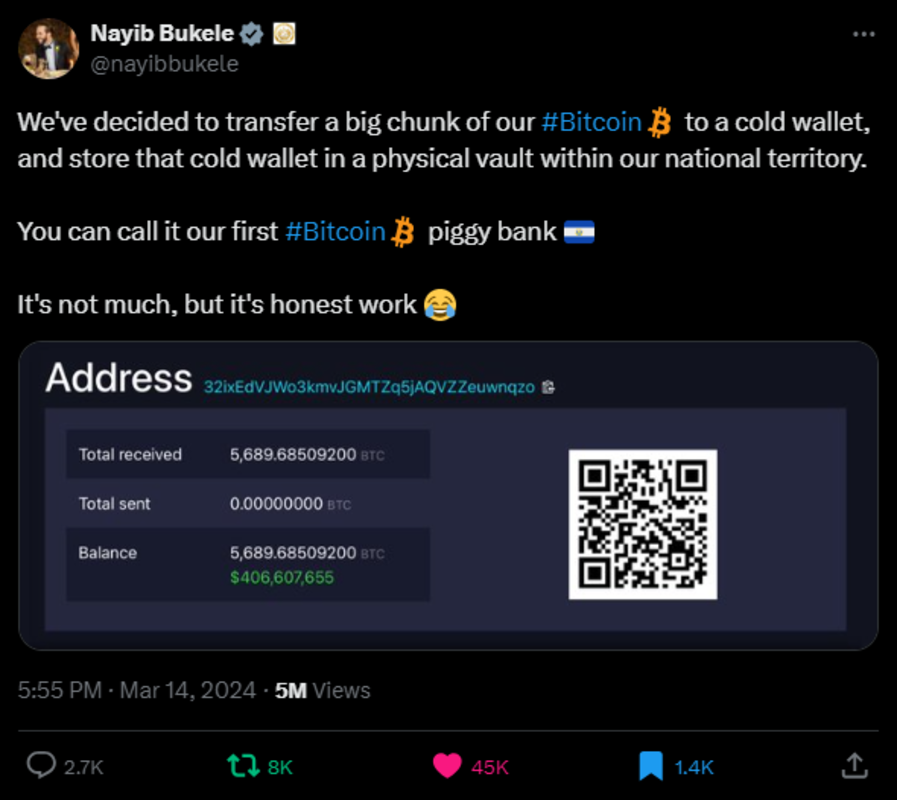

On March 14, 2024, El Salvador’s president-elect, Nayib Bukele, unveiled a historic bold maneuver that echoed across the Bitcoin world: El Salvador confirmed the transfer of a substantial portion of its Bitcoin holdings into cold storage, securely kept within a vault in its national borders. This strategic decision marks a pivotal juncture in El Salvador’s Bitcoin journey since the introduction of the Bitcoin Law, which has drawn both admiration and skepticism worldwide.

Amidst a cacophony of critiques ranging from allegations of human rights violations to inadequate modern infrastructure, El Salvador has stood committed, weathering storms of disapproval from traditional finance stalwarts and even fervent Bitcoin maximalists on Twitter (X) Spaces. The veil of ambiguity surrounding the size of El Salvador’s Bitcoin reserves, a point of contention and criticism for many, has now been decisively lifted, ushering in a new era of transparency and confidence in the nation’s commitment to fostering a thriving Bitcoin-friendly ecosystem.

With this groundbreaking move, Salvadorans and Bitcoin enthusiasts worldwide have the ability to audit El Salvador’s Bitcoin reserves and can see all inbound and outbound transactions. This audacious step wasn’t mandated but was taken willingly, embodying El Salvador’s commitment to its citizens’ trust and the global Bitcoin community’s ethos of openness. Unsurprisingly, shortly after Bukele announced El Salvador’s Bitcoin address, Bitcoiners began to send donations to the wallet, with nearly 6 Million Sats in transactions as of this writing. To date, plebs can track El Salvador’s daily 1 bitcoin DCA purchases. In this historic moment, El Salvador not only charts a new course in financial governance but also silences its critics by setting a precedent of leading by example in responsibly disclosing and managing its modest but modern sovereign Bitcoin wealth reserves.

With 5,689 Bitcoins—valued at $385,111,456 USD as of this writing—El Salvador has secured its digital wealth and aptly navigated the treacherous waters of international politics. The decision to shift its Bitcoin holdings from Bitgo, an American custodian, to a vault within its sovereign borders wasn’t just a public relations masterstroke; it was a strategic imperative. Given the strained relations between the American government and El Salvador over the Bitcoin Law, the mounting holdings under Bitgo’s custody risked becoming entangled in potential sanctions and regulatory quagmires. This decisive action safeguards El Salvador’s financial autonomy and showcases a shrewd understanding of the intricacies of the American regulatory landscape.

While the disclosure of the reserves has garnered widespread approval, there may have been compelling and strategic reasons behind the nation’s initial reluctance to divulge its complete holdings. Nayib Bukele’s affirmation that only a “big chunk” of the total Bitcoin reserves has been transferred to cold storage underscores a nuanced understanding of the country’s strategic financial management. In the complex realm of nation-states navigating the uncharted waters of a Bitcoin Standard, maintaining a degree of opacity can be a prudent strategy. El Salvador, in its quest to carve a distinct path in the world, has tactically kept some cards close to its chest, waiting for the opportune moment to unveil its Bitcoin wealth in a calculated move. This wise approach reflects a careful balancing act between transparency and strategic advantage in the dynamic landscape of geopolitics.

Bukele shed light on El Salvador’s Bitcoin holdings in earlier tweets, surpassing their earlier acquisition strategies and dollar-cost averaging efforts. Contrary to speculations circulating on social media, Bukele revealed a multifaceted approach that had propelled the nation’s Bitcoin reserves. Beyond mere purchases, El Salvador’s innovative visa program, profits from Bitcoin-to-dollar exchanges held in escrow, revenue from government services, and mining endeavors have collectively contributed to a handsome Bitcoin treasury. This revelation further dispels misconceptions propagated by armchair quarterbacks and highlights El Salvador’s innovative courage in leveraging diverse avenues to bolster its growing Bitcoin wealth.

Disclosing El Salvador’s Bitcoin reserves represents a significant stride toward transparency and accountability for its citizens. Yet, it’s crucial to recognize that there will always be a segment of critics who demand more and complain about every detail in an attempt to find fault. However, it’s essential to remember that these measures are not solely aimed at appeasing detractors. Instead, they serve as a foundational step in creating a positive business environment where Bitcoiners can confidently establish their ventures, knowing that the country is dedicated to their success.

The ultimate goal for Bukele and El Salvador extends beyond merely silencing critics; it’s about transforming the nation into a prosperous hub of opportunity for Salvadorans. In a stroke of genius, El Salvador has built its own digital Fort Knox, with the exceptional feature that citizens can verify the existence of the funds. The Salvadoran government aims to nurture a culture of trust and investment in the country’s future by rewarding proof-of-work and low-time preference. This vision encompasses building a new El Salvador where citizens can thrive, seize opportunities at home, and contribute to the nation’s growth, rather than seeking elusive promises abroad. As El Salvador continues its journey toward economic empowerment and progress, these strategic moves serve as foundational pillars for a brighter and more prosperous future.

This is a guest post by Jaime Garcia. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)