- Cryptocurrency transactions in Bolivia surged over 100% in the past three months, according to the Central Bank.

- The Central Bank of Bolivia attributes this growth to stablecoins, crypto assets linked to traditional currencies.

The Central Bank of Bolivia (BCB) recently reported a substantial increase in cryptocurrency transactions across the country. According to a report released on September 26, 2024, the volume of virtual asset transactions surged by more than 100% through electronic payment channels.

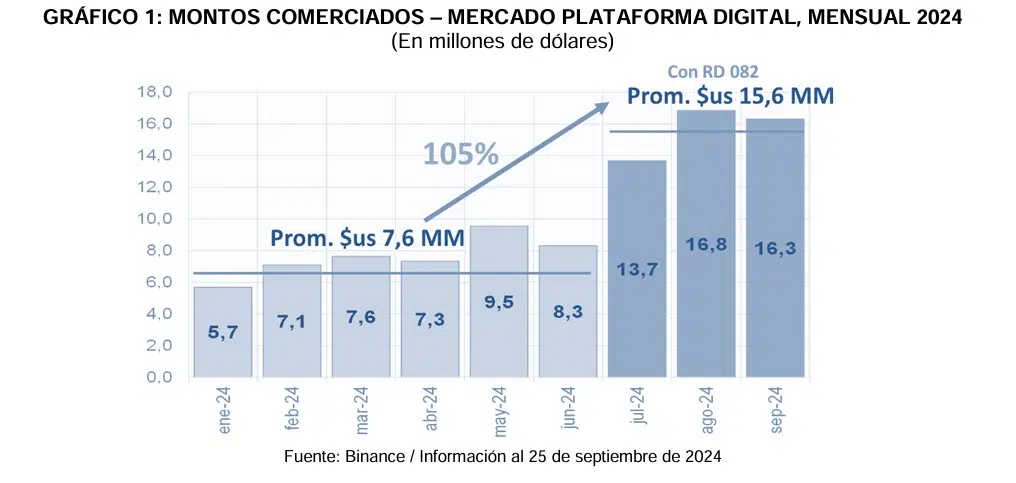

This growth was particularly evident in the period from July to September, when monthly transaction volumes rose from $7.6 million in the first half of the year to $15.6 million.

The BCB attributed the rapid expansion in transaction volume to the stability provided by these stablecoins. Backed by the U.S. dollar and precious metals, stablecoins have become a central component of Bolivia’s evolving digital economy.

This growth translated into a total transaction value of $46.8 million during the last three months, surpassing the first half of the year by a wide margin. The BCB linked this expansion to Board Resolution 082/2024, enacted on June 25, 2024, which authorized the use of electronic payment channels for virtual asset transactions.

Edwin Rojas Ulo, president of the BCB, commented on the development, stating:

“The Central Bank of Bolivia is paving the way for the use of crypto assets in the country. We are making significant strides towards an economy that embraces accessible digital tools.”

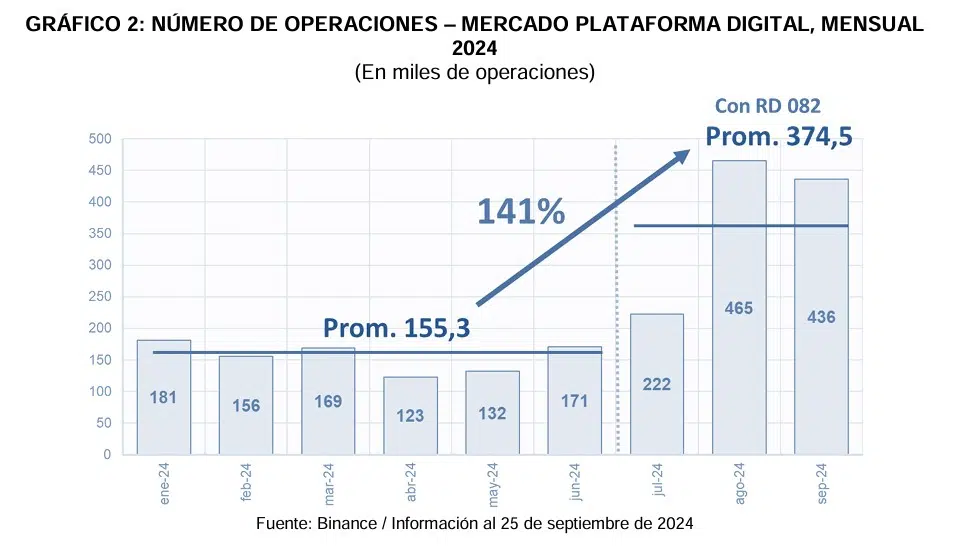

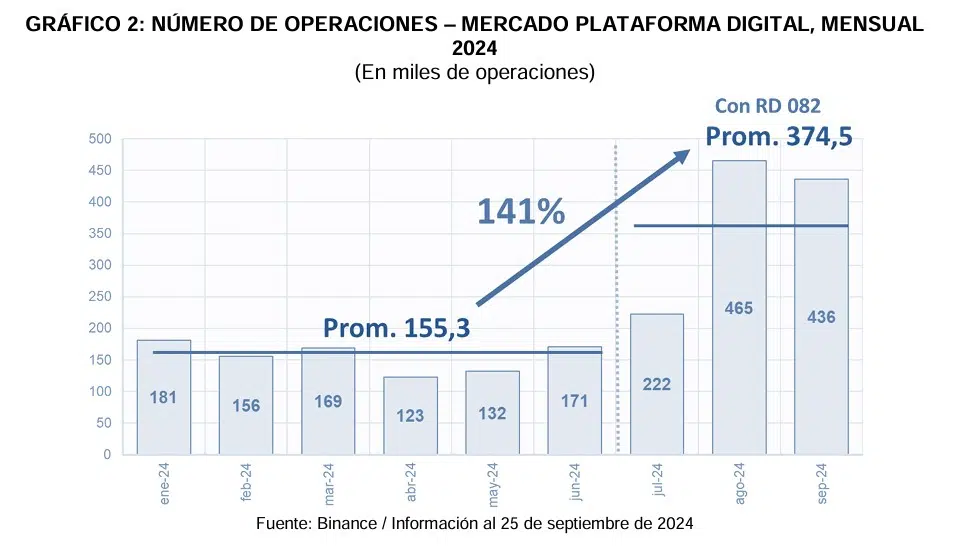

He also noted that the number of transactions reached 1,123,000, marking a 141% increase compared to the previous six months.

This rise in cryptocurrency trading aligns with data from the Financial System Supervisory Authority (ASFI). Six financial institutions have reported digital asset transactions, with a 40% increase between July and August. Most of these transactions were carried out by individuals, further indicating growing adoption.

No spam, no lies, only insights. You can unsubscribe at any time.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC