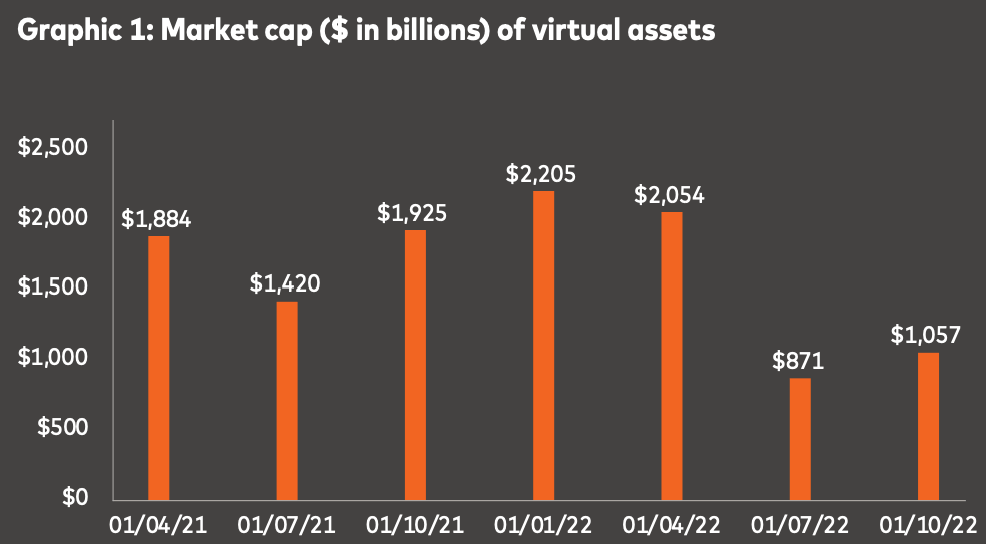

The total market cap (TMC) of crypto assets lost nearly half of its value between January 2022 and September 2022, according to a recent report by crypto intelligence company CipherTrace.

However, the report did note that the TMC grew over 20% between the third and fourth-quarter of 2022.

According to the numbers, the crypto TMC increased to $1.05 billion in October 2022 from the $871 million recorded in July 2022. Despite this considerable growth, October’s $1.05 billion still marked a 52% fall from $2.205 billion in January 2022 — reflecting the impact of the coldest winter in crypto history.

The report also notes that the size of the market cap at the end of the third-quarter of 2022 indicated a 63% decrease from the market cap’s all-time high of $2.83 billion — recorded on November 14, 2021.

Defi and NFTs

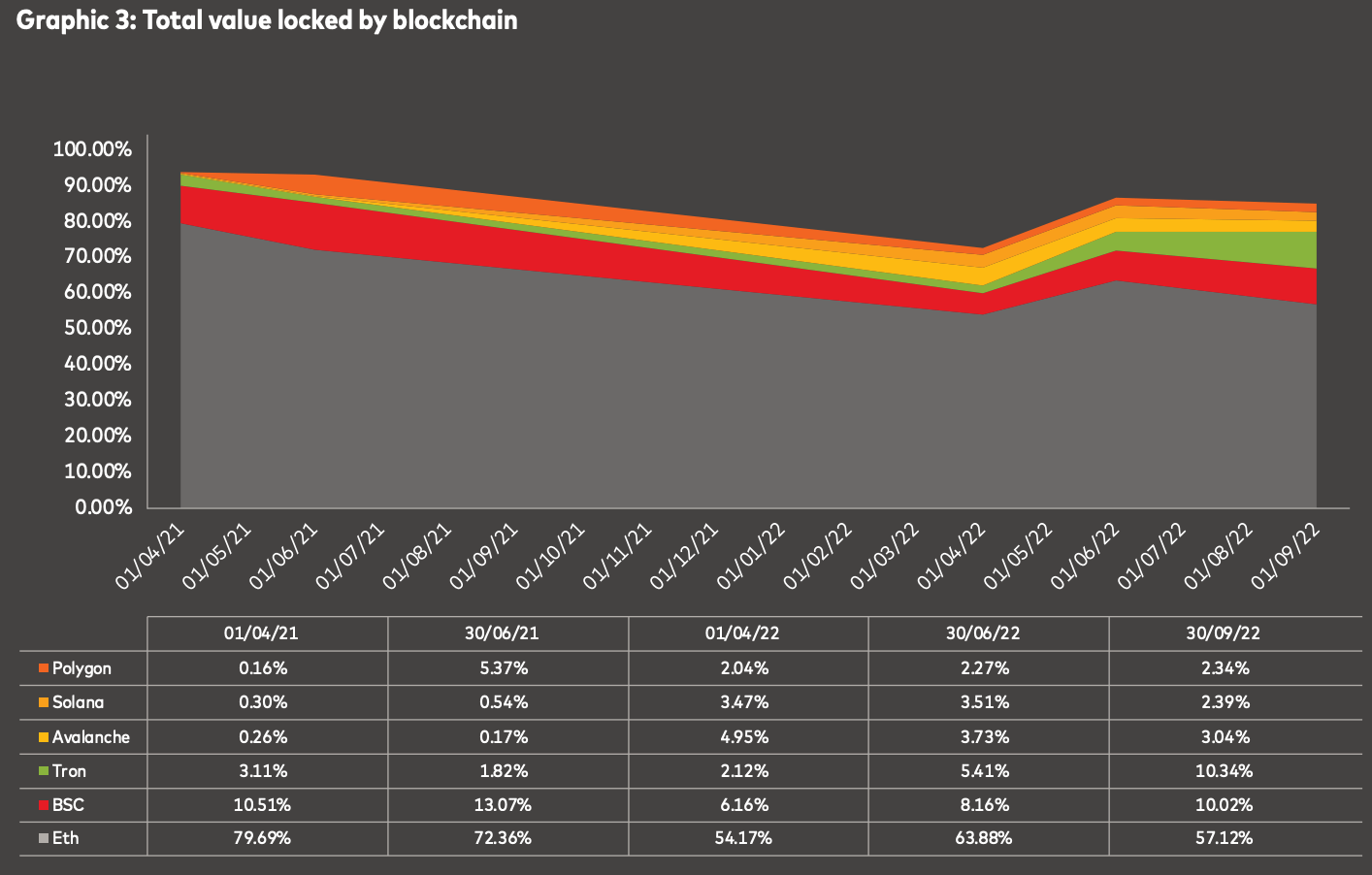

The Total Value Locked (TVL) volume at the end of the third-quarter of 2022 sat at around $54 billion — barely showing any difference from the end of the second-quarter. However, the second quarter started with $165 billion TVL — indicating a 67% fall in TVL volume by the end of the third quarter.

From January 2022 to September 2022, Ethereum (ETH) continued to account for the most significant TVL volume. Its yearly high was recorded during the first-quarter at 79.9% but fell to 57.12% by the third-quarter.

Total non-fungible token (NFT) trading volumes also reflected the effects of the bear market throughout 2022. The aggregate trading volume of the top eight chains fell to $2.3 billion in the third-quarter from the $13.9 billion recorded in the first — marking an 83% decrease.

Hacks, thefts, and fraud

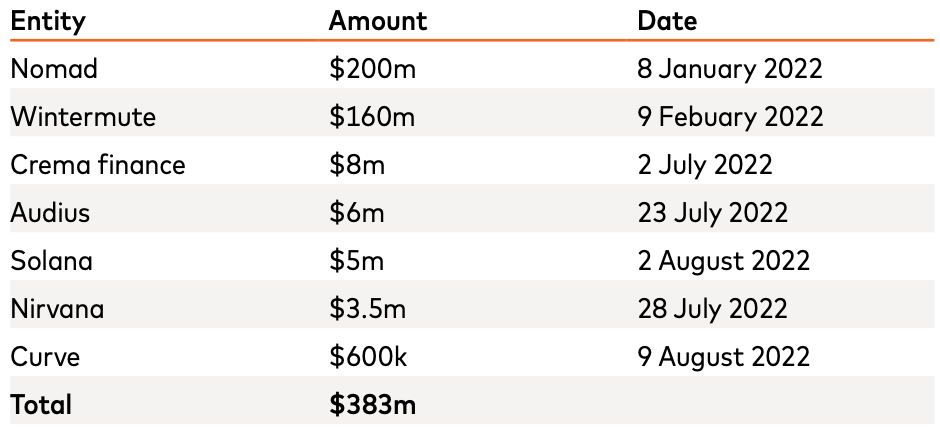

The report also examines the significant exploits that took place between January 2022 and September 2022. The numbers indicate that the crypto sphere lost $383 million to only seven criminal episodes.

Nomad recorded the largest loss of over $190 million to a bridge exploit in January 2022 — while Wintermute saw the second-largest loss, losing $160 million to a hack. Crema Finance ranked third after losing over $8 million to a flash loan attack.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC