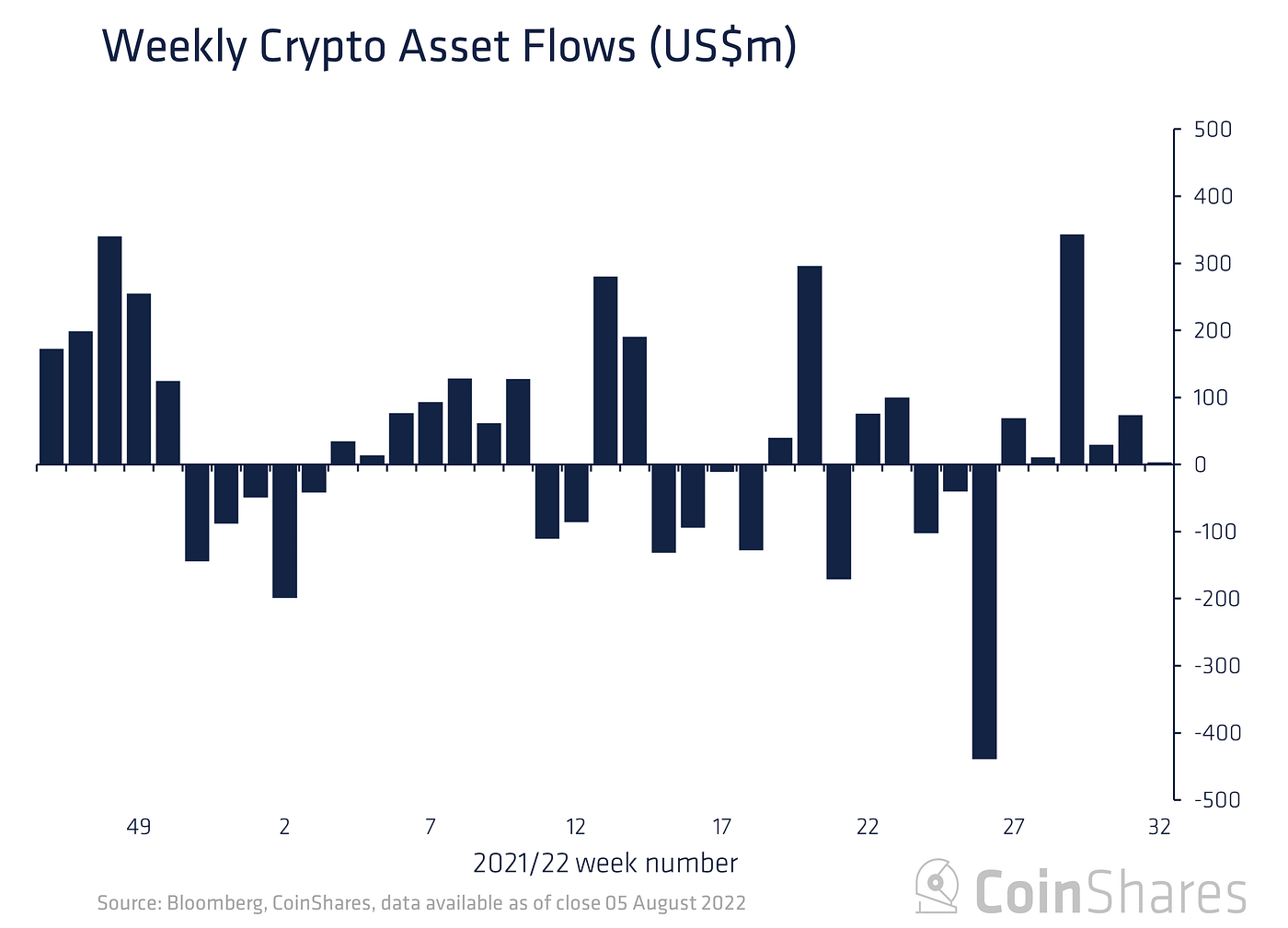

Inflows into crypto investment products have been experiencing an uptick for six consecutive weeks, topping $500 million, according to a report by market insight provider CoinShares.

The study dubbed “Volume 92: Digital Asset Fund Flows Weekly Report” highlighted:

“Digital asset investment products saw inflows totalling US$3m last week marking the 6th consecutive week of inflows that total US$529m, representing 1.7% of total assets under management (AuM).”

Source:CoinShares

CoinShares noted that constant inflows are happening despite the crash in the crypto market witnessed in the second quarter of 2022.

As the much-anticipated merge in the Ethereum network edges closer, more inflows have been trickling into the second-largest cryptocurrency. The report pointed out:

“Ethereum saw inflows totalling US$16m and is enjoying a near 7 consecutive week run of inflows totalling US$159m. We believe this turn-around in investor sentiment is due to greater clarity on the timing of The Merge.”

The merge, which is expected to happen on September 19, will change the current proof-of-work (PoW) framework to a proof-of-stake (PoS) consensus mechanism. Moreover, it’s speculated to be the biggest software upgrade in the Ethereum ecosystem.

American multinational investment bank Citi recently noted that the merge would make Ethereum a “yield-bearing asset,” Blockchain.News reported.

On the other hand, CoinShares noted that despite sentiment in the crypto market improving, trading volumes remained low the past week at $1.1 billion compared to the year-to-date weekly average of $2.4 billion.

“Bitcoin saw very minor outflows totalling US$8.5m while short-Bitcoin investment products saw a record outflow totalling US$7.5m, and for the second consecutive week suggesting investors believe Bitcoin prices have troughed,” CoinShares added.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB