Canary Capital Group filed for a Litecoin ETF with the SEC. This pushed LTC price up 9.5% to over $73, its highest since July 2024. But experts warn institutional investors might not rush in.

In this guide we will dive into this topic to better understand the circumstances.

Also Read: Cardano Price Prediction: Will ADA Drop Below $0.25? Experts Weigh In

Canary Capital’s Litecoin ETF Filing: Impact on LTC and Market Dynamics

New ETF Player

Canary Capital is new to crypto investing, and it plans on staying here long-term. Their Litecoin ETF filing is causing some buzz.

Steven McClurg leads the firm and he wants to tap into crypto investment interest. But Canary’s size makes some doubts about its appeal to big investors. Will it be enough? Only time will tell.

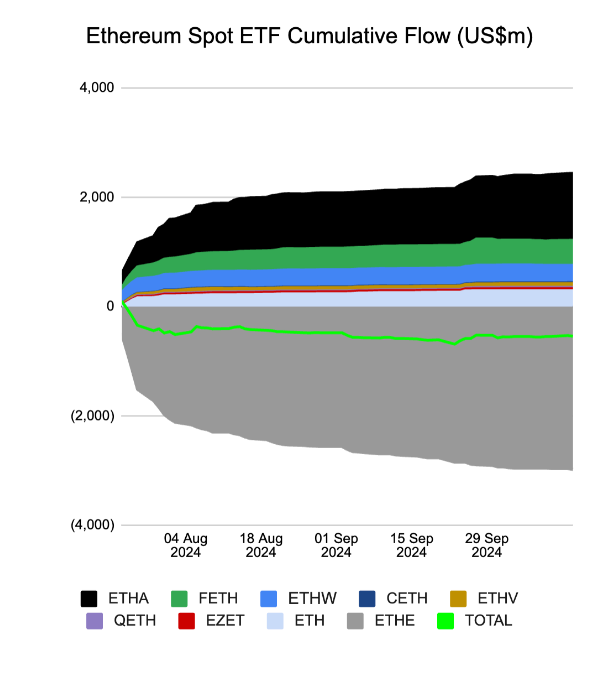

Ethereum ETF Lessons

Ethereum’s ETF launch is a warning for Litecoin fans. Ether prices fell 25% after ETFs launched. This shows risks of hyping non-Bitcoin crypto funds. It might limit hopes for an LTC price surge.

InvestingHaven tweeted:

“$LTC Buy the Dip Coming Soon? Litecoin is trading in its expected range, and a key ‘buy the dip’ zone between $57.85 and $61.15 could happen soon. This might be a solid long-term entry. Is #Litecoin on your radar?”

Also Read: Bitcoin Barely Used: 92% Salvadorans Skip BTC For Everyday Transactions

Grayscale and Price Trends

If Grayscale turns its Litecoin Trust into an ETF, it could hurt LTC prices. Litecoin’s value vs Bitcoin is weak. LTC/BTC pair dropped 98% since November 2013. The SEC’s choice on Canary’s filing may affect this.

Also Read: US Bank Pays $29 Million to Customers After Bombarding Them With Calls

Canary’s filing excited markets short-term. But long-term investor interest is unclear. Litecoin’s weak appeal to institutions and technical issues may limit sustained price surges for this cryptocurrency.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)