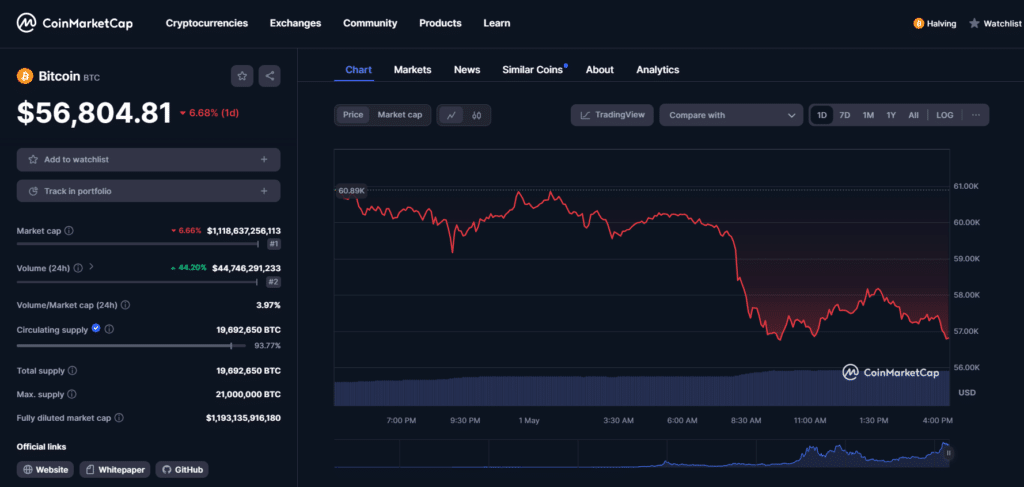

Bitcoin prices plunged or traded sideways after the halving, prompting opinions that BTC price activity could cool as spot ETF outflows proceeded.

The U.S. spot Bitcoin (BTC) ETF data from April 30 showed that GBTC single-day net outflows amounted to over $93 million, contributing to a cumulative outpour worth more than $162 million from four tradable funds.

Grayscale’s Bitcoin ETF outflows have recently decelerated, but historical GBTC exits remain staggering at over $17.3 billion since its conversion in January.

Grayscale CEO Michael Sonnenshein previously said outflows should decline as the year unfolds and addressed GBTC’s industry-high fee by saying the cost would also reduce with time.

Elsewhere, six funds recorded zero net inflows, but experts have stressed that the trend is common on Wall Street as there are over 2,000 ETFs trading in America. One product offered jointly by ARK 21Shares diverged from the day’s status quo and attracted over $3 million in net inflows.

Overall, the total net asset value of assets under management (AUM) in spot Bitcoin ETFs fell below $50 billion per SoSoValue. Data suggests that the decline in AUM is split between Grayscale outflows and Bitcoin prices.

Spot ETF activity correlates with Bitcoin Prices

According to CoinMarketCap, BTC changed hands below $57,000 after plunging over 6% in 24 hours. Nuklai CEO Matthijs de Vries told crypto.news that markets will likely experience a hiatus from higher prices for some time following the Bitcoin halving.

“The off-chain speculatory trading price discovery is also far from straightforward: distorted supply dynamics create a new fundamental equilibrium, and a new consensus price corridor is gradually built up. This uncertainty creates a period of the sideways market; the behavior we have seen after the past halvings.”

Matthijs de Vries, Nuklai L1 blockchain CEO

Many speculated that spot BTC ETF demand would sustain rising prices for the leading cryptocurrency. However, the blockchain expert opined that several on-chain indicators have signaled flat prices and market retraces.

“Firstly, the open interest on Bitcoin futures has fallen from $39 billion in notional value to $30 billion, indicating less certainty on future price direction. Secondly, the trading activity in both Bitcoin and altcoin pools has fallen, while the USDT pools, on the contrary, are experiencing higher volume. It’s a signal that traders are flying to safety and cashing out profits from the bull run.”

Matthijs de Vries, Nuklai L1 blockchain CEO

Nonetheless, the consensus points to positive sentiment regarding the long-term impact of U.S. spot ETFs and the halving. As crypto.news previously reported, Bitwise CIO Matt Hougan stressed that removing $11 billion of annual BTC supply thanks to the technological tweak around block rewards and token emissions should bolster market prices within a year.

Credit: Source link

![Shiba Inu (SHIB) Price Prediction: Amid a Meme Coin Frenzy, Will SHIB See a 200% Increase While Another Presale Coin Emerges as a Competitor? [TG Casino]](https://news.coinspectra.com/wp-content/uploads/2023/10/Will-SHIB-See-a-200-Increase-1-1024x576-100x70.png)

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  Sonic (prev. FTM)

Sonic (prev. FTM)  sUSDS

sUSDS