Aside from bringing the world to a standstill, the 2020 pandemic brought on the largest fiscal stimulus program ever seen.

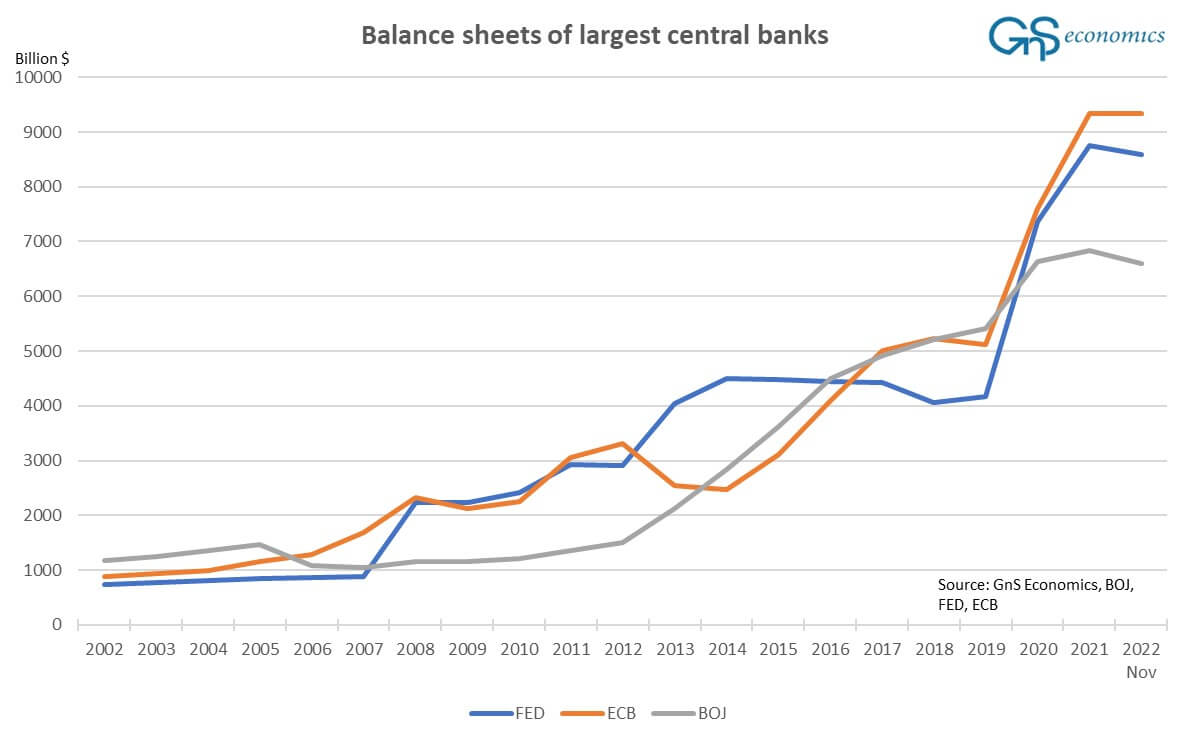

Two of the largest central banks in the world — the U.S. Federal Reserve and the European Central Bank (ECB) — saw their balance sheets double in less than a year. The Federal Reserve increased its balance sheet from just over $4 trillion at the end of 2019, to over $8.7 trillion at the end of 2020.

The European Central Bank grew its balance sheet from $5 trillion to over $9 trillion in a year. Meanwhile, the Bank of Japan was more conservative with its balance sheet, adding around $1.5 trillion in a year to reach a total of almost $7 trillion in 2021.

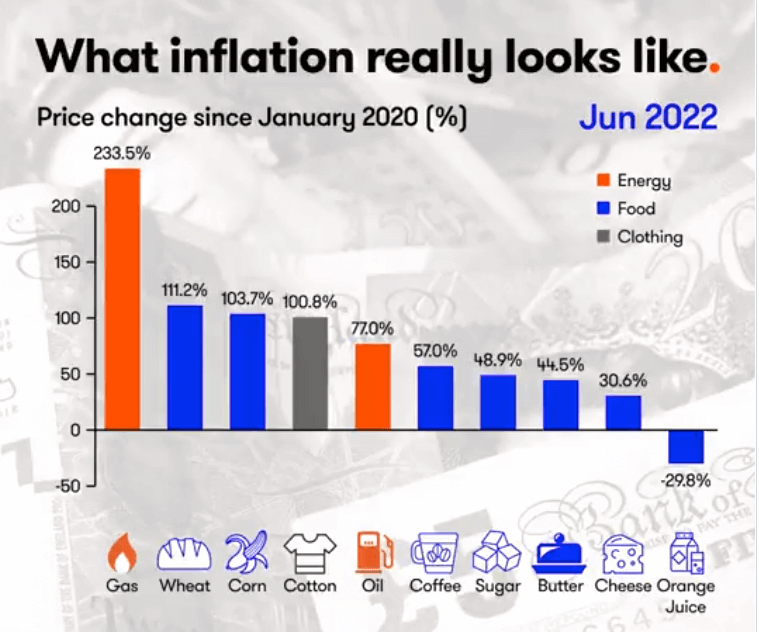

The historically unprecedented stimulus program has resulted in rampant inflation that’s yet to reach its peak. Consumer price indexes across the world have been steadily increasing since 2020 and have picked up pace in the second quarter of 2022.

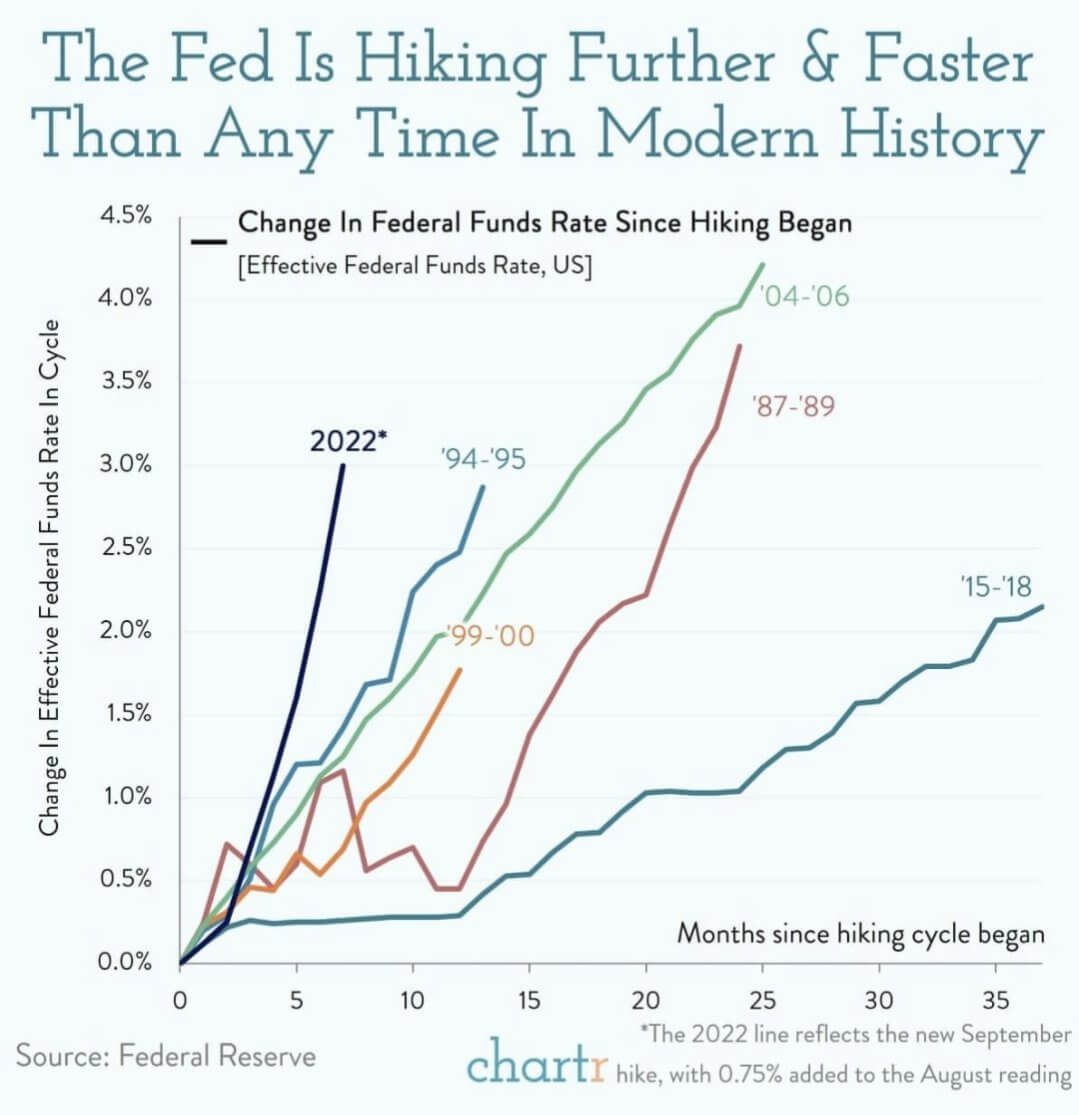

To curb the rising CPI, central banks around the world are racing to increase interest rates and make lending more expensive. Since the beginning of 2022, inflation in the U.S. has been rising at such an alarming pace, the Federal Reserve has embarked on the quickest rate of interest rate hikes in modern history.

Looking at the single-digit CPI increase in the U.S. fails to show just how aggressive inflation really is. Since 2020, many commodities have seen triple-digit increases, with gas seeing its price increase by more than 233% in two years. The prices of wheat, corn, and cotton increased by over 100% each.

Traditional financial assets have also seen an incredibly volatile couple of years.

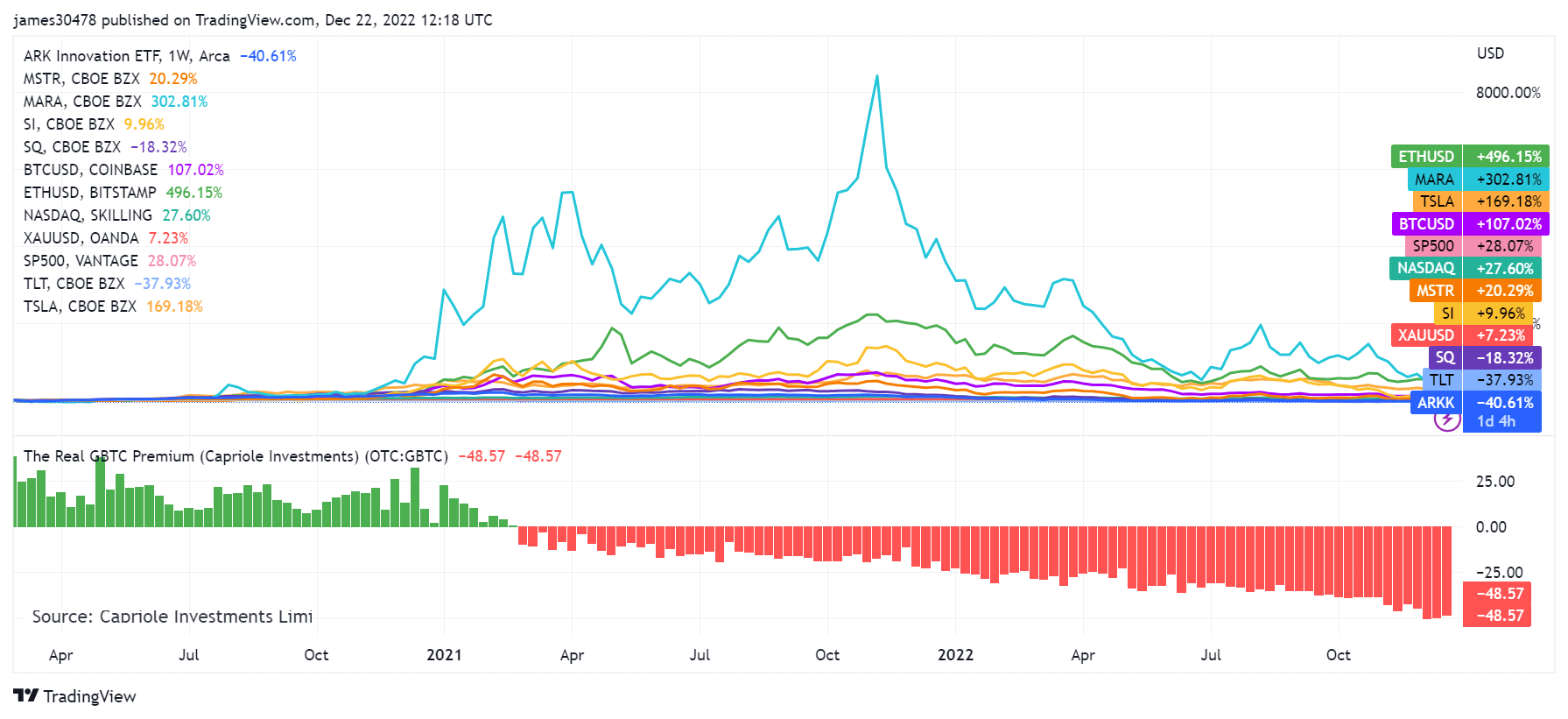

Nasdaq and the S&P 500 managed to post modest growth that has been more or less in line with inflation in the past year, with the former increasing by 27.6% and the latter growing by 28%.

Gold saw a relatively flat year, growing only 7.23% since 2020.

Long-term U.S. Treasury bonds have seen their value decrease by more than 39% since January 2020, showing investors have lost confidence in 20+ year government bonds.

On the other hand, the crypto industry and the companies operating within it not only outpaced inflation but left almost all traditional assets in the dust.

Ethereum and Bitcoin have appreciated almost 496.15% and 107.02% respectively since January 2020.

Marathon Digital, one of the largest publicly traded Bitcoin miners, saw its stock increase by 302.81%, while Tesla appreciated almost 170% during the same period.

Other large crypto and crypto-connected companies appreciated as well — Michael Saylor’s Microstrategy increased over 20%, while Silvergate saw its stock rise almost 10%.

However, the crypto industry saw some losers as well. The ARK Innovation ETF, a fund tracking Cathie Wood’s Ark Invest, dropped over 40% in two years.

Square, Jack Dorsey’s financial tech company, posted a loss of 18.32%.

Grayscale’s Bitcoin’s trust lost almost 50% of its value against Bitcoin’s NAV since 2020. Before the pandemic, GBTC was trading at a 20% premium to Bitcoin’s market price.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Litecoin

Litecoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hedera

Hedera  Stellar

Stellar  Sui

Sui  LEO Token

LEO Token  Shiba Inu

Shiba Inu  Toncoin

Toncoin  USDS

USDS  MANTRA

MANTRA  Polkadot

Polkadot  Hyperliquid

Hyperliquid  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Dai

Dai  Ondo

Ondo  Internet Computer

Internet Computer  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Gate

Gate  Official Trump

Official Trump  Mantle

Mantle  Coinbase Wrapped BTC

Coinbase Wrapped BTC  POL (ex-MATIC)

POL (ex-MATIC)