Ethereum’s EIP-155 upgrade went live last year. The improvement proposal significantly changed Ethereum’s monetary policy and introduced the whole burning mechanism.

Post the upgrade, even though burning was implemented, ETH’s price did not react to it immediately. More so because the issuance was higher than that of the burning rate. However, on a couple of occasions when the burning rate has accelerated, ETH has noted minor relief upticks simultaneously. At the moment, however, things are a bit haywire.

Ethereum burning rate at an ATL

Before stepping into the burning rate, it is essential to note that Ethereum gas prices have dropped to around 17.5 gwei. As illustrated in the chart below, this is the lowest network congestion and gas price since May 2020. A low gas fee usually means fewer people are using the network and vice versa. Elaborating on the current state, Glassnode’s latest weekly report noted,

“This signals that despite recent positive price action, there has not been an influx of new usage, and overall, the Ethereum is at a multi-year low in relative activity.”

Here it is essential to note that with every transaction on the network, a small amount of ETH [the base fee] is removed out of circulation via burning. The burn rate has hit, with the network usage remaining low.

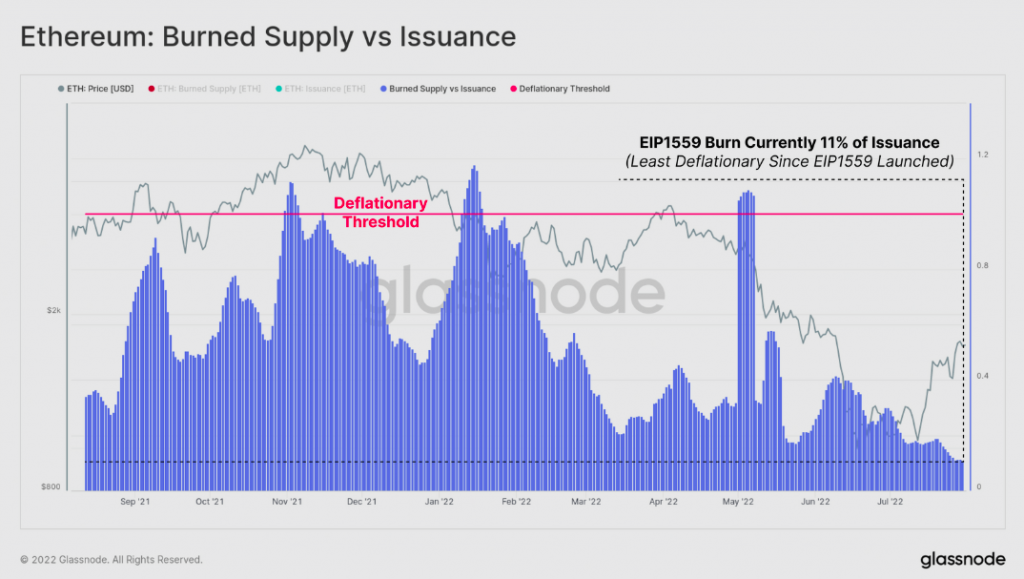

As depicted in the chart below, the ETH burn rate via EIP1559 currently stands at an all-time low, implying that ETH is the least deflationary ever since last year’s upgrade went live. Glassnode revealed,

“Total ETH burned is now just 11% of the total issuance.”

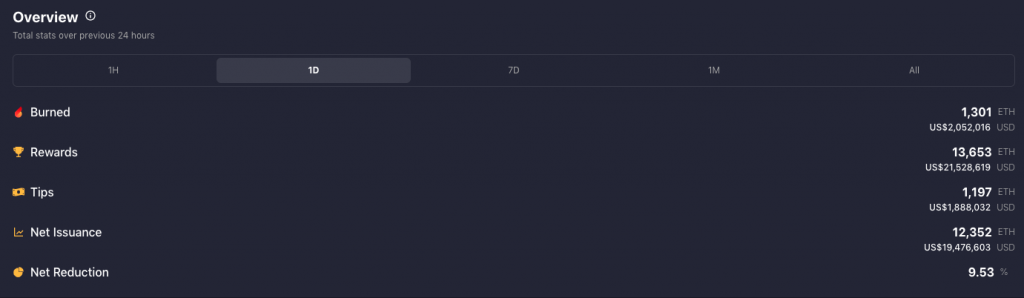

The situation continues to remain lackluster. According to Watch The Burn’s latest data, only 1301 ETH tokens have been burned over the past day, relative to the 12,352 tokens brought into circulation. The net reduction, as a result, stood at merely 9.53% at press time.

Price implication

Well, the current state of affairs w.r.t. burning and issuance points to the fact that the circulating supply is on the rise, making the landscape unfavorable for the price to incline. Market participants have also been selling their tokens, adding fuel to the fire. Per data from ITB, over the past 6 hours alone, the sell-side tokens have exceeded the buy-side by 20.84k ETH.

The price has been reacting to the same. Ethereum has lost the most value over the past 24 hours relative to its top-10 peers. After depreciating by almost 7% on the daily window, ETH was trading at $1575 at press time. And, if the network activity doesn’t improve, the burn rate remains stagnated, and the sell-pressure intensifies, then the price dip will likely continue.

Read More: Ethereum: How supply-demand will change ETH’s value post the Merge

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  Official Trump

Official Trump  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  Bittensor

Bittensor  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB