The price of the popular meme-inspired cryptocurrency Dogecoin (DOGE) has seen intense volatility over the past month. DOGE fell sharply after a failed breakout before finding support at a key technical level.

According to the data, Dogecoin surged in early December, breaking out from an ascending parallel channel where it had been trading. The breakout propelled Dogecoin to a local high of $0.108 on December 11th. However, the rally was short-lived. Over the following weeks, the price retreated as quickly as it had spiked.

At press time, Dogecoin had plunged to a low of $0.08094. However, DOGE has surged 5% from its 24-hour low of $0.07681. The sell-off appears to have been driven by profit-taking after the overheated rally as well as weakness in the broader cryptocurrency market.

Also read: VeChain Is A Top Pick For 2024, Analyst Says VET Can Hit $1.14

However, Dogecoin managed to bounce to a critical support level near the $0.074 mark. The rebound came right at the rising trendline support of Dogecoin’s previous ascending channel, underscoring the technical relevance of this price zone.

Will DOGE climb to $0.1?

Still, analysts caution that there are few signs of strength for Dogecoin over the near term. The Relative Strength Index (RSI), a momentum indicator used to gauge asset price trends, remains below the 50-neutral mark after peaking above 80 in early December, when Dogecoin was overbought. Readings below 50 typically indicate negative momentum and the absence of a sustainable price bottom.

Also read: Shiba Inu: Boldest SHIB Price Prediction For 2024

With the RSI not yet oversold, traders may look for more sideways consolidation and potential retests of support around the $0.074 mark before Dogecoin mounts a lasting recovery. Volume trends also remain lackluster despite Tuesday’s intraday spike, indicating caution among buyers.

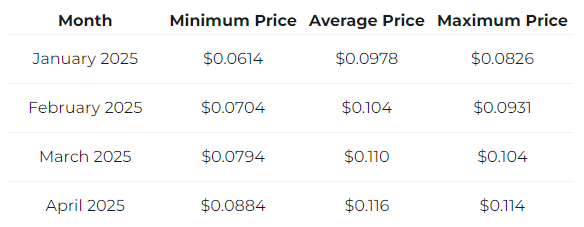

According to the experts at Changelly, Dogecoin is likely to reach $0.1 in February 2025. However, it all depends on the overall market conditions.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)