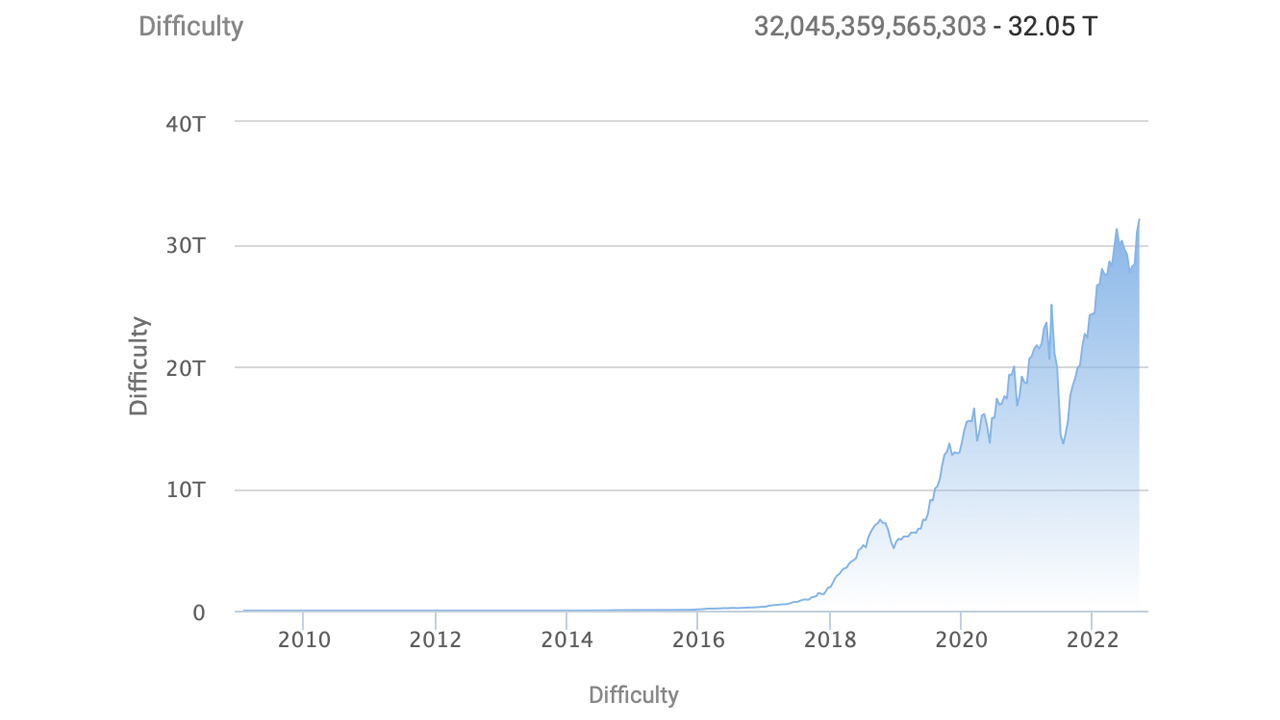

Bitcoin’s mining difficulty reached a new all-time high at block height 753,984 from 30.97 trillion hashes to 32.05 trillion hashes. After two difficulty increases during the past month, the network’s mining difficulty jumped another 3.45% higher on September 13.

Bitcoin’s Difficulty Reaches 32 Trillion

The leading cryptocurrency by market capitalization, bitcoin (BTC), is now a lot more difficult to mine. In fact, on Tuesday, September 13, 2022, the network difficulty tapped an all-time high at 32.05 trillion. Roughly two weeks or 2,016 blocks ago, the difficulty printed the second-largest increase in 2022 as it increased by 9.26%.

Two weeks or 2,016 blocks before the last change, the difficulty jumped slightly by 0.63%. Following the increase today, at block height 753,984, it has never been more difficult to find a bitcoin (BTC) block reward. Furthermore, BTC’s U.S. dollar value dropped over 9% on Tuesday afternoon (ET), following the recently published U.S. CPI report.

Despite the price drop and recent difficulty rise, BTC’s hashrate has remained above the 200 exahash per second (EH/s) range and at the time of writing, it’s running at 227.07 EH/s. During the past 24 hours, Foundry USA has been the network’s top pool with 26.85% of the global hashrate.

Foundry is followed by F2pool with 15.4% of BTC’s hashpower, and Binance Pool with 14.77% of the global hashrate. Binance Pool is followed by Antpool (13.42%) and Viabtc (10.74%) respectively. 149 blocks were mined in the last 24 hours, and Foundry USA discovered 40 of those blocks, while F2pool captured 23 blocks.

Currently, BTC block time is 9:17 minutes per block, and there’s 2,011 blocks left to mine until the next difficulty change expected on September 27, 2022. At current block interval speeds and the realized hashrate today, the network could see a negative 3.7% decrease.

What do you think about the recent difficulty change and the difficulty tapping an all-time high on September 13, 2022? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC