Embattled crypto lender Celsius Network is shaking up its ether (ETH) staking strategy, congesting the already month-long queue to activate new validators on the Ethereum network.

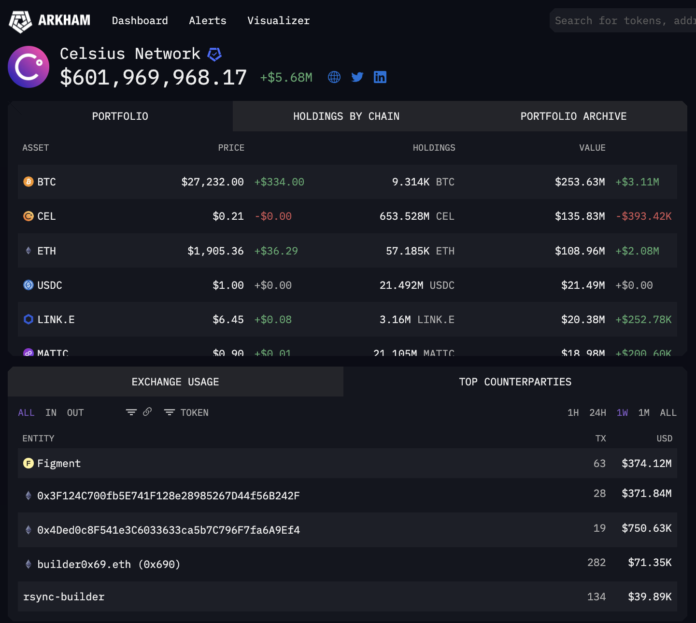

Over the course of two days, the firm has been diligently moving ETH into staking contracts after redeeming some $813 million of staked ETH from liquid staking leader Lido Finance. Since June 1, Celsius has deposited some $745 million of ETH, data by Arkham Intelligence shows.

The transfers have stretched the already long queue to establish new validators on the Ethereum network to 44 days, with Celsius potentially responsible for almost a week of extra time, Tom Wan, analyst at crypto investment product manager 21Shares noted.

The transactions are the latest development in the lender’s maneuver to reshuffle its staked ETH stash since Ethereum’s Shanghai upgrade enabled withdrawals from staking contracts in April. At that time, Celsius held some 460,000 of ETH – now worth $870 million – staked with liquid staking platform Lido Finance and some 160,000 tokens – about $300 million at current prices – deployed in its own staking pool.

The transfers have occurred as the firm restructures after filing for bankruptcy protection in July, when it succumbed to liquidity issues due to plummeting cryptocurrency prices and a wave of user withdrawals. Last week, the U.S. bankruptcy court auctioned the lender to winning bidder Fahrenheit, an investment group backed by Arrington Capital that will assume the firm’s assets, including its institutional loan portfolio, staked cryptocurrencies and crypto mining units.

Celsius’ staking maneuvers

The lender’s maneuver to shake up its staking allocations started with staking some $75 million of its available ETH stash with non-custodial, institutional staking service Figment, CoinDesk reported.

Celsius also requested to redeem its 460,000 staked ETH from Lido as soon as the platform allowed withdrawals. It has already reclaimed 428,000 tokens, worth $813 million. Celsius split the assets into two separate crypto addresses that the firm previously used to stake with Figment and to deposit in its own staking pool, blockchain data shows. The lender is still waiting to receive 32,000 ETH from Lido.

On Thursday, the firm moved a total of 291,000 ETH, worth $553 million, into staking contracts, according to a Dune Analytics chart by 21Shares. A total of 192,000 tokens were deposited into the Celsius staking pool, while 99,000 tokens were staked with Figment, Wan reported.

On Friday, the company resumed moving tokens into staking contracts, putting it on track to stake all the 428,000 ETH stash. At the time of publication, the firm had staked some $199 million of ETH via Figment and deposited some $12 million to the Celsius staking pool, Arkham data shows.

After the transfers, Celsius wallets still held some $109 million in ETH, according to Arkham.

Staking allows the beleaguered lender to earn rewards on digital asset holdings while the withdrawal freeze on user deposits is in effect.

However, it also significantly stresses an already crowded queue to add new validators on the Ethereum network. Validators are entities in a proof-of-stake blockchain, who stake tokens to guard the network and oversee transactions in exchange for a reward.

Demand for staking has increased dramatically since the Shanghai upgrade activated on April 12. Deposits surpassed withdrawals by almost $5.5 billion, leaving new entrants with a month-long wait time to set up validators, data by blockchain intelligence firm Nansen shows.

Celsius’ latest staking deposits further stretched the queue. The estimated time to clear the queue now stands at 44 days and one hour, according to Ethereum tracking website Wenmerge.

If Celsius commits all the 428,000 tokens to staking, it will add six days and 15 hours to the waiting time, increasing to 45 days, Wan predicted on Thursday.

“Staking activation queue up only,” pseudonymous blockchain sleuth Alto, who was first to report Celsius’ transfer to staking wallets, tweeted.

Edited by James Rubin.

https://www.coindesk.com/markets/2023/06/02/crypto-lender-celsius-800m-ether-staking-shake-up-stretches-ethereum-validator-queue-to-44-days/?utm_medium=referral&utm_source=rss&utm_campaign=headlines

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC