- Coinbase and MicroStrategy insiders sold $1.25 billion and $567.8 million in shares, respectively, during a bullish crypto market in 2024.

- Insider sales contrasted with stock surges—Coinbase rose 43%, and MicroStrategy soared 358.5%, sparking debates on transparency and market impact.

Executives at Coinbase and MicroStrategy emerged as major insider sellers in the U.S. market last year, capturing significant attention. As the broader market experienced a surge, crypto industry insiders sold considerable shares.

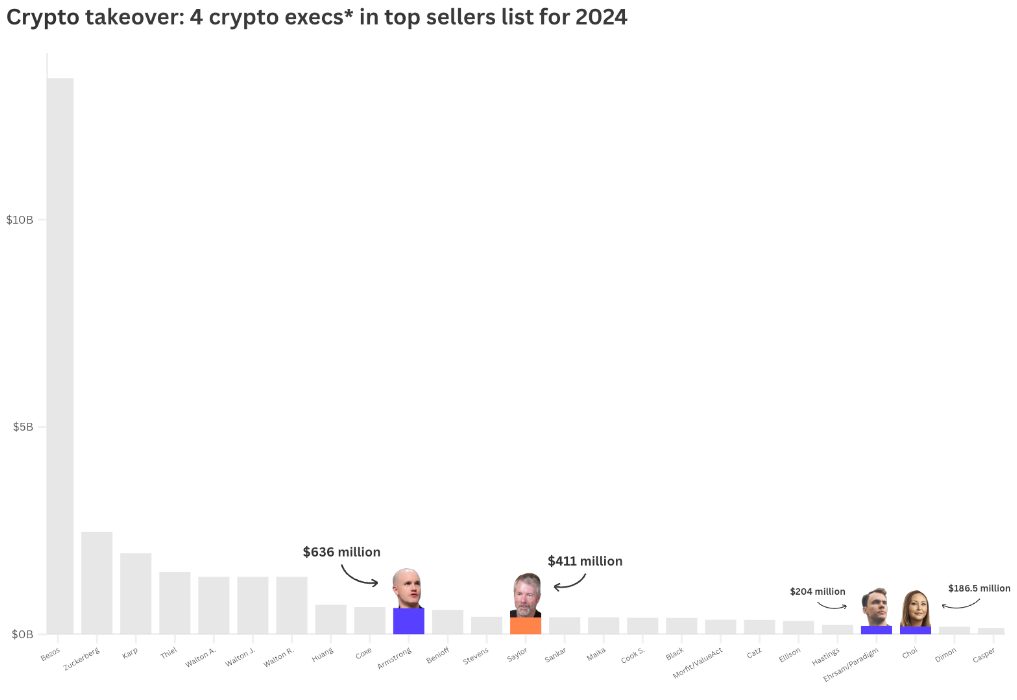

The Securities and Exchange Commission (SEC) filings revealed that 500 insiders collectively sold shares valued at $36.9 billion in 2024, with prominent activity from crypto sector leaders.

Brian Armstrong, the CEO of Coinbase, ranked among the top eight sellers by offloading $636 million in COIN shares. Key executives Fred Ehrsam and Emilie Choi contributed to Coinbase’s total insider sales reaching $1.25 billion, placing the company seventh among U.S. firms in insider sales volume.

Michael Saylor, founder of MicroStrategy and a prominent Bitcoin advocate, followed closely by selling $410.8 million worth of MSTR shares, earning the 13th spot. In total, MicroStrategy insiders sold shares amounting to $567.8 million, positioning the company 11th nationwide.

Coinbase & MicroStrategy Soar — But Insiders Cash Out

The insider sales coincided with a bullish crypto market that drove Coinbase and MicroStrategy stocks to outperform much of the S&P 500. Coinbase, riding the wave of Bitcoin’s price momentum, posted over 43% annual growth. Starting 2024 at $173.02, COIN closed the year at $248.30, with additional gains of nearly 6% already recorded this year.

MicroStrategy fared even better. Its stock surged by 358.5% in 2024, largely driven by its increasing Bitcoin holdings and the firm’s correlation with the digital asset. MSTR’s meteoric rise was fueled by the company’s commitment to its “21/21 plan,” an ambitious strategy aimed at aggressive Bitcoin acquisitions.

While both companies enjoyed remarkable stock performance, insider sales have raised eyebrows. Crypto influencer Tommy Famous criticized the sheer scale of insider selling, warning of potential harm to the sector’s credibility. He questioned the contradiction of promoting decentralization while profiting massively, urging for transparency and accountability.

Market Wobbles Despite Strong Performances

Bitcoin’s New Year rally spurred optimism by rising 5.50% within the first week, with 78% of investors to increase BTC holdings in 2025, as reported by CNF. Despite this surge, market confidence faces challenges. Key institutions, including BlackRock, have sold substantial Bitcoin holdings while El Salvador scaled back its aggressive adoption strategies. Additionally, the absence of new token issuance by Tether indicates a cautious market sentiment.

MicroStrategy, previously a steadfast supporter of Bitcoin, has drawn attention to reducing its cryptocurrency purchases. This change, coupled with other conservative market actions, raises concerns about the sustainability of Bitcoin’s bullish outlook.

Looking ahead, MicroStrategy’s planned large-scale Bitcoin acquisitions for 2025 are under scrutiny, highlighting questions about insider confidence and the firm’s strategy. Its future decisions may either reinforce its leadership or invite increased skepticism. Simultaneously, Coinbase’s steady stock growth continues to capture investors’ interest, even as insider sales remain significant.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Stellar

Stellar  Sui

Sui  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Litecoin

Litecoin  Hyperliquid

Hyperliquid  Bitget Token

Bitget Token  WETH

WETH  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  MANTRA

MANTRA  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ondo

Ondo  Pepe

Pepe  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Mantle

Mantle  Official Trump

Official Trump  Dai

Dai  Internet Computer

Internet Computer  Aptos

Aptos  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  OKB

OKB  Gate

Gate  POL (ex-MATIC)

POL (ex-MATIC)