California-based Silicon Valley Bank (SVB), a unit of SVB Financial Group, has been shut down, according to an announcement from financial regulators on March 10.

Silicon Valley Bank closed by regulators

The Federal Deposit Insurance Corporation (FDIC) said that the California Department of Financial Protection and Innovation closed SVB today.

The FDIC said that it has been designated as the receiver and added that eligible bank customers will have access to insured deposits by March 13.

Though the FDIC did not describe the course of events leading up to SVB’s closure, the bank’s collapse was prompted by a March 8 sale proposal through which it aimed to cover a $1.8 billion loss. The firm’s share value fell by 60% from $267.83 to $106.4 within a day.

This led to a bank run after third parties advised companies to withdraw funds on March 10. Trading on the company’s shares has since been halted.

Executives, including CEO Gregory Becker, CFO Daniel Beck, and CMO Michelle Draper collectively sold millions of dollars of stock in the weeks leading up to these events.

The company had $209 billion of assets, which makes it the second-largest U.S. bank failure in history and the largest bank failure since the 2008 financial crisis.

Crypto companies may have exposure

Though Silicon Valley Bank is not directly related to the crypto industry, some crypto companies may have exposure to the failed bank.

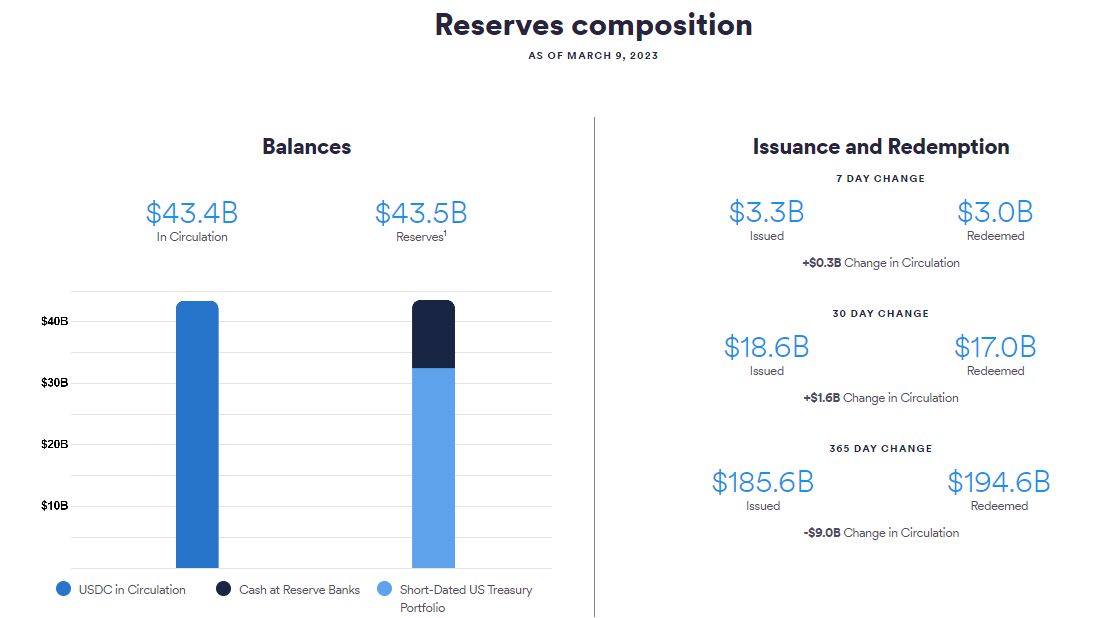

Circle held funds with various banks, including Silicon Valley Bank as recently as January. However, the company has recently moved funds between banks, according to TechCrunch, and it may or may not hold funds with SVB at present.

Though it is unclear how much money Circle might hold with Silicon Valley Bank specifically, it currently holds a quarter of its USDC reserves ($11 billion) in banks.

Elsewhere, bankrupt lending firm BlockFi was reported to have exposure to SVB. The U.S. Trustee said in a March 10 filing that BlockFi holds $227 million with the bank. It says these funds are “unprotected” and requires a bond or deposit under the bankruptcy code.

Other companies deny exposure

Binance CEO Changpeng Zhao said that his exchange company does not have exposure to Silicon Valley Bank. He tweeted: “Funds are #SAFU.”

John Wu, president of Avalanche firm Ava Labs, has also commented on the situation. During the initial bank run on March 9, Wu said that Silicon Valley Bank was one bank that his company relies upon. Rather than pulling all funds from the bank, he said Ava Labs diversified and held less with SVB than it did in previous weeks and months.

Immutable Labs co-founder Robbie Ferguson said that his company has no exposure to Silicon Valley Bank, nor does it have exposure to the failing Silvergate Bank. Immutable is known for its Immutable X blockchain and focus on Web3 gaming.

Elsewhere, the asset manager Valkyrie said that it has no exposure or banking relationship with Silicon Valley Bank. It nevertheless called the news “devastating.”

The Blockchain Intelligence Group (BIGG) and its related Canadian crypto trading platform Netcoins have also denied any exposure to the failed bank.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC