Quick Take

- As Q1 has ended with a remarkable Bitcoin performance of over 70%, it is worth analyzing the spot vs. derivatives trend over Q1.

- The network is much healthier at the end of the quarter than when we started back in January.

- The exchange balance is now flat year-to-date, with roughly 2.28 million Bitcoin on exchanges, and demand started to return after the SVB collapse.

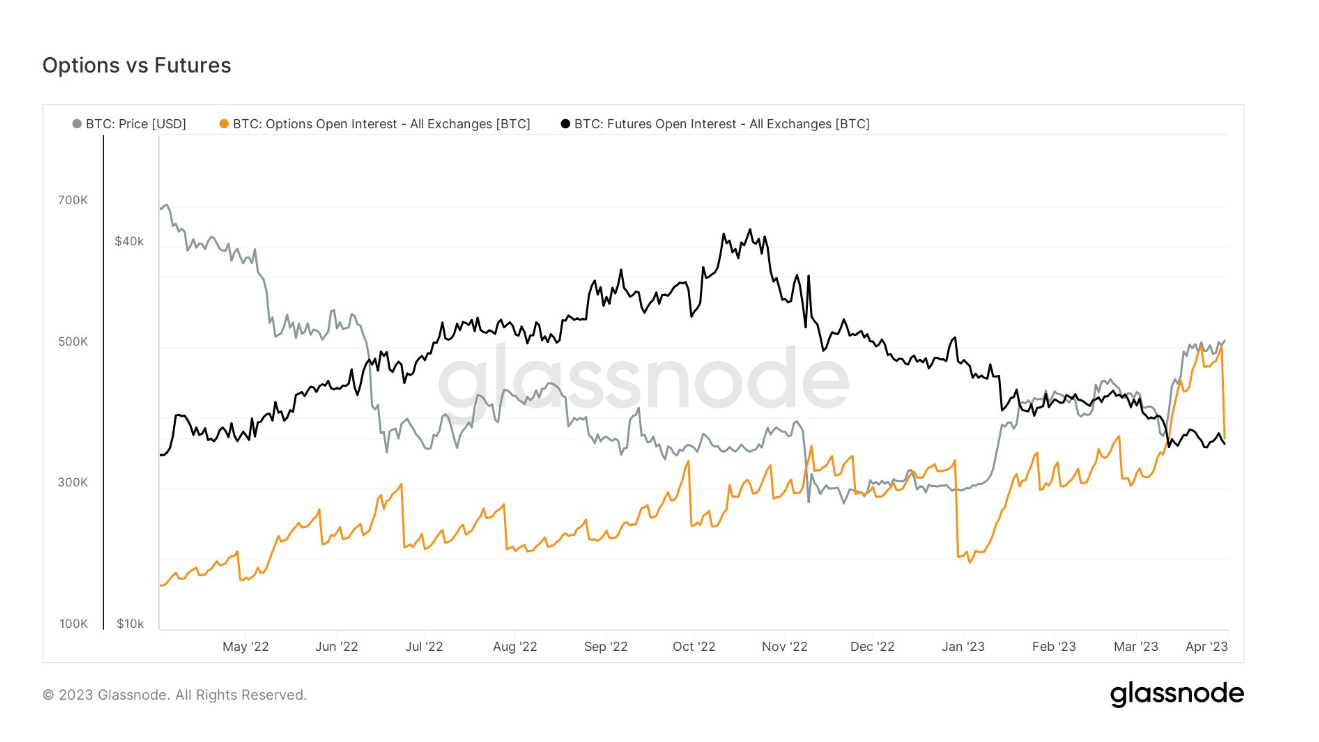

- Futures’ open interest is now at a one-year low, with roughly 300,000 Bitcoin liquidated from the 2022 peak in October.

- Last, options open interest saw a record-breaking amount of $4 billion worth of options expiring on March 31. Roughly 130,000 Bitcoin have been unwound in contracts from the exchange Deribit.

- The rally in Bitcoin price has been driven by spot demand in recent weeks.

The post Comparing Bitcoin’s spot and derivatives markets in Q1 2023 appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Toncoin

Toncoin  Wrapped stETH

Wrapped stETH  Shiba Inu

Shiba Inu  Wrapped Bitcoin

Wrapped Bitcoin  Sui

Sui  Stellar

Stellar  Polkadot

Polkadot  Hyperliquid

Hyperliquid  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena