Ethereum was the first generalist blockchain to popularize Decentralize Finance (DeFI) through its use of smart contracts. In turn, they created a rich ecosystem of dApps as web interfaces to the blockchain’s smart contract, so far accounting for 3,778 dApps across 6,730 smart contracts. Such dApps have recreated virtually the entire financial system – borrowing, lending, market making, exchanging – and are now moving toward blockchain gaming metaverses and NFTs.

Yet, this monetary revolution transpired on fragile legs. Ethereum might’ve amassed DeFi momentum with the highest number of developers and dApps, but its Proof-of-Work foundation makes it prohibitively expensive to use.

Contrary to the original vision of crypto payments and transactions as frictionless and cheap, Ethereum leaves for progress to be made. An estimated 71% of consumers prefer to pay with a debit or credit card, and for good reason: transactions are simple, with some degree of protection, they’re generally fast (from the consumer’s perspective – they swipe and leave the store with their goods), and they’re free. Merchants pay a fee, which is usually under 3%.

Transactions on Ethereum are much different when compared to such traditional payment processors. Fans of Ethereum argue the solution lies in the ETH 2.0 upgrade, transforming Ethereum to a Proof-of-Stake blockchain, the Beacon Chain. This will be Ethereum’s new backbone, managing all shard chains and validators, as detailed in the ETH 2.0 upgrade roundup. At the end of October, Ethereum completed the Altair upgrade, bringing it one step closer to the Beacon Chain.

What Does the Altair Upgrade Bring?

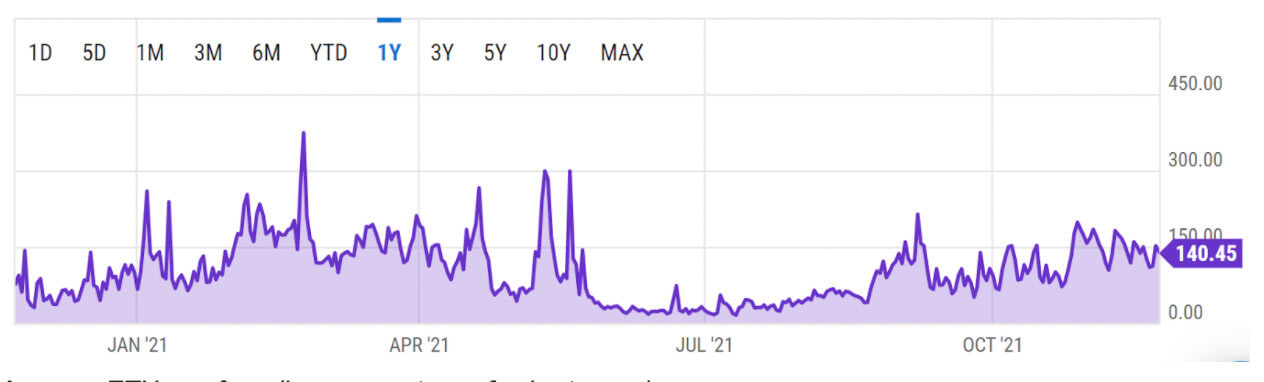

After the Altair upgrade launched on October 27, 2021, ETH shortly thereafter eclipsed its all-time-high price (at the time) of over $4,500. With hopes inflamed, in this delicate transition period, both Ethereum’s Proof-of-Work (PoW) and Proof-of-Stake (PoS) consensus work in parallel to each other.

As the biggest Beacon Chain upgrade since December 2020, Altair is a test run to make sure the projected 2022 Ethereum-Beacon Chain merger will be successful. Here are some of the Altair upgrades:

- Light clients for easier interaction with the network due to lower computational and bandwidth costs than full nodes.

- Incentive restructuring which brings more efficient bit yield to reduce complexity, inactivity leak quadratic function that is based per validator, instead of global. The latter helps validators that have over 80% percent participation rate.

- Bug fixes for validator rewards.

In theory, they should all lead to an Ethereum 2.0 that is as fast and affordable as other layer-1 competitor blockchains that have recently risen in popularity. In the meantime, Ethereum will continue to rely on Layer 2 solutions to make it so. However, there is another matter emerging outside of Ethereum’s scalability. How decentralized is it really?

Ethereum’s Decentralization Examined

If there are other smart contract platforms with both negligible fees and fast transaction speeds, Ethereum’s strongsuit remains its wide adoption and decentralization. On PoS blockchains, validators are equivalent to PoW’s miners, making the network run.

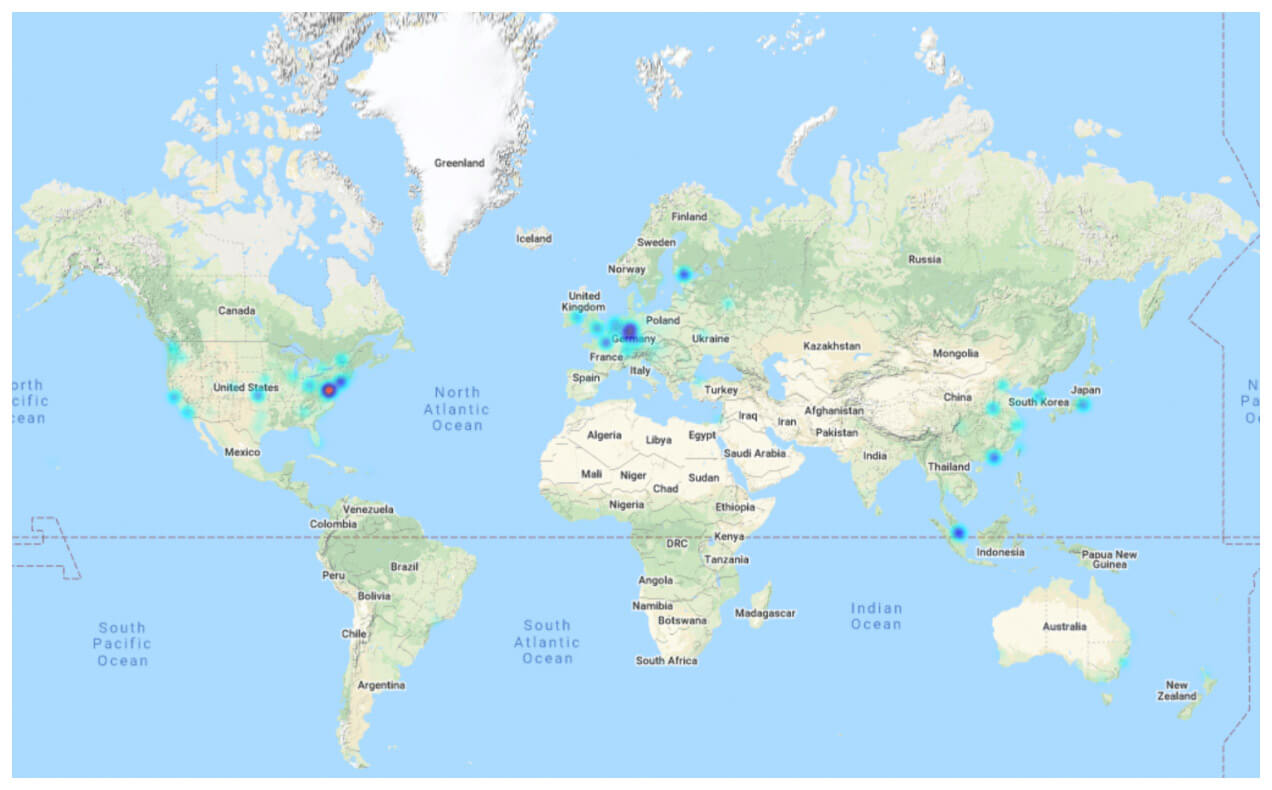

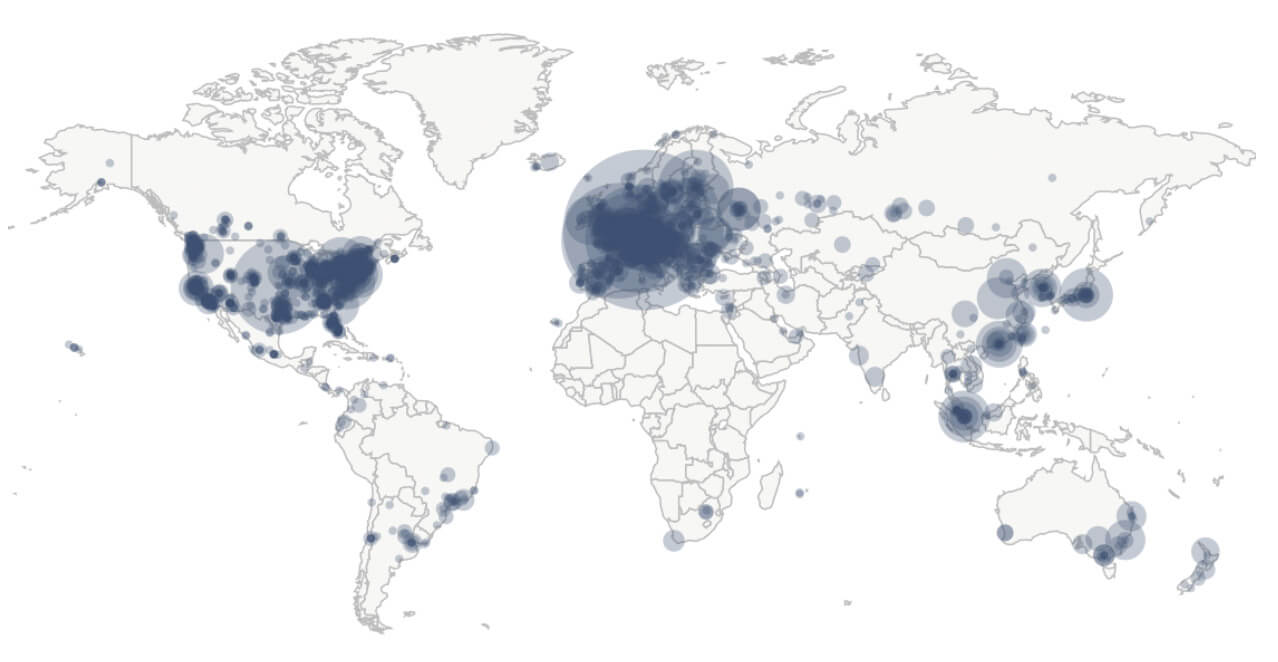

Simply put, a validator is software running on node hardware. A validator’s job is to approve blockchain transactions and pass this data to a node, which will then add it to the blockchain. According to ethernodes.org, Ethereum is presently hosted by 2843 nodes, most of which are concentrated in Northern America and Europe.

In percentages, the US holds 35.21%, Germany 15.20%, China 6.79%, Singapore 4.89%, Finland 3.87%, France 3.52%, Canada 2.92%, and the UK 2.85% Combined with other countries, North America and Europe make up nearly 80% of Ethereum’s nodes.

To illustrate this concentration further, Ethereum 2.0 nodes, on the Beacon Chain, are even more concentrated on the same two continents.

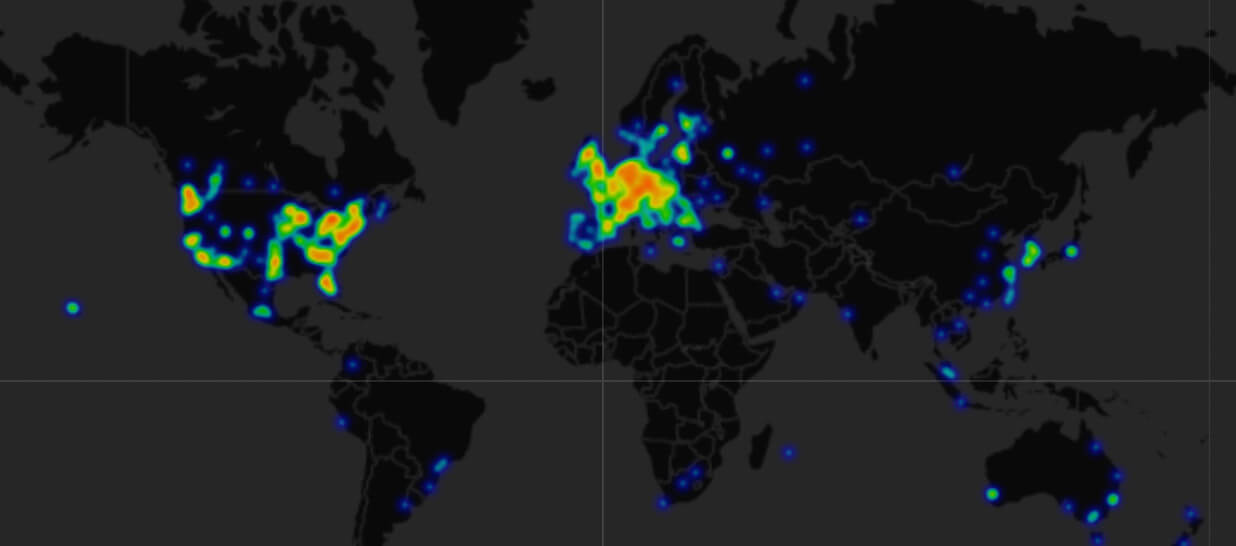

Out of 4,688 Beacon Chain nodes, over a quarter, 27.22% are in the US. Combined together, the two continents of Europe and North America make up 81% of node distribution. When compared to Bitcoin, accounting for 13,239 nodes, the trend is similar, but there is more spread toward South America and Asia.

Likewise, Solana, a smart contract alternative to Ethereum, also follows this concentration trend.

From these images, we clearly see the divide between the Global South and the Global North. In other words, between the developed and developing nations. Even Ethereum, by far the largest smart contract platform with over $100 billion TVL holds this gap.

The real question is, what are the factors that are causing such a concentration of nodes, and are they impeding global crypto adoption?

Why Is the Global South Lagging?

When viewed as a technology, blockchain networks are ideally suited for geographic regions that have either low population density or low infrastructural development. This is why the Kenyan M-Pesa was so successful, spreading financial services to the most unbanked regions of the world. Presently, these regions include South and Central America where 38% of the population are unbanked, and Africa where 50% are unbanked.

With a simple SMS message on an old-gen phone, one could send funds to other M-Pesa accounts, with only cellular network coverage required (meaning, no data). A blockchain version of a similar concept is Celo (CELO), a mobile platform that transforms phones into virtual banks for both crypto and fiat payments through Celo’s cUSD stablecoins.

However, can blockchain technology penetrate further from that base level into the Global South? Unfortunately, there are severe obstacles to overcome first:

- Economically developing states can be vulnerable to high levels of corruption. The Corruption Perceptions Index (CPI) places Sub-Saharan Africa at 32 out of 100, the lowest-performing score globally. South America also generally scores low according to CPI criteria.

- In such scenarios, there is less capacity to onboard new tech onto the population. As high levels of corruption have a corrosive effect on people’s livelihoods, they are more focused on satisfying basic needs first.

- In turn, the talent pool willing to entertain the complexity of blockchain projects, including node hosting, is limited from the onset.

This is why outside help is necessary to jumpstart blockchain projects in these regions. Specifically, various UN agencies like UNICEF and UNDP (United Nations Development Programme). Both allocate funds to grant blockchain projects in developing countries, starting as far back as 2018.

Moreover, by lagging in blockchain infrastructure, the Global South leaves itself wide open to potential economic sanctions, as we have seen with Iran, Libya, Venezuela, and other nations. Can these nations follow the example of Estonia, which in less than 30 years transitioned into a developed nation with a strong FinTech sector?

Only if the governments of the Global South focus on developing infrastructure first – stable electricity and mobile coverage – forming the building blocks for e-Government.

Guest post by Shane Neagle from The Tokenist

Shane has been an active supporter of the movement towards decentralized finance since 2015. He has written hundreds of articles related to developments surrounding digital securities – the integration of traditional financial securities and distributed ledger technology (DLT). He remains fascinated by the growing impact technology has on economics – and everyday life.

Learn more →

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)