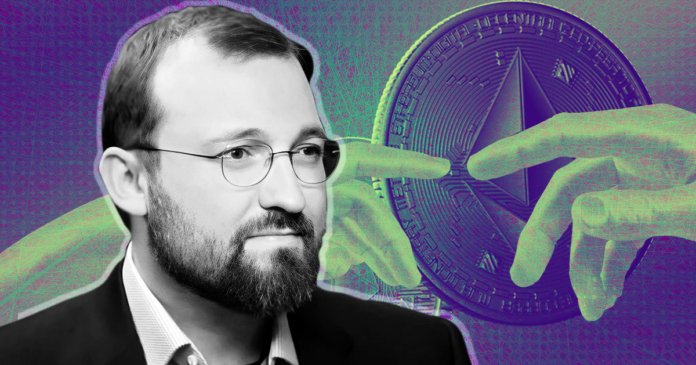

Input Output CEO Charles Hoskinson said the Merge changes nothing in terms of performance, operating cost, and liquidity.

Eth 2.0 requires Shanghai which is next year minimum by their own release schedule. My prediction is still on target. You do understand that nothing has changed in terms of performance, operating cost, nor liquidity?

— Charles Hoskinson (@IOHK_Charles) September 15, 2022

After months of build-up, the Ethereum Merge happened on September 15 at around 08:00 UTC. Vitalik Buterin commented that the event was a milestone moment for Ethereum and that he is proud of the efforts of all involved that made it happen.

The Merge refers to joining the Proof-of-Work(PoW) execution layer to the concurrently running Proof-of-Stake (PoS) Beacon chain consensus layer, thus rendering the PoW chain obsolete. Proponents say the switch to PoS will make Ethereum more secure, scalable, and eco-friendly.

The Merge is not Ethereum 2.0

Hoskinson’s comments came in response to a Twitter user mocking him for saying Ethereum 2.0 will likely occur in 2024.

In response, the IO boss said ETH 2.0 refers to the final product and that the Merge is just one step in getting there. As such, a 2024 release date “is still on target.”

To hammer home his point, Hoskinson said the Merge will not improve Ethereum’s “performance, operating cost, nor liquidity.”

Staked ETH is currently locked into the contract and cannot be withdrawn. The Shanghai fork will enable validators to withdraw their staked tokens.

Other milestones are the surge, which will add sharding for better scaling via lower operating costs. The verge, or the implementation of “Verkle trees” (a mathematical proof) to minimize data storage requirements. The purge to further cut the protocol’s store history for better data efficiency. And the splurge for whatever is deemed “fun” enough to implement.

Proof-of-Stake under fire

PoS relies on validators rather than miners to validate transactions and secure the network. The current requirement to become a validator on Ethereum is to stake 32 ETH, which costs approximately $51,200 at today’s price – a hefty capital outlay.

Critics argue that only suitably financed entities can act as validators. Therefore, the switch to PoS will make the Ethereum network more centralized.

According to data from Nansen, just five entities, Lido, an unknown entity, Coinbase, Kraken, and Binance, control 64% of the staked ETH.

On the other hand, becoming a Cardano validator, also known as a Stake Pool Operator (SPO,) has a much lower barrier to entry. There is no required ADA pledge amount, and the hardware needed is attainable for most – which encourages even small players to become network validators.

Some SPOs prefer to run virtual machines on cloud services, such as Amazon Web Service, due to the reliability of cloud service networks. However, this strategy will increase running costs compared to a private network.

With the Merge now complete, Hoskinson voiced his concern that PoS will now be seen as a highly centralized consensus mechanism – which is not true in the case of Cardano.

Now begins the Era of everyone assuming that all Proof of Stake works like Ethereum’s Proof of Stake. The maxis will attack Cardano for slashing and label all the ethereum problems as ours. Thanks Jack https://t.co/XpL4OynoeM

— Charles Hoskinson (@IOHK_Charles) September 15, 2022

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)