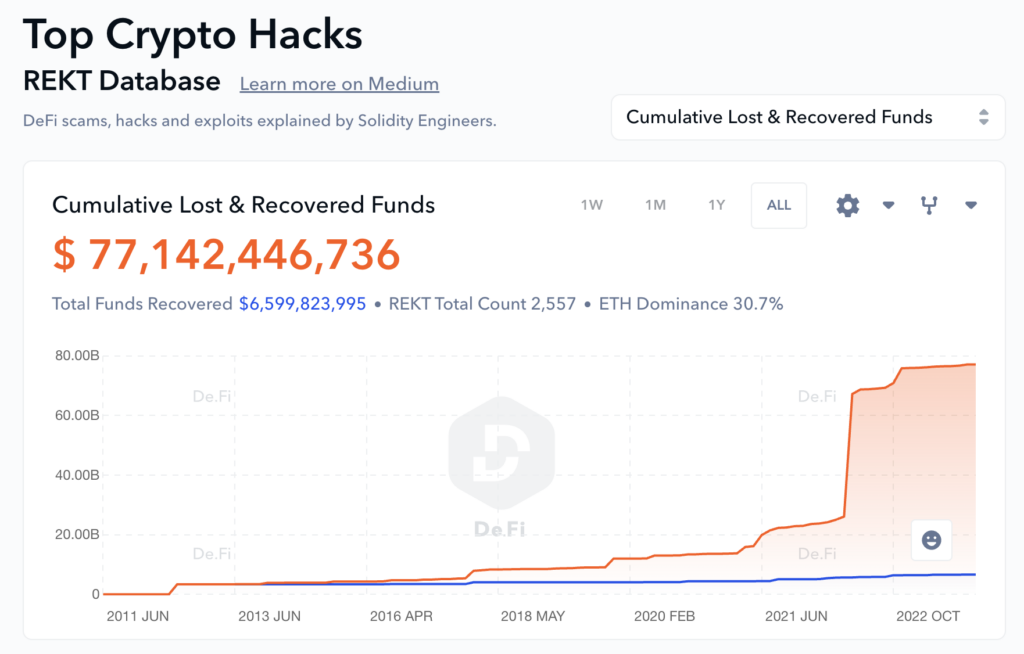

De.Fi’s Rekt Database reports that July saw $389.82 million in DeFi losses related to hacks and exploits, pushing the cumulative total value of all of to cross the threshold of $77 billion.

Ethereum emerged as the most targeted, losing $350 million across 36 incidents. Multichain, however, suffered the most severe single-case loss of $231 million due to an access control exploit, according to the De.Fi analysis.

Criminals’ diverse arsenal of exploits across DeFi.

Access control issues led to three significant cases resulting in a staggering loss of $287 million. Rugpulls, even though the most common with 38 reported cases, resulted in significantly lower losses totaling $36 million. Reentrancy attacks, although less frequent with six cases, still led to substantial losses of $58 million.

Among the different categories of targets, tokens were the most frequently attacked, with 39 cases reported leading to losses totaling $35.9 million. Borrowing and lending protocols were targeted once, with a loss of $3.4 million. The Bridge category was hit hardest, reporting a loss of $241 million from two incidents.

The Multichain exploit was at the top of the exploit list, with $231.1 million lost due to access control issues. The Vyper Compiler saw losses of $50.5 million due to a reentrancy attack, while the BALD Token lost $23.1 million due to a token rugpull. De.Fi provided CryptoSlate with a list of the top exploits in July, shown below.

| Rank | Platform/Token | Amount Lost | Type of Exploit |

|---|---|---|---|

| 1 | Multichain | $231.1m | Access Control |

| 2 | Vyper Compiler | $50.5m | Reentrancy |

| 3 | BALD Token | $23.1m | Token Rugpull |

| 4 | AlphaPo | $22.8m | CeFi, Access Control |

| 5 | Poly Network | $10.2m | Access Control |

According to the Rekt Database, the recovery of exploited funds in July was notably low. A mere $7 million was recouped from the vast loss, continuing the unfortunate trend of low recovery rates in recent months.

July marks the height of DeFi’s losses for 2023, with close to $1 billion now lost in total for the year. There was $73 million more lost in July than the next highest month, which occurred in March.

These figures serve as a sobering reminder of the inherent risks and vulnerabilities of the current DeFi landscape. While the promise of decentralized finance is compelling, the reality, as evidenced by the $77 billion cumulative total lost, is not without its challenges.

De.Fi’s Rekt Database allows further analysis across many chains. It includes the $40 billion loss from the Terra collapse in 2022, along with other notable incidents involving Silk Road, Africrypt, PlusToken, and many more. Each incident is explained by solidity engineers giving a layer of additional transparency to the average investor.

According to the database, the Terra collapse still stands tall at the top of the black hat pile, with ten times more lost than the Africrypt rugpull in second place, which saw $3.8 billion lost in 2021.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Toncoin

Toncoin  Sui

Sui  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Official Trump

Official Trump  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB