Quick Take

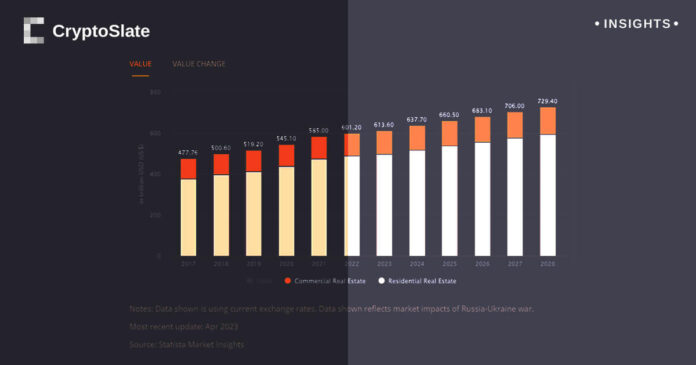

As one of the largest global wealth sources, the real estate sector continues to demonstrate tremendous growth. According to Statista, it’s projected to hit a whopping $613 trillion in 2023 and potentially reach $700 trillion by 2027. Much of this wealth is concentrated in China, the world’s largest real estate asset class, with an estimated value of $131 trillion in 2023, according to Statista. Yet, a financial storm brews on the horizon for China, as discussed previously by CryptoSlate, with the country grappling with deflation and currency issues.

Simultaneously, a dramatic shift is occurring in the Western markets. As reported by The Kobessi Letter, the rates and yields are on a steady upward climb, with the 30-year mortgage rates touching a 21-year high of 7.5%. This rise indicates more capital being funneled into servicing housing loans, leaving less for economic circulation. Additionally, as properties often represent a significant portion of people’s net worth, the resulting decrease in property values due to rising rates could trigger a reverse wealth effect.

The post China’s real estate wealth meets financial storm while Western markets see mortgage rate spike appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)