BlackRock’s move to register an iShares Ethereum Trust in Delaware signaled a potential game-changer for Ethereum as an institutional-grade investment. Ethereum (ETH) surged on the news, breaking above $2,000 for the first time since July. Understanding the ETH/BTC ratio’s behavior is crucial in dissecting the market’s response to such developments, offering an alternative perspective to the conventional ETH/USD or ETH/USDT pairs.

The ETH/BTC ratio represents Ethereum’s strength against Bitcoin—the standard-bearer of the crypto market. This ratio increases in value when Ethereum gains momentum or retains its value better than Bitcoin, suggesting that the market favors ETH over BTC. Conversely, a decline in the ETH/BTC ratio indicates Ethereum’s underperformance relative to Bitcoin, which could suggest investor preference for the relative safety of Bitcoin.

Movements in the ETH/BTC ratio are more than just price action; they represent the shifting tides of investor confidence and market sentiment between two of the largest cryptocurrencies. This ratio refines the raw price data into comparative performance, going beyond the fiat value of Ethereum and presenting its relative standing within the crypto domain.

CryptoSlate analysis found that, in the past 30 days, the overall correlation coefficient between the ETH/BTC closing price and trading volume was slightly negative at approximately -0.103. This suggests that trading volumes did not heavily influence price movements within the month—a surprising insight given the tumultuous nature of cryptocurrency markets.

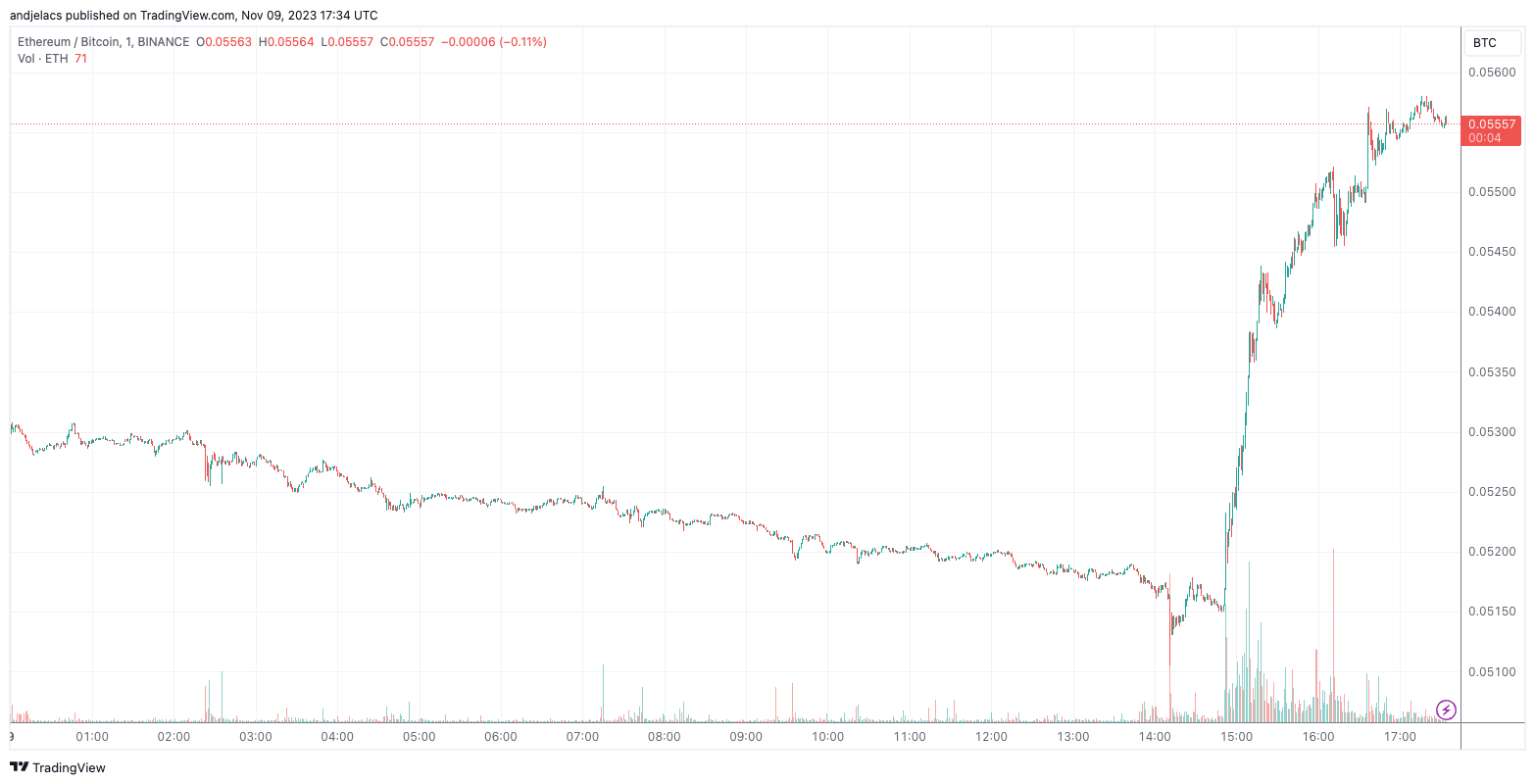

However, looking at the past 24 hours, the correlation turns positive at around 0.264. This shift accompanies a spike in ETH/BTC, where the ratio peaked at 0.05493. This positive correlation in the last day indicates a synchronized price and trading volume increase, driven by the market’s reaction to BlackRock’s Ethereum ETF registration.

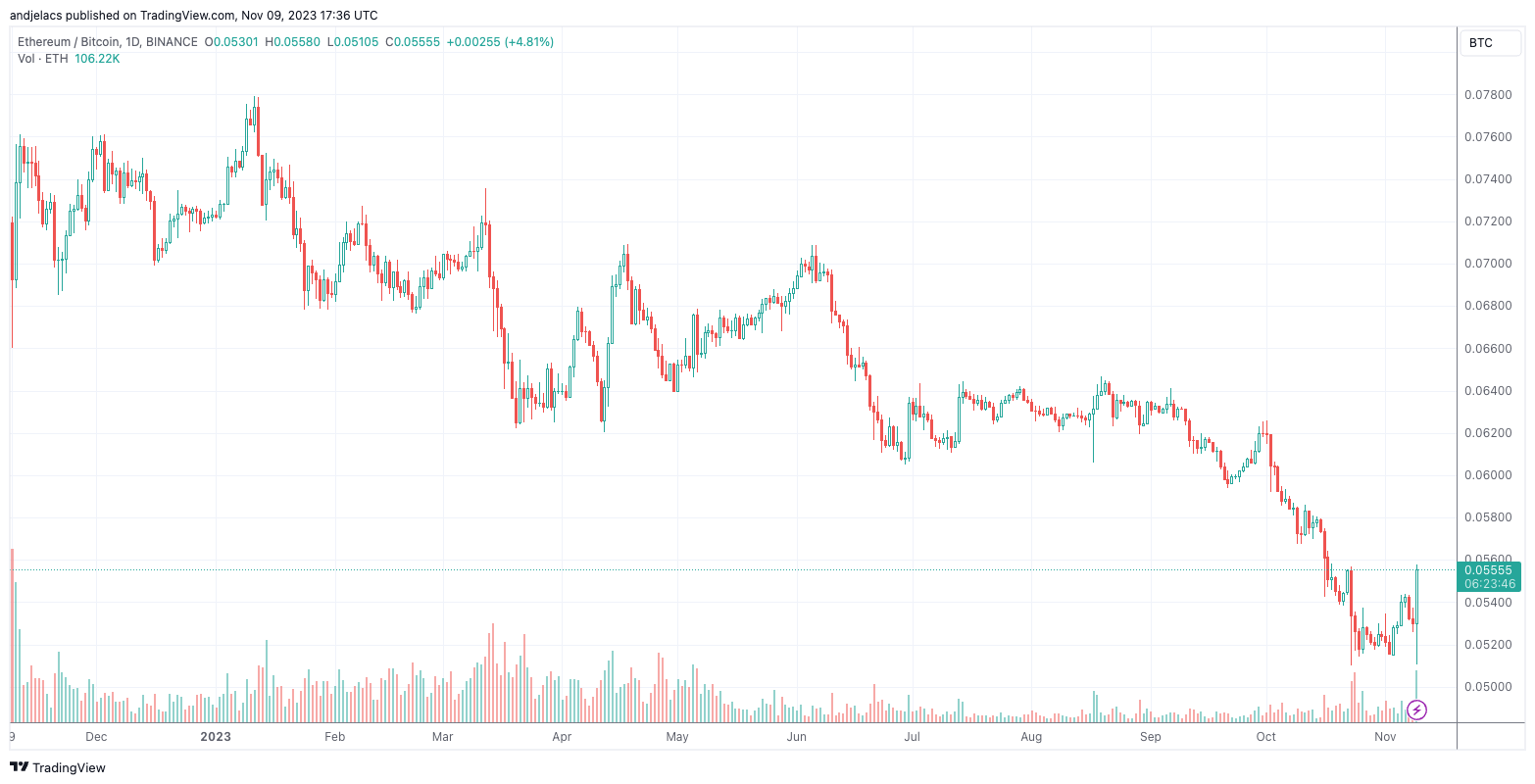

In a year-long retrospective, the ETH/BTC market showed a correlation coefficient of around 0.377 between price and volume, indicating a moderate positive association. This trend implies that investor engagement, as measured by volume, has generally risen in tandem with ETH’s value relative to BTC, reflecting a broader confidence in Ethereum’s market proposition.

These fluctuations in the correlation coefficient, observed over different time frames, show the interplay between Ethereum’s relative valuation and trading activity. It paints a picture of a market sensitive to immediate developments—like BlackRock’s registration—but also wary of the broader trends in the crypto industry.

Why is this shift important? The ETH/BTC ratio’s spike and the increased trading activity mean heightened market attention. BlackRock’s registration echoes its earlier steps with the iShares Bitcoin Trust, preluding what many anticipate to be an official ETF application. This activity spotlights Ethereum’s rising stature and suggests an undercurrent of optimism despite the SEC’s historic unwillingness to approve an ETF.

This juxtaposition of BlackRock’s bold stride against regulatory uncertainty brings quite a bit of uncertainty to Ethereum’s future. The registration is a beacon of institutional validation for Ethereum, but it is shrouded in the unpredictability of the SEC’s decisions—a familiar suspense for the crypto industry.

The post BlackRock Ethereum ETF sparks surge in ETH/BTC ratio appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC