- Chainlink introduces a multi-model AI strategy using systems like OpenAI, Google, and Anthropic to reduce AI hallucinations in financial data processing significantly.

- By employing blockchain and a decentralized oracle network, Chainlink aims to establish a secure, transparent, and unified ‘golden record’ for verified financial information.

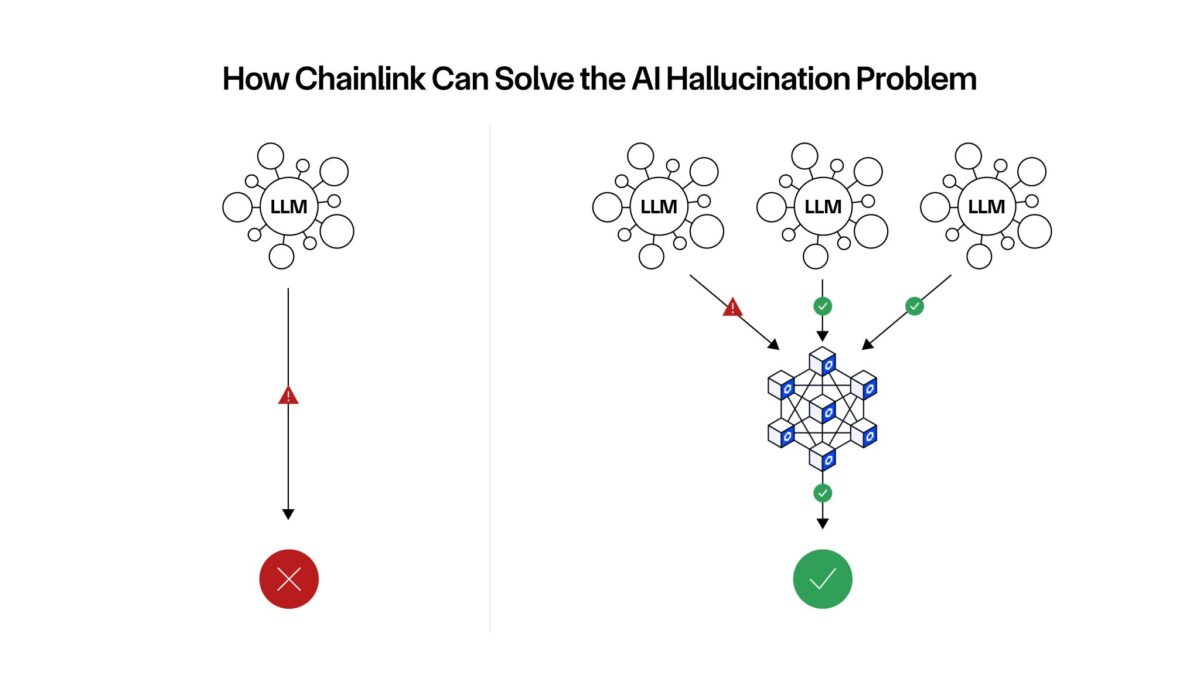

Chainlink has introduced a bold new strategy to tackle a major problem in artificial intelligence—AI hallucinations. When large language models (LLMs) misinterpret or fabricate data, the consequences can be costly, especially in finance. Instead of depending on a single AI model, Chainlink is using a multi-model approach, tapping into AI systems from OpenAI, Google, and Anthropic.

Can Chainlink help solve the AI hallucination problem?

Laurence Moroney, Chainlink Advisor and former AI Lead at Google, on how Chainlink implemented a novel technique to overcome the risks of hallucination:… pic.twitter.com/1wHMSepd1P

— Chainlink (@chainlink) February 11, 2025

Laurence Moroney, Chainlink Advisor and former AI Lead at Google, explained that using multiple AI models instead of relying on one helps reduce errors. Each AI model is given a different prompt to analyze the same financial data. He said:

Instead of trusting a single prompt to a single LLM, the idea was to have a swarm of LLM-prompt combinations to produce various results. The consensus could then be measured. If they all produced the same result, we could begin to trust it.

The system records the verified data on the blockchain, making it transparent, immutable, and secure. This consensus-driven method prevents misinformation from corrupting critical financial records, strengthening the reliability of AI-generated data.

Chainlink AI Aims to Slash Financial Errors Costing $3-5M annually

Mistakes in corporate action processing cost businesses anywhere from $3 million to $5 million annually. In extreme cases, firms have suffered losses of up to $43 million due to flawed financial data. Chainlink’s approach aims to change that by cutting down on manual data revalidation and improving financial accuracy.

In a recent collaboration with top financial institutions—including UBS, Franklin Templeton, Wellington Management, Vontobel, and Sygnum Bank—Chainlink tested this AI-blockchain system. The results proved promising, demonstrating a reduction in financial data errors and inefficiencies.

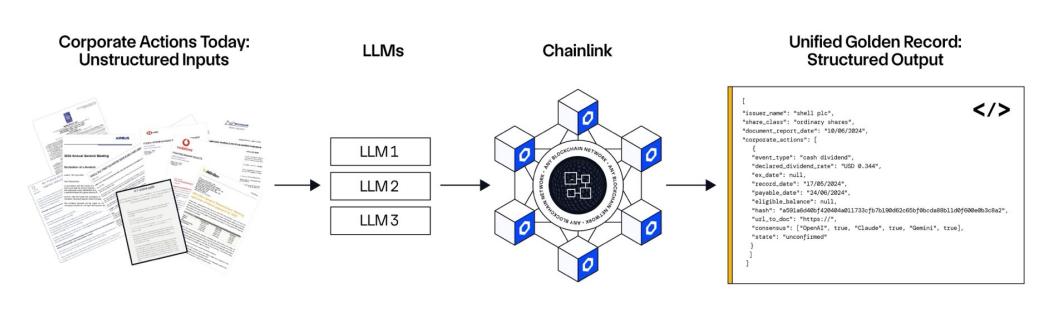

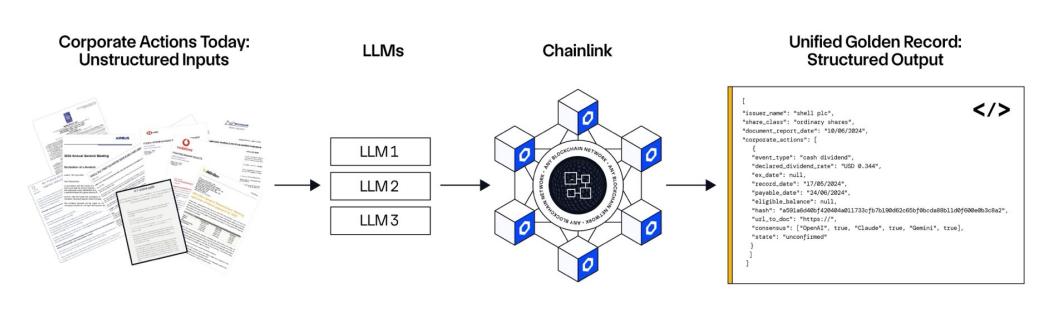

The method is particularly beneficial in handling corporate actions, where companies announce events like dividends, mergers, or stock splits. AI extracts that data and converts it into a structured, machine-readable format known as JSON, making financial transactions smoother and error-free.

Chainlink’s “Golden Record” with AI Validation—No More Fragmentation

Chainlink’s initiative introduces what the industry calls a “unified golden record“—a single, verifiable source of structured financial data stored across multiple blockchains. This eliminates fragmented records, allowing banks, investors, and asset managers to access accurate corporate action data without redundant manual processing.

A key component of this system is Chainlink’s decentralized oracle network (DON), which runs multiple AI models to validate financial data. OpenAI’s ChatGPT-4o, Google’s Gemini 1.5 Pro, and Anthropic’s Claude 3.5 Sonnet each analyze corporate actions independently. If inconsistencies arise, the system flags them, preventing misleading data from entering financial workflows.

Blockchain technology plays a critical role in ensuring maximum security. By storing cryptographically verified financial reports on-chain, Chainlink guarantees that corporate data remains tamper-proof, transparent, and synchronized across different market participants.

Cross-Border, Cross-Industry Collaboration

Chainlink isn’t just working with financial firms—it’s aligning with global industry standards to ensure seamless integration. Institutions like DTCC, Clearstream, and Euroclear are on board, making sure the AI-generated structured data is compatible with traditional financial messaging protocols like Swift.

For even broader accessibility, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) allows financial institutions to pull structured corporate action data from multiple blockchain ecosystems. This enables banks and asset managers to access real-time, verified data using existing financial infrastructure without costly overhauls.

Looking ahead, Chainlink plans to refine its AI training to minimize hallucination risks further. The initiative will also integrate more data sources and enhance compliance with corporate action standards, including CAJWG and SCoRE. The long-term vision is to create an automated, scalable financial data processing system that transforms the global financial industry.

Recommended for you:

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Sui

Sui  Stellar

Stellar  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Toncoin

Toncoin  USDS

USDS  WETH

WETH  Hyperliquid

Hyperliquid  MANTRA

MANTRA  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Mantle

Mantle  Internet Computer

Internet Computer  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  Sonic (prev. FTM)

Sonic (prev. FTM)