After a weeklong rally that pushed Bitcoin (BTC) value above $23,000, the crypto market experienced a significant sell-off in the last 12 hours that liquidated $183.99 million, according to Coinglass data.

Total liquidations over the last 24 hours stood at $223.43 million as of press time. Of these liquidations, 90.29% occurred on traders who took long positions on the market, according to Coinglass data.

During this period, 63,210 traders were liquidated — the most significant liquidation being a $4.64 million long position on BTC.

Bitcoin tumbles below $23k as investors take profit

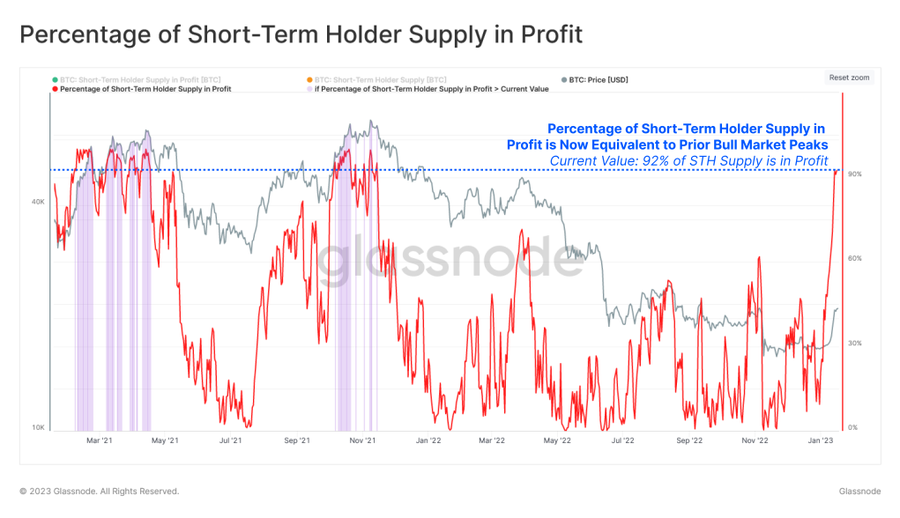

Short-term BTC investors appear to be taking profit after the cohort saw a dramatic increase in the number of their coins held in profit.

Glassnode said that this group’s supply in profit reached 92% — last seen in May 2021 and when BTC traded at its all-time high in November 2021.

“Given this substantial spike in profitability, the probability of sell pressure sourced from short-term holders is likely to grow accordingly.”

Glassnode further pointed out that the profitability spike has driven the cohort’s spending volume above the long-term declining trend.

Top 10 assets average a 5% loss

Except for stablecoins, other digital assets on the top 10 crypto assets list posted an average of a 5% loss in the last 24 hours, according to CryptoSlate data.

During the reporting period, Ethereum (ETH) fell 5.20% to $1,552, while BNB declined 5.14% to $302. Cardano (ADA), Solana (SOL), and Dogecoin (DOGE) plunged by 6.88%, 6.53 and 5.40%, respectively.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC