Borrowing rates for USDC, one of the most liquid dollar-pegged stablecoin, remain high on Aave and Compound v2, two of the world’s top decentralized protocols. According to Kaiko, a blockchain analytics platform, rates have ranged from 4% to 15% on Aave and around 13% on Compound.

It should be noted that this surge is when the crypto and decentralized finance (DeFi) scene is recovering after an extended “winter” that froze participation.

Borrowing USDC on Aave and Compound Is Expensive

Kaiko notes that the utilization rate for USDC on Aave has remained close to optimal levels, indicating steady demand for the stablecoin among borrowers, mainly in the second half of November. Looking at trends, it is evident that borrowing rates in Aave v2 have been stabilizing between 4% and 15% over the past week.

Meanwhile, on Compound v2, borrowing USDC has been more expensive than others, including USDT and DAI. The USDC borrowing rate is around 13%, much higher than borrowing Ethereum-based DAI or Tether Holding’s USDT.

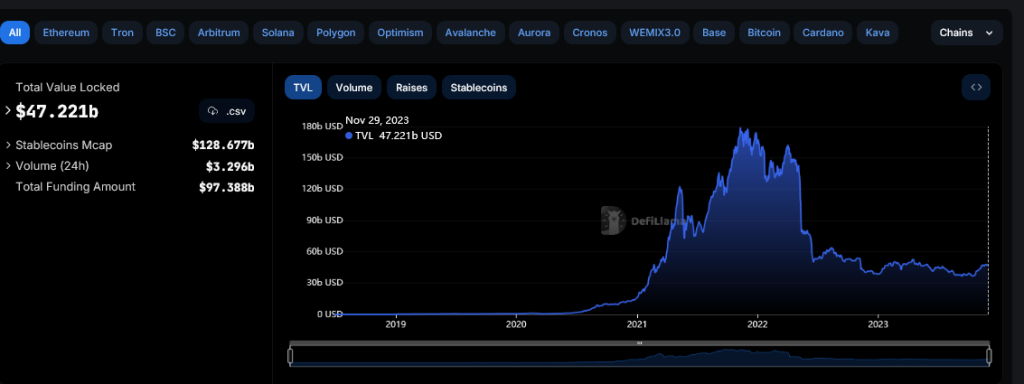

There is no precise reason to explain this divergence. However, the reason why demand is varying could be multifaceted. One of the key reasons is that after depressed activity in the better part of 2022 and 2023, activity is expanding as total value locked (TVL) not only in Ethereum but in other chains, including Solana, shows.

DeFiLlama says the total TVL is around $47 billion, up from approximately $38 billion registered in mid-October. Subsequently, with rising demand, USDC holders will likely want more yield from willing borrowers.

Beyond this, increasing borrowing rates could be due to users averse to using centralized exchanges opting to secure a stablecoin that’s fully audited, publishing attestation statements regularly.

In the case of USDC, these attestations are independent audits that verify whether Circle, the issuer, holds sufficient reserves to back every token in circulation.

Are Bulls Ready To Lift Crypto Prices Higher?

While the high borrowing rates for USDC may make it less attractive for some borrowers, it also highlights the strong demand for stablecoins and their growing importance in DeFi. In the crypto market, the demand for stablecoins, such as USDC, can indicate the start of a bull run.

Stablecoins provide a gateway into crypto. When there is a higher demand for these tokens, the chances of the crypto market rising also increase. As the crypto and DeFi scene matures, stablecoins like DAI and USDT are expected to play a critical role.

Feature image from Canva, chart from TradingView

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Wrapped Bitcoin

Wrapped Bitcoin  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Toncoin

Toncoin  Sui

Sui  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Polkadot

Polkadot  Litecoin

Litecoin  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Official Trump

Official Trump  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Internet Computer

Internet Computer  Aptos

Aptos  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB