Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›

A fractal is a repeating pattern often found all throughout nature. It is only fitting then that Covesting strategy manager Fractalz is working toward a repeating pattern: one where they dominate the Covesting leaderboards on PrimeXBT month after month on end.

Check out how they were able to reach more than 5,700% ROI since the start of the year, a closer look at the current Covesting leaderboard standings, and a very special spotlight on an emerging superstar trader right on the tails of the top ten. Also read on to find out how you can follow these top traders via the Covesting copy trading module on PrimeXBT.

Important March Close, Q1 2022 In Review

The month of March brought with it the close of the ever-important first quarter of the year. Q1 of any year often predicts the future outcome of the year. A bearish first quarter calls for a year of a possible downtrend, while a bullish quarterly close yields dramatic results to the upside.

This often makes for a highly volatile quarter as the market looks to determine the trend ahead. March 2022 was no different, with significant shakeups in the stock market, crypto, precious metals, and the energy sector. No event held more significance than the still ongoing war in Ukraine. Right behind it was the US Federal Reserve raising rates for the first time in several years, all while supply chain issues persist and inflation spirals out of control.

The backdrop in global markets has been a fearful one, but the quarter closed, holding onto some hope. Oil prices have pulled back, as have metals. Meanwhile, stocks and crypto have recovered. Understanding this, we might have our answer for how Fractalz was able to add to their already strong ROI in the last few days of March.

How Did Fractalz Find Repeat Success?

How Did Fractalz Find Repeat Success?

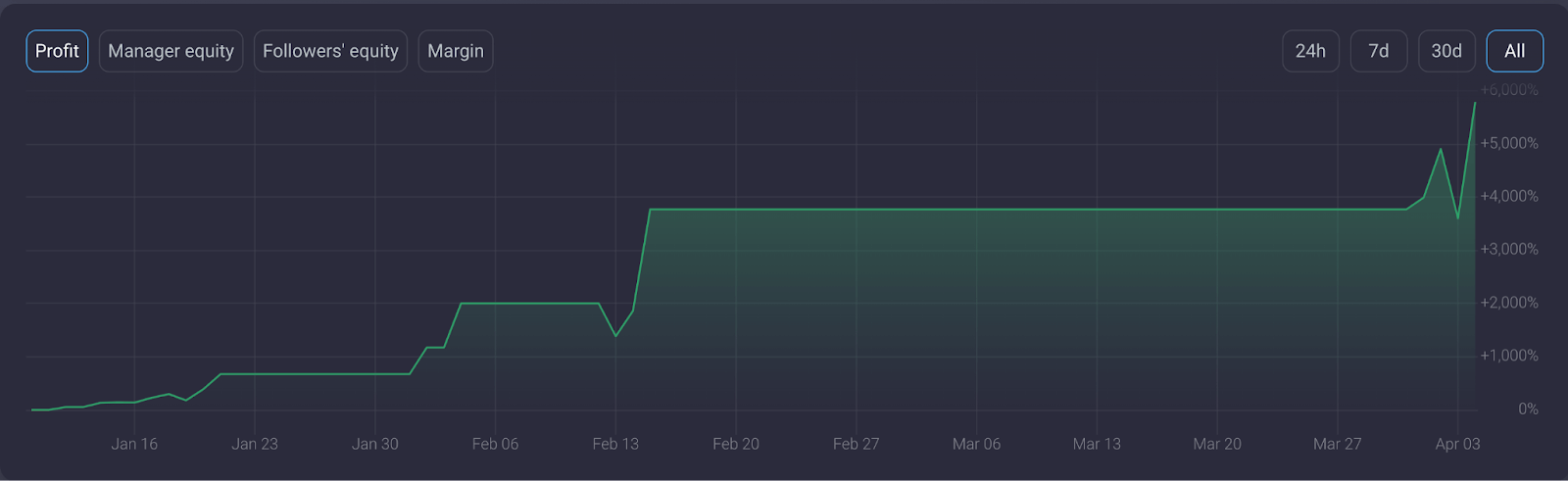

Looking at Fractalz’s ROI within the Covesting copy trading module above, we can see that ROI essentially flatlined for almost two whole months. The plateau that began in mid-February, right about on Valentine’s Day, left a heart-breaker of a month ahead on the chart.

After another month of sideways and boredom, there was a sudden breakout higher in late March. The price action possibly connected to the chart pattern above is more than likely Bitcoin itself. On the BTCUSD trading pair, Bitcoin had been building a base after failing to break below $33,000 per coin earlier in Q1.

Following weeks of stagnancy, Bitcoin broke up from $45,000 resistance and is currently attempting to establish it as resistance turned support. Other markets have been more volatile throughout the timeframe of the ROI plateau.

Covesting Leaderboard Top Ten Spotlight

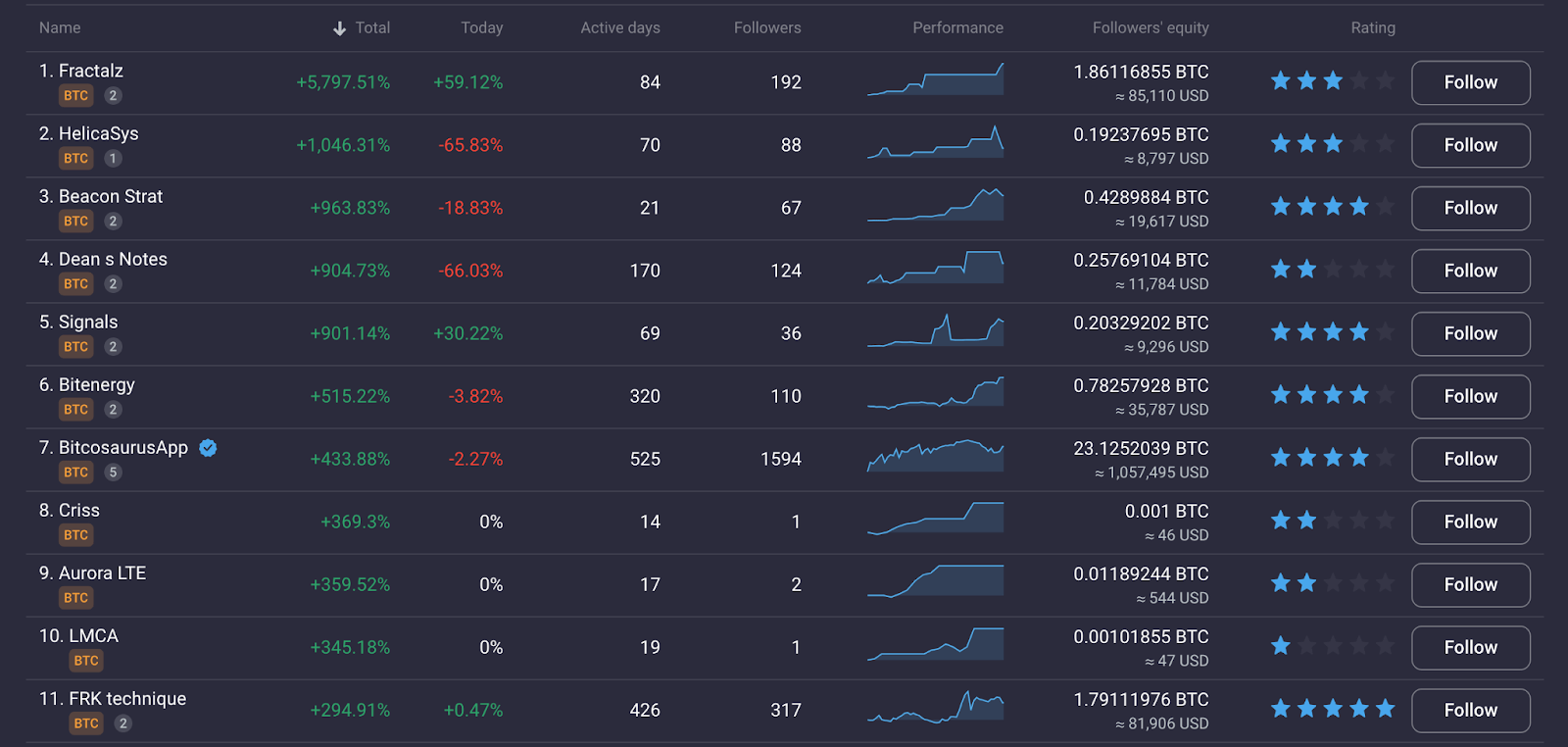

In a rare occurrence, we’ve taken a snapshot of the top eleven best-ranked traders in the Covesting leaderboards. No, this isn’t an April Fools prank, and the top ten will remain the main focus. But it would be cruel not to share the spotlight with FRK technique in 11th place, who, unlike those ranked above them, have achieved a five-star rating.

Five-star ratings don’t come up often and are even tougher to maintain. It is a hallmark of an exceptionally skilled and risk-averse trader and makes an ideal strategy to follow, especially when higher-ranked strategies are at max capacity.

Refocusing on the top ten, below Fractalz, HelicaSys is ranked in second with more than 1,000% ROI. Right behind them is Beacon Strat, with 960%. Dean s Notes follows in fourth, with Signals in fifth place. Bitenergy ranks sixth, with the verified BitcosaurusApp taking seventh. Eighth place goes to Criss, and in ninth, we have Aurora LTE. Finally, in tenth place is LMCA.

Gain The Covesting Copy Trading Edge

For those that don’t already know, Covesting is a massive peer-to-peer copy trading community where followers find strategy managers to follow using fully transparent performance metrics. Followers can copy the trades of these more experienced traders, without having to navigate markets on their own.

Strategy managers are provided with the advanced trading tools available at the award-winning margin trading platform PrimeXBT. The platform gives these strategy managers exposure to a wide range of markets under one roof, including forex, stock indices, crypto, and commodities. Built-in technical analysis tools assist strategy managers with maintaining a high win to loss ratio and consistent ROI.

With these tools at their disposal, strategy managers have in the past been able to achieve astronomical returns to the tune of 90,000%. The money followers made from such a win streak was life-changing.

Covesting March Review Conclusion

With March now concluded and the dust settled on the historical volatility, the Covesting leaderboards are showing incredible promise for the rest of the year. Who will you choose to follow?

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC