The biggest news in the cryptoverse for Nov. 25 includes Binance publishing BTC proof of reserve, BNB hitting 6% market dominance as mid-cap tokens outperform Bitcoin, 100,000 Bitcoin worth over $1.5 billion leaving Coinbase in 48 hours, and CoinList denying rumors of insolvency.

Bitcoin worth $1.5B withdrawn from Coinbase in 48 hours

Glassnode data reveals that Coinbase BTC reserve lost about 50,000 BTC on Nov. 24, and another 50,000 BTC on Nov. 25.

As a result, Coinbase lost Bitcoin worth over $1.5 billion in a space of 48 hours, which marks the third-largest BTC withdrawal in the exchange’s history.

Binance publishes BTC proof of reserves to provide more transparency on customer funds

Leading crypto exchange Binance has started rolling out its proof of reserves (PoR) beginning with Bitcoin. Binance PoR shows that customers’ balance on the exchange was 575,742.4228 BTC, while its on-chain reserve sits 1% higher at 582,485.9302 BTC.

Binance said it will publish the PoR of other crypto assets and involve third-party auditors to audit its reserve in the coming weeks.

Mid-cap tokens outperform Bitcoin over past 7 days as BNB hits 6% market dominance

Over the past seven days, the market capitalization of mid-cap tokens (projects with a market cap between $100 million and $1 billion) surged by 4% while Bitcoin’s dominance fell from a high of 45% to 40%.

Similarly, Binance BNB has gained over 31% against Bitcoin since Oct. 23, as its market dominance hit an all-time high of 6% of the total crypto market cap.

CoinList denies insolvency rumors, claims technical difficulties causing issues with withdrawals

Over the last seven days, CoinList has reportedly failed to process withdrawal requests, raising concerns over its insolvency risk.

The ICO platform in addressing the insolvency rumors said it was experiencing technical issues from its custodial partner which affected users’ deposits and withdrawals.

CoinList added that it was working to resolve the issues and would publish its proof of reserves soon.

Belgium says Bitcoin, Ethereum are not securities

The Belgium Financial Services and Markets Authority stated that assets with issuers and investment objectives are labeled as securities.

On this basis, the regulator has clarified that Bitcoin and Ethereum are not securities, given that there is no issuer, but are created by a computer code.

FTX attacker turns to ChipMixer to launder tokens

The hacker who attacked FTX on Nov. 12 has moved to launder some of the stolen Bitcoin via Chipmixer. So far, the attacker has laundered about 360 BTC.

However, ongoing discussions in the crypto community led by FatManTerra suggest that the mixing protocol may have been deployed by the U.S. government to crack Bitcoin privacy.

Bahamas Securities Commission calls FTX CEO John Ray’s allegations inaccurate; says its actions were ‘misinterpreted’

FTX CEO John Ray III alleged that the Securities Commission of The Bahamas (SCB) was behind the unauthorized move to transfer its assets to the regulator.

The SCB claimed that the asset transfer was executed to protect crypto assets under FTX’s control from potential thefts and hacks.

Massive staked Ethereum withdrawals by whales allow arbitrageurs to profit

Over the past 24 hours, two Ethereum whales reportedly withdrew 84,131 ETH and 42,400 stETH respectively from the Aave V2 protocol.

As a result, the stETH/ETH pair on Curve depegged to 0,9682, which saw arbitragers traders take advantage of the price difference to pocket massive profits.

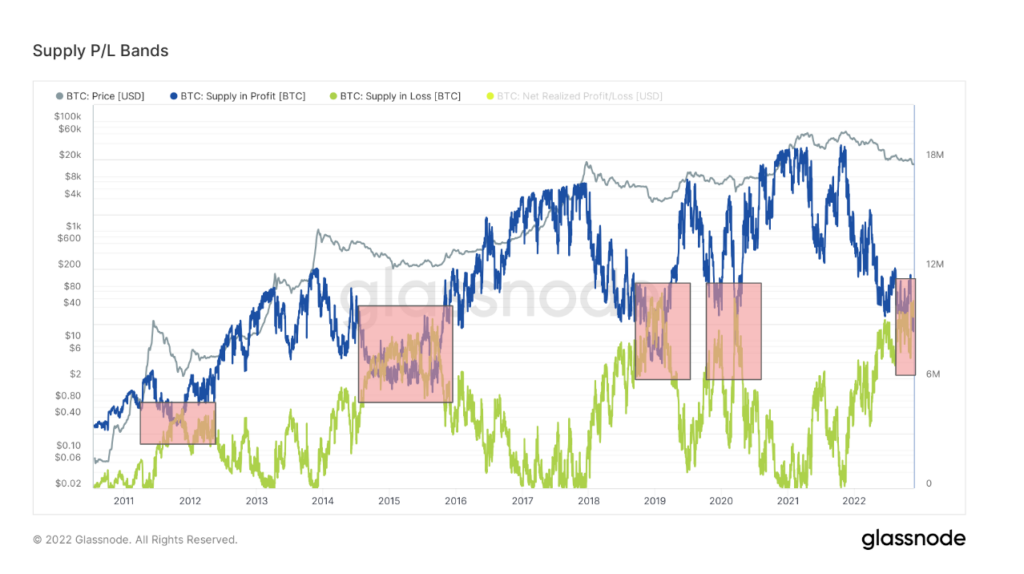

On-chain data flashes multiple bear market bottom signals

As the Bitcoin halving of 2024 draws near, on-chain data analyzed by CryptoSlate indicates that the bear market may be close to its bottom.

Looking into the Supply P/L Bands, its blue (profit) and green (loss) lines have converged, which coincides with previous bear market bottoms. This is the fifth time in Bitcoin’s history, that the convergence happened, The previous events of 2012, 2014, and 2019 were followed by a surge to a new all-time high price.

Similarly, the short-term holder supply metrics have surpassed three million coins, which indicates the Bitcoin crabs are filling their bags as the market bottoms.

News from around the Cryptoverse

El Salvador opens Bitcoin office

The government of El Salvador led by Bitcoin Maximalist Nayib Bukele has created the National Bitcoin Office (ONBTC) to manage all Bitcoin-related projects.

The ONBTC will oversee the development of Bitcoin, Blockchain, and cryptocurrency companies in the nation.

Binance allocates $1B to crypto recovery fund

Binance CEO Changpeng “CZ” Zhao said his exchange has allocated another $1 billion to increase the size of the industry recovery fund to over $2 billion.

Other leading crypto companies including Jump Crypto and Aptos Labs pledged to contribute about $50 million to the recovery fund.

Sam Bankman-Fried under investigation by Turkish Authorities

Turkey’s Financial Crimes Investigation Board said it is investigating FTX founder Sam Bankman-Fried for allegedly facilitating asset laundering. Consequently, the authority is looking to seize the “suspicious assets” from the bankrupt crypto exchange.

Crypto Market

In the last 24 hours, Bitcoin (BTC) decreased slightly by -0.28% to trade at $16.526, while Ethereum (ETH) decreased by -0.5% to trade at $1,196.

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC