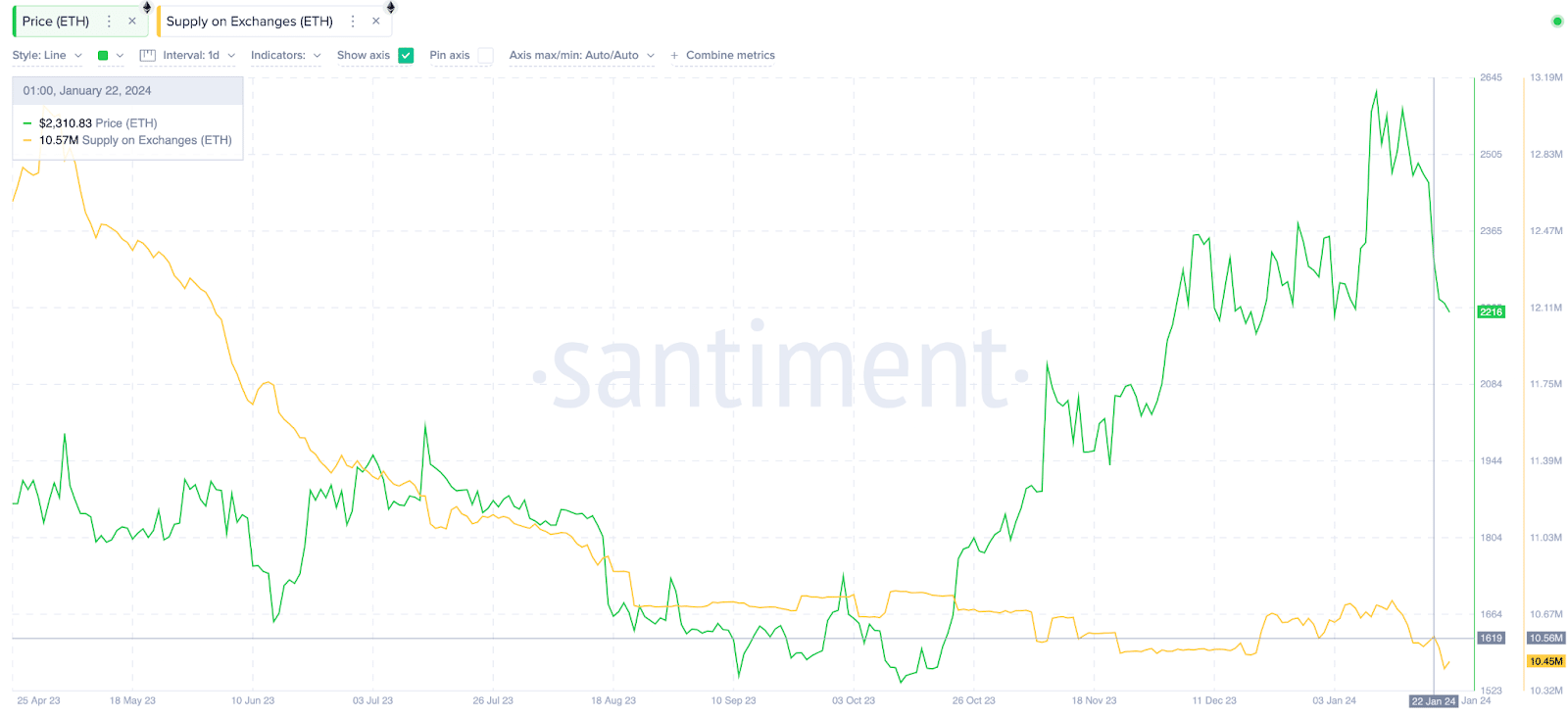

Furthermore, Ethereum has also recorded a steady decline in exchange reserves this week, which could be linked to the rise in whale activity.

Corporate entities and whales are known to be value investors who tend to hold for longer periods. Unsurprisingly, the rising volumes of whale transactions on the Ethereum network in recent months have coincided with a rapid decline in supply deposited on exchanges.

At the start of the week on Jan. 22, Ethereum supply on exchanges stood at 10.5 million ETH. But interestingly, that figure has dropped sharply to 10.4 ETH by Jan. 25.

Effectively, this means that investors have shifted 150,000 ETH worth approximately $330 million from exchanges and trading platforms into long-term storage or staking contracts.

Despite bearish headwinds, Ethereum Supply on Exchanges dropped by 150,000 ETH in the last four days, signaling a dominant preference for long-term holding and passive income staking among current holders.

Notably, Ethereum exchange supply has been in a downtrend since the Proof of Stake (PoS) transition in May 2023, a move that has coincided with an extended period of price uptrend.

ETH price prediction: Can Ethereum Price Stay Above $2,000?

As the downward trend in exchange supply persists, fewer ETH coins are readily available to be traded in spot markets. This appears to have decelerated the selling pressure on Ethereum this week relative to the broader altcoins market. Combined with the steady rise in whale transactions, Ethereum price is in a prime position to defend the $2,000 territory.

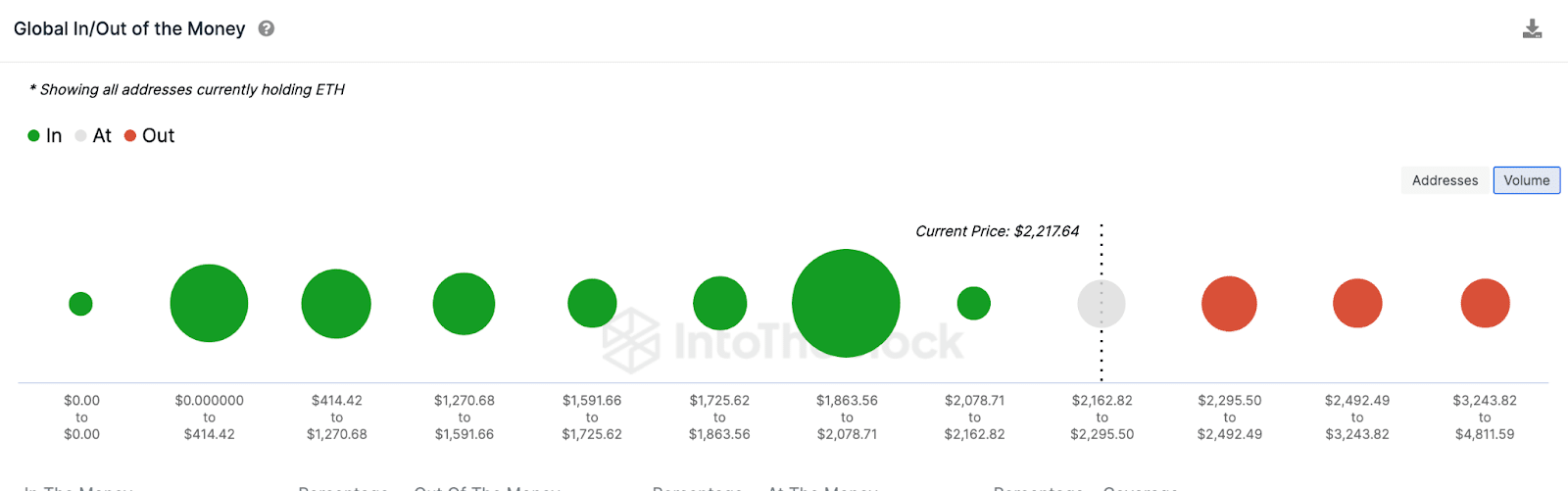

IntoTheBlock’s in/out of the money around price data, which groups all existing ETH holders by their entry prices, also affirms this stance.

It shows that 8.3 million addresses, the largest cluster of ETH holders, had acquired 46.5 million ETH at the maximum price of $2,078. If Ethereum price slides toward $2,100, many of these holders could make frantic covering purchases to defend their positions to avoid slipping into net-loss positions. This could effectively trigger an instant Ethereum price rebound.

On the upside, Ethereum bulls could overturn the bearish pressure if it reclaims the $2,500 territory. But this looks unlikely within the current market dynamics. As seen above, a significant cluster of 3.7 million addresses had acquired 7.1 million ETH at an average price of $2,400.

If they engage in mild profit-taking as prices hit their break-even point, Ethereum could slide into another correction phase.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)